Managing money can feel overwhelming, but the right budgeting app on your iPhone can make it much simpler. Whether you’re trying to stay within a monthly budget, save for something big, or just keep better track of where your money goes, there are plenty of solid tools out there to help. This article covers the best iPhone budget apps that are easy to use, packed with helpful features, and perfect for everyday budgeting needs.

Eyeing the best budgeting apps for iPhone in 2025 to manage your money? Before you balance your wallet, let’s streamline your kitchen to save time and cash. The secret to easy cooking is having all your recipes in one spot, and our app delivers. ReciMe pulls recipes from TikTok, Instagram, Pinterest, and beyond, organizes them neatly, creates aisle-sorted grocery lists instantly and lets you tweak dishes to fit your budget. Download it now and keep your kitchen on track!

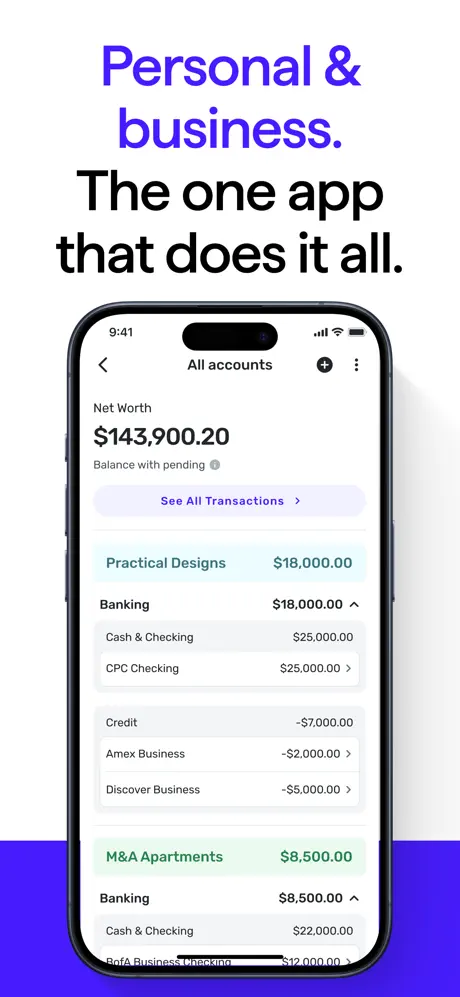

1. Copilot: Track & Budget Money

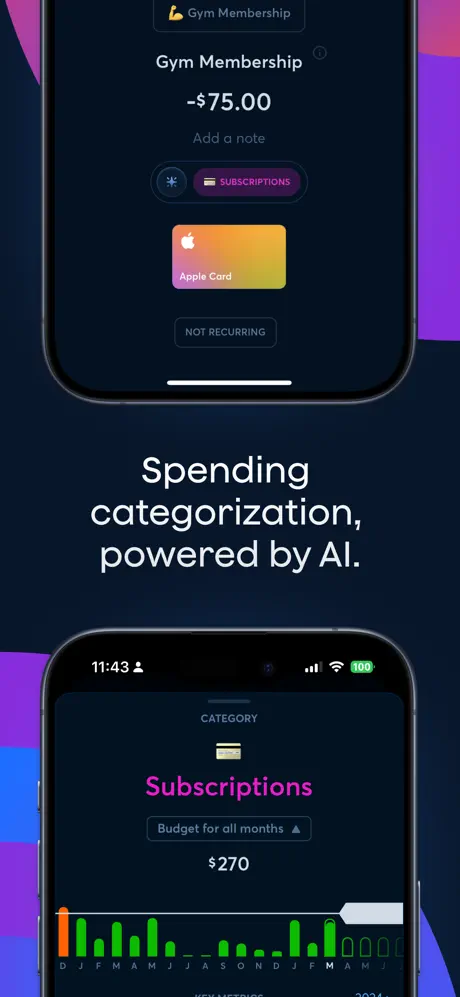

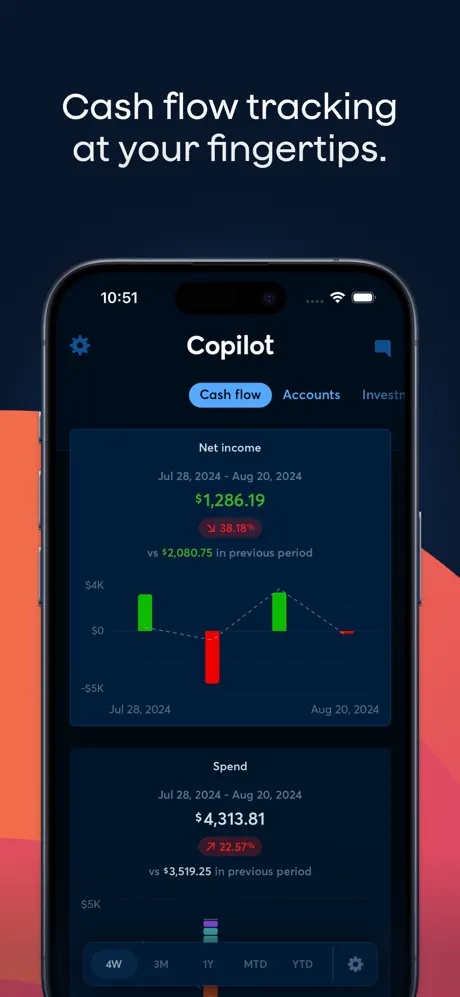

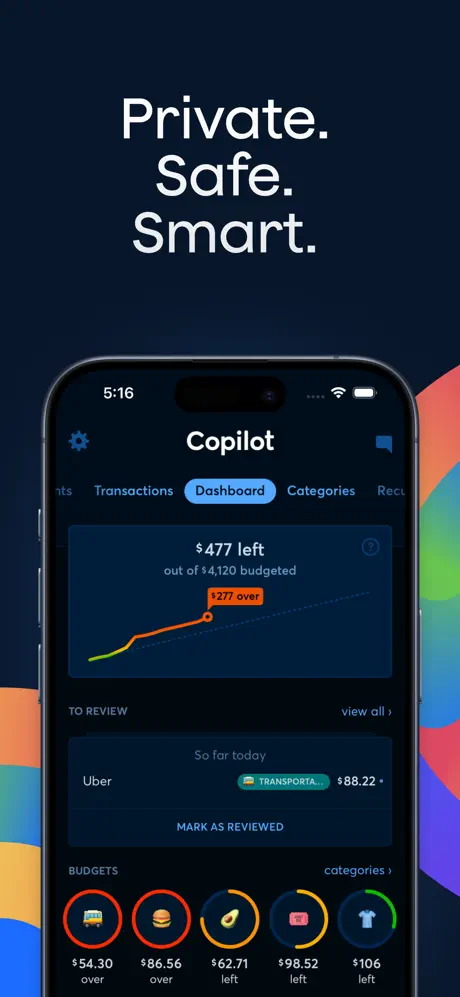

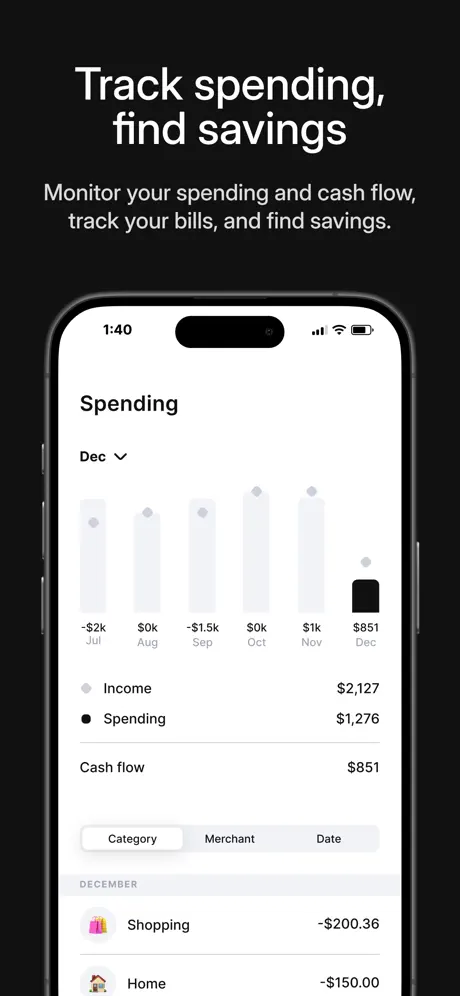

Copilot is a finance app designed for iPhone, iPad, and Mac users that consolidates multiple financial accounts in one place. It supports account connections from over 10,000 institutions, including services like Apple Card, Venmo, Coinbase, and Amazon. The app automatically categorizes transactions using AI and provides users with visual tools to analyze cash flow, spending habits, and investment performance. It also includes features for monitoring recurring subscriptions and setting up budget goals based on spending history.

The app requires a paid subscription, which removes advertising and data-sharing practices common in some other financial platforms. Copilot offers monthly and yearly plans and is currently only available to users with U.S.-based financial accounts. It includes tools such as custom notifications, split charge tracking, internal tagging, and various customization options like dark mode and widgets. Users can communicate directly with the support team to ask questions or request new features.

Key Highlights:

- Supports account linking from over 10,000 financial institutions

- AI-based automatic transaction categorization

- Subscription tracking and recurring payment reminders

- Cash flow insights segmented by income, spending, and net income

- Visual investment performance tracking

- In-app tagging and custom charge splitting

- Compatible with iPhone, iPad, Mac, and Apple Vision

- Requires iOS 15.0, iPadOS 15.0, or macOS 12.0 and above

- Paid subscription with monthly and annual options

- No advertising or data reselling

Who it’s best for:

- Individuals with multiple bank and investment accounts

- Users seeking automated categorization and visual financial summaries

- People looking to monitor subscription-based expenses

- Those who want finance apps without built-in ads or affiliate marketing

- iPhone and Mac users based in the United States

Contact Information:

- App store: apps.apple.com/us/app/copilot-track-budget-money

- Website: copilot.money

- E-mail: hello@copilot.money

- Instagram: www.instagram.com/copilotmoney

- Twitter: x.com/copilotmoney

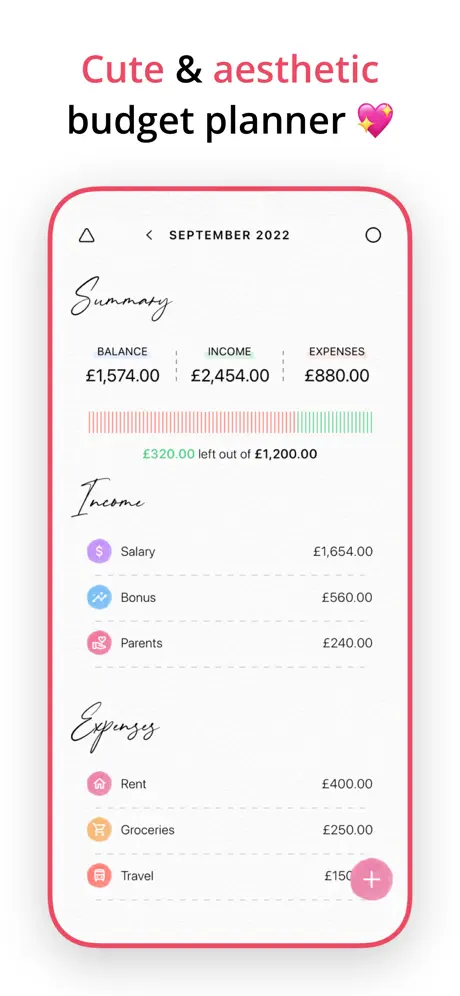

2. Financielle: Budget Planner

Financielle is a finance app designed for iPhone users and focuses on helping individuals track budgets, manage debt, and monitor net worth. The app includes both free and paid features, with the premium version offering access to a budgeting tool and a net worth tracker. It was built following the growth of an online community and contains various tools such as e-books, money guides, and admin tracking features. Users can also access digital content like blog posts and financial stories.

Budget entries in the app must be added manually, and access to core functions like budgeting requires a subscription. The app includes the Financielle Playbook, which is a structured digital guide aimed at teaching money management in a step-by-step format. It also provides reminders and tools for tracking savings, spending, and financial goals. The app is compatible with iPhones running iOS 13.0 or later, and offers several subscription models.

Key Highlights:

- Manual budget entry system

- Step-by-step money guide called the Financielle Playbook

- Net worth tracker to monitor long-term financial changes

- Debt tracking tools included

- Available in both free and subscription versions

- Digital content access: e-books, blogs, and goal-setting reminders

- Compatible with iPhone, iPod touch, Mac, and Apple Vision

Who it’s best for:

- Individuals who prefer manual entry for budget tracking

- Users interested in a structured financial education format

- People seeking tools to track savings, debt, and net worth

- iPhone users looking for female-focused financial content

- Those who want budgeting resources combined with written guides and reminders

Contact Information:

- App store: apps.apple.com/us/app/financielle-budget-planner

- Google Play: play.google.com/store/apps/details

- Website: www.financielle.com

- E-mail: hello@financielle.com

- Facebook: www.facebook.com/financielle

- Instagram: www.instagram.com/financielle

- LinkedIn: www.linkedin.com/company/financielleuk

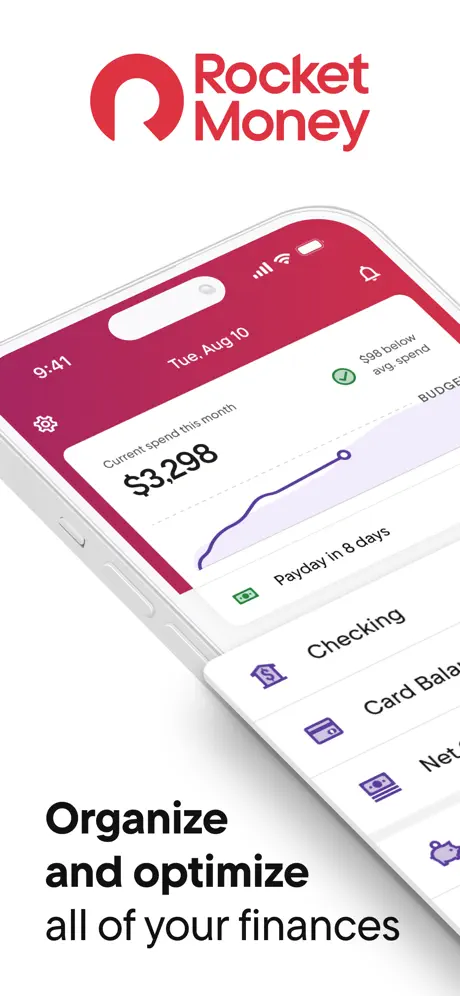

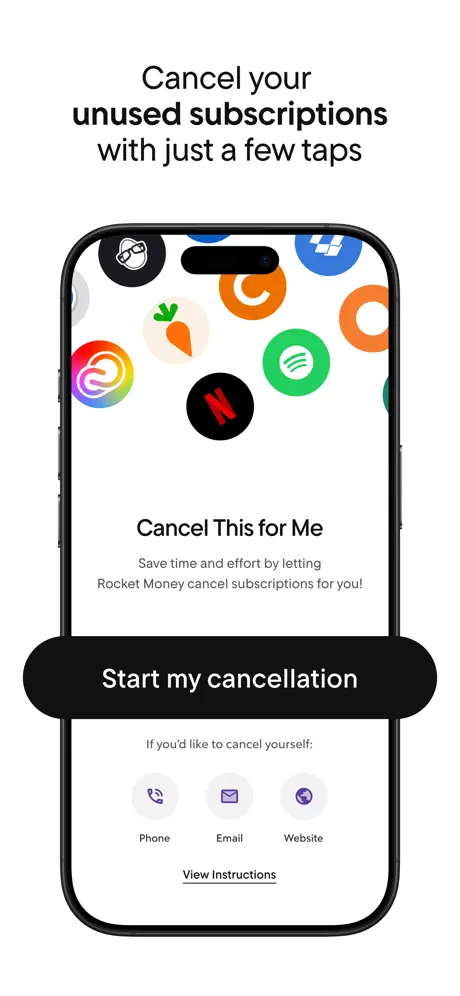

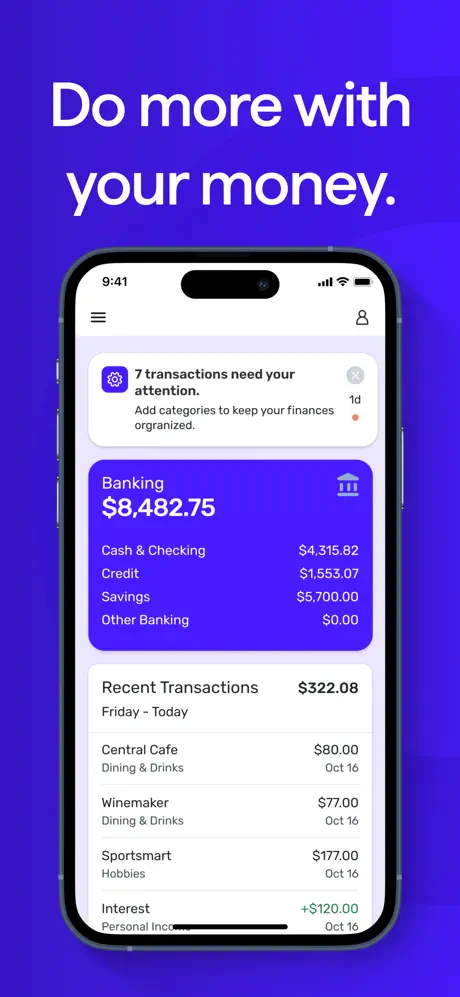

3. Rocket Money – Bills & Budgets

Rocket Money is a personal finance app for iPhone users that provides tools to track expenses, manage subscriptions, and view overall financial health. It connects to user accounts to monitor balances, identify upcoming bills, and offer insights into spending patterns. One of its key functions is subscription detection, helping users view and cancel recurring charges. The app also provides features for creating budgets, viewing credit scores, and monitoring net worth over time.

Additional services include bill negotiation and an optional savings automation tool where users can set specific goals and recurring transfer amounts. Rocket Money offers free features, but several functions, such as premium support or pay advance tools, are part of paid plans. User reviews indicate that the app is helpful for consolidating financial information in one place, though some features may require upgrades.

Key Highlights:

- Subscription tracking and cancellation

- Bill negotiation support

- Budgeting tool by spending category

- Savings automation with goal settings

- Net worth tracking with full asset and debt visibility

- Credit score monitoring

- Account linking across multiple banks and services

- Requires iOS 15.0 or later

Who it’s best for:

- Users who want help identifying and managing subscriptions

- Individuals seeking consolidated visibility into their finances

- People interested in automated budgeting and savings setup

- iPhone users looking to track net worth and monitor credit scores

- Those who manage bills and expenses across several accounts

Contact Information:

- App store: apps.apple.com/us/app/rocket-money-bills-budgets

- Google Play: play.google.com/store/apps/details

- Website: www.rocketmoney.com

- Instagram: www.instagram.com/rocketmoney

- LinkedIn: www.linkedin.com/company/rocketmoney

- Twitter: x.com/rocketmoneyapp

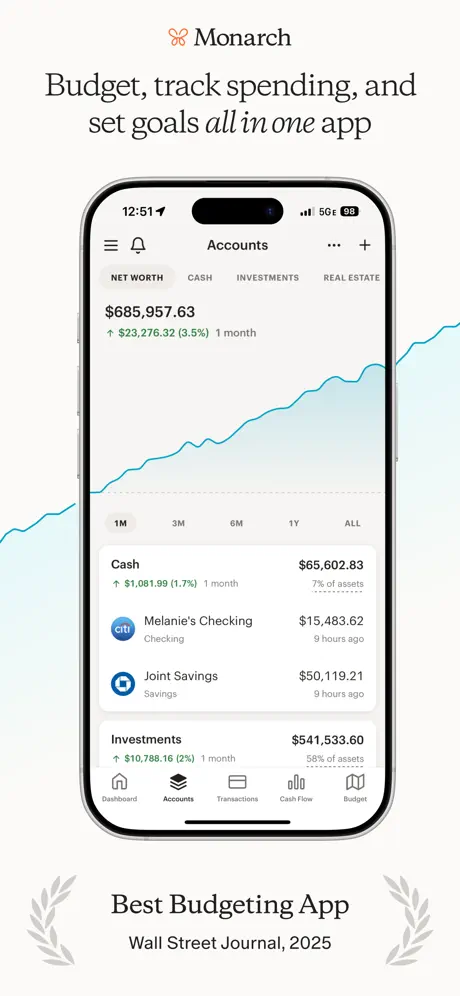

4. Monarch: Budget & Track Money

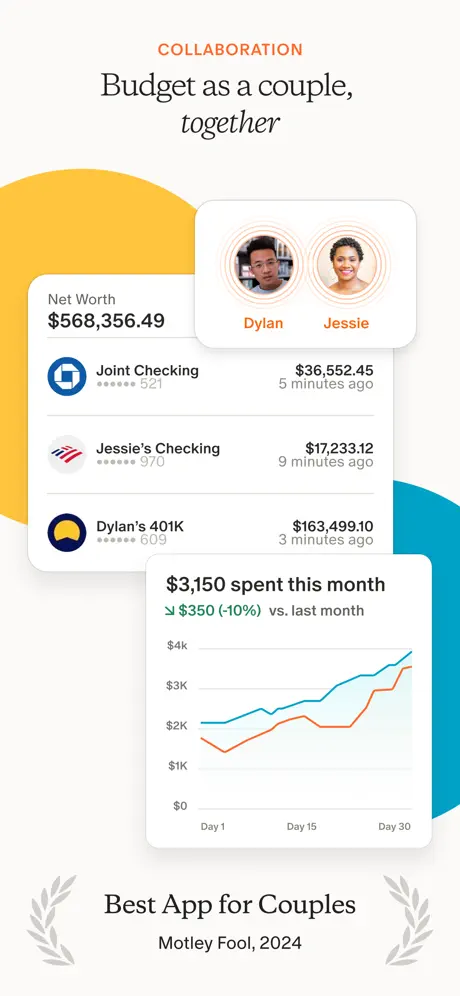

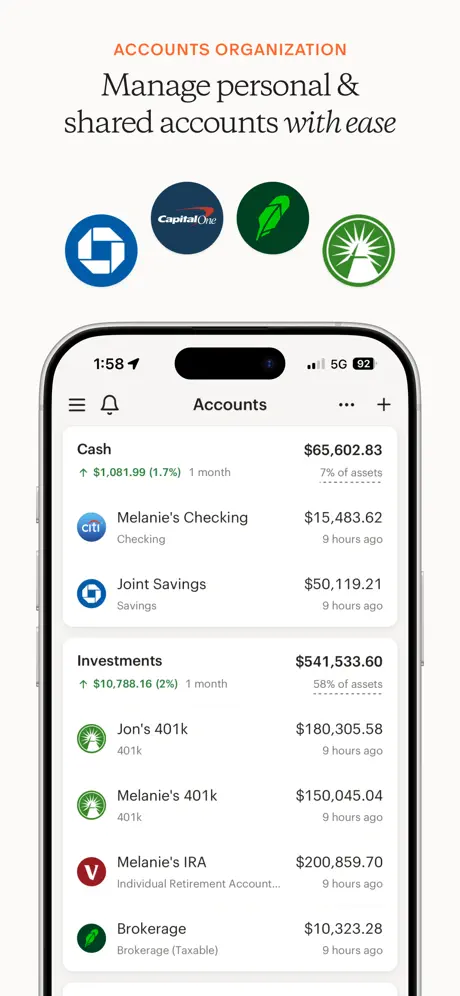

Monarch is a finance app designed for iPhone and iPad users who want to track spending, manage budgets, and view their net worth in one place. It supports account connections across various institutions and automatically categorizes transactions once accounts are linked. Users can choose between different budgeting styles, including flexible and category-based budgeting, and create dashboards that display spending summaries, upcoming bills, investments, and overall progress toward goals.

The app provides options for collaboration, allowing users to invite household members or financial professionals to access shared financial data. It supports both joint and separate accounts and offers tools for tracking medium- to long-term goals. Features like bill calendars, custom categories, and spending trend reports are included. Monarch runs on a subscription model with monthly and annual pricing options and does not show advertisements or offer third-party financial products.

Key Highlights:

- Aggregates financial data from linked accounts

- Supports both flex and category-based budgeting styles

- Visual dashboard with custom widgets and spending bars

- Investment tracking and goal-based savings tools

- Shared access with partners or financial advisors

- Calendar and list views for upcoming bills and recurring payments

- No advertising or promotional product content

- Compatible with iOS 14.0 or later

Who it’s best for:

- Individuals managing multiple financial accounts and subscriptions

- Users who prefer visual financial dashboards with custom features

- Couples or households wanting shared financial visibility

- People tracking both short- and long-term financial goals

- Those seeking budgeting options beyond a single method

Contact Information:

- App store: apps.apple.com/us/app/monarch-budget-track-money

- Google Play: play.google.com/store/apps/details

- Website: www.monarchmoney.com

- Instagram: www.instagram.com/monarch_money

- LinkedIn: www.linkedin.com/company/monarch-money

- Twitter: x.com/monarch_money

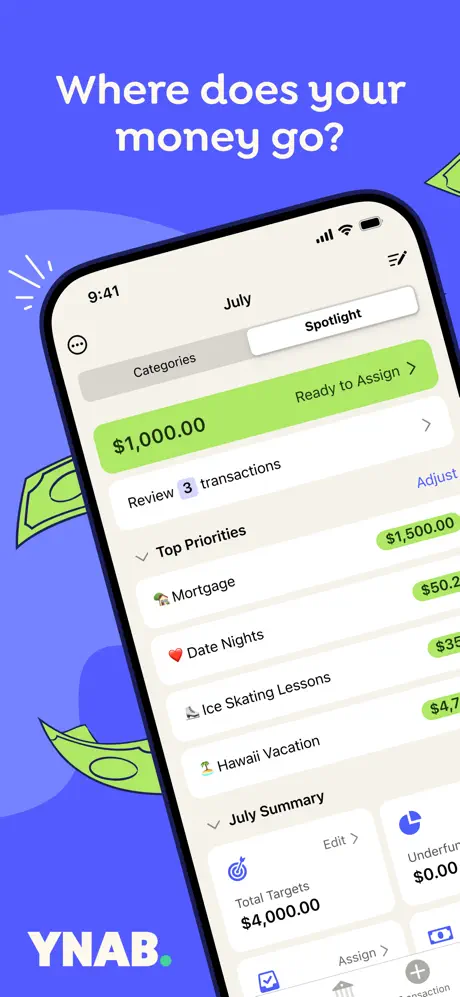

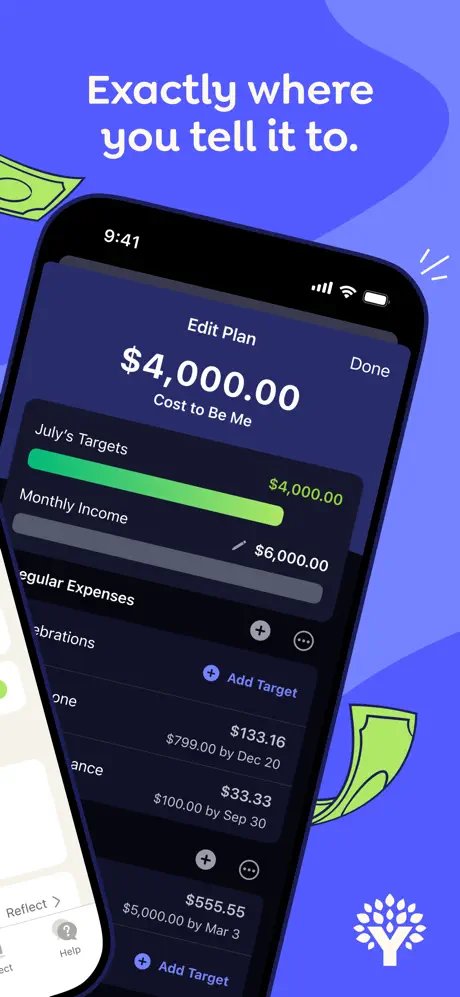

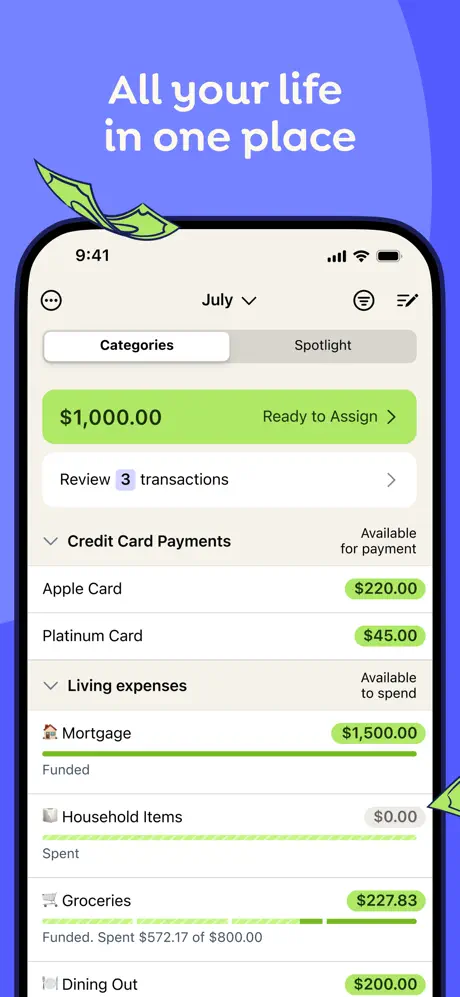

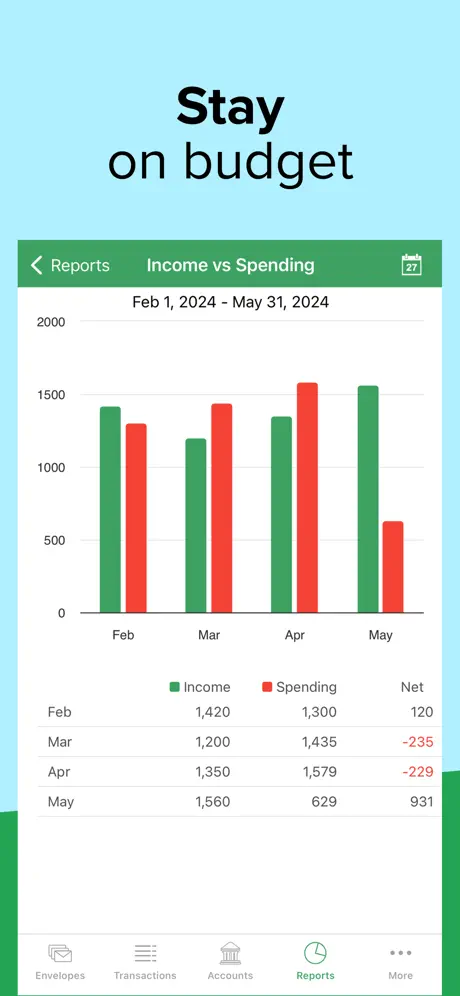

5. YNAB (You Need A Budget)

YNAB is a budgeting app built for iPhone, iPad, and Apple Watch users that focuses on assigning every dollar a specific purpose. It provides tools for planning expenses, managing debt, and tracking overall financial progress through various reports. Users can import transactions automatically by linking financial accounts or choose to input them manually. The platform supports collaborative budgeting for up to six users on a single subscription, which may be useful for households or partners managing shared finances.

The app offers category-based budgeting, loan planning, and real-time transaction updates. It features visual budget tools, income-versus-expense reports, and net worth summaries. There are no advertisements or external product promotions in the app. YNAB is a subscription-based service with a free trial available, and subscriptions are billed either monthly or annually.

Key Highlights:

- Category-based budgeting with custom tracking

- Loan planner with interest and payoff timelines

- Up to six users can share one subscription

- Secure account linking and manual transaction entry

- Reports include net worth, income vs expense, and spending breakdowns

- No advertising or third-party offers

- Compatible with iPhone, iPad, and Apple Watch

- Requires iOS 16.0 or later

Who it’s best for:

- Individuals seeking a structured, hands-on budgeting method

- Households or couples looking to manage shared finances

- Users interested in detailed debt planning tools

- People who want to track progress toward financial goals over time

- iOS users who prefer manual or linked transaction entry methods

Contact Information:

- App store: apps.apple.com/us/app/ynab

- Google Play: play.google.com/store/apps

- Website: app.ynab.com

6. Buddy: Budget Planner App

Buddy is a budgeting app built for iPhone, iPad, and Apple Watch users that supports both individual and shared financial tracking. It offers tools for setting up personal or group budgets, managing expenses, and viewing financial summaries. Users can manually input transactions or connect their bank accounts to import data automatically. A shared budgeting feature allows users to track who paid what during joint activities, such as trips or shared living expenses.

The app includes split tracking, visual overviews of income and spending, and basic savings summaries. While it supports bank integration, users have reported occasional syncing issues or delays in balance updates. Buddy is available in multiple languages and offers a premium version through monthly or yearly subscriptions. Compatibility extends across Apple devices running the latest operating systems.

Key Highlights:

- Manual entry and bank account transaction import

- Shared budget tracking with invitation support

- Visual overview of income, expenses, and savings

- Split feature to track shared expenses between users

- Available in multiple languages including English, Spanish, French, and German

- Compatible with iOS 17.0+, iPadOS 17.0+, and watchOS 4.0+

- Premium features available via subscription

Who it’s best for:

- Individuals managing budgets alone or with partners

- Groups tracking joint expenses for trips or shared costs

- Users who want manual control or automatic bank imports

- iPhone and iPad users looking for multilingual support

- People seeking a visual layout for spending and savings overviews

Contact Information:

- App store: apps.apple.com/us/app/buddy-budget-planner-app

- Website: buddy.download

- Address: Vidargatan 5 BV, 113 27 Stockholm

- E-mail: hello@buddy.download

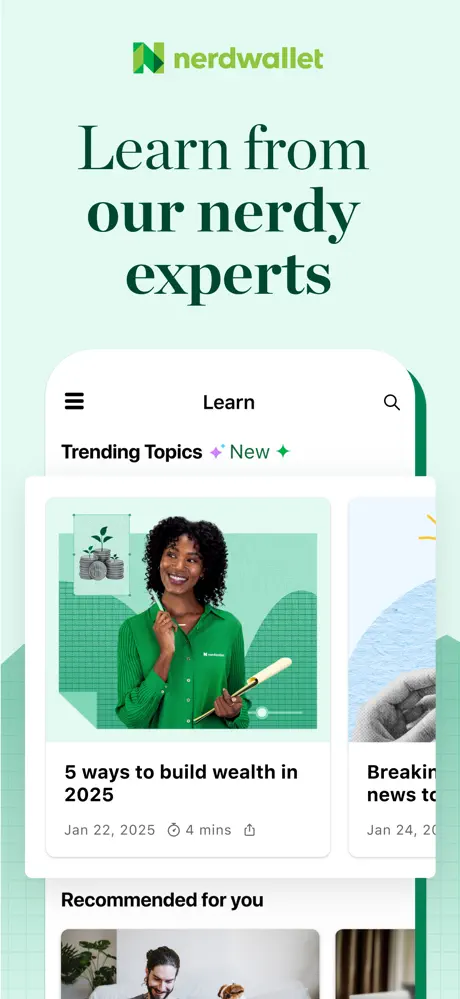

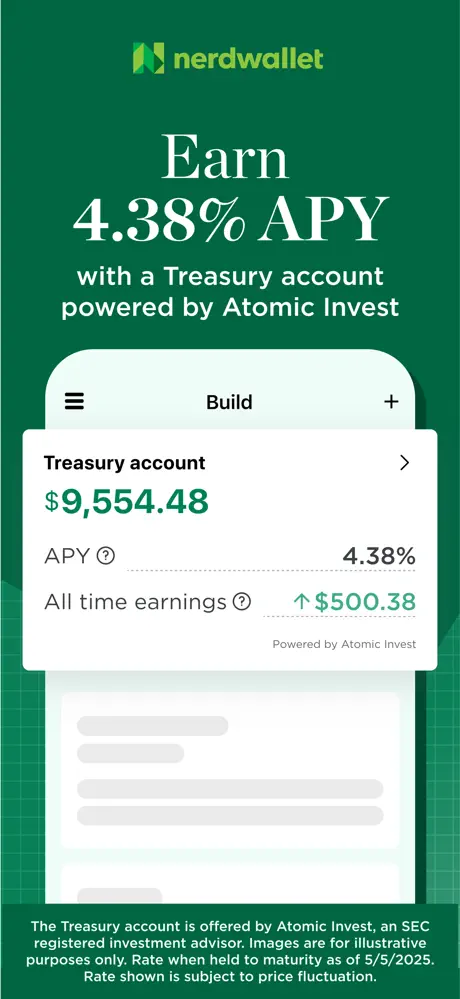

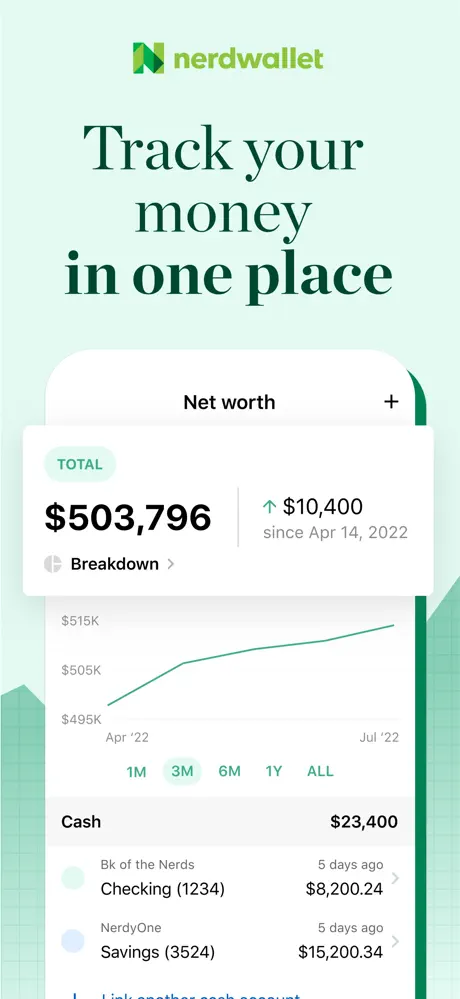

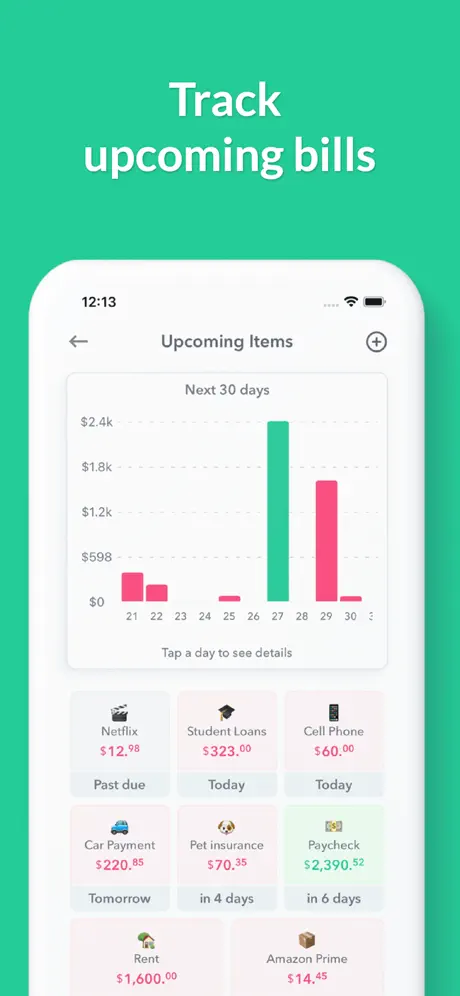

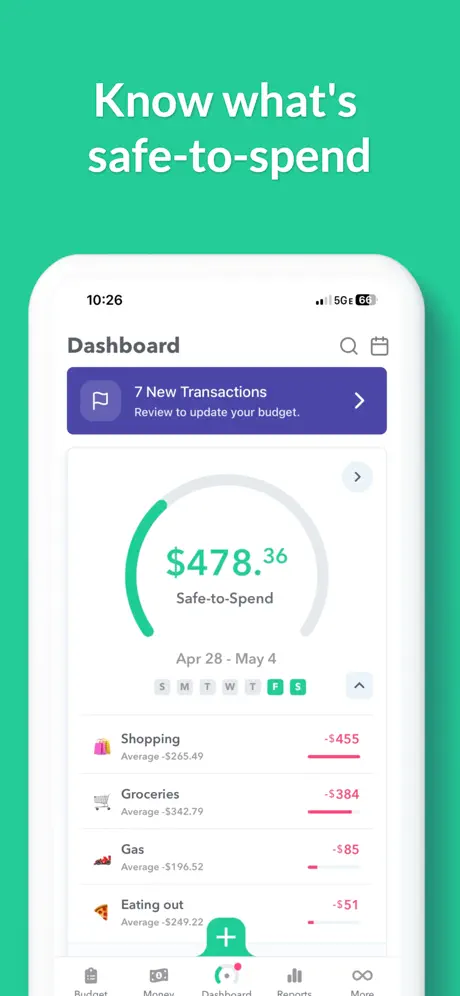

7. NerdWallet: Smart Money App

NerdWallet is a finance management app available for iPhone and iPad users that brings together various tools for tracking, saving, and investing. It connects to user accounts to monitor spending, subscriptions, credit score, and net worth. The app provides financial insights based on user data and offers access to additional services like investment accounts and Treasury savings through a third-party provider. Users can view financial product comparisons and read reviews to support decision-making on credit cards, loans, and insurance.

The app includes a free version with basic features and a premium subscription known as NerdWallet+. This membership includes subscription cancellation tools, potential investment fee reductions, and rewards opportunities. The app does not include in-app purchases outside of the membership fee and requires iOS 15.1 or later. Reviews of the app have noted both the usefulness of insights and occasional syncing issues with linked accounts.

Key Highlights:

- Monitors spending, subscriptions, credit score, and net worth

- Access to savings and investment products via third-party provider

- Basic financial product comparison tools

- Credit tracking and financial insights based on user data

- Option to upgrade to NerdWallet+ for rewards and additional features

- Available in English; requires iOS/iPadOS 15.1 or later

- Free to use with optional paid membership

Who it’s best for:

- Individuals tracking their financial position and credit status

- Users seeking basic investment and savings tools within one app

- People who want insight into spending and recurring payments

- Those looking to explore and compare financial product options

- iPhone or iPad users interested in financial tracking with no upfront cost

Contact Information:

- App store: apps.apple.com/us/app/nerdwallet-smart-money-app

- Google Play: play.google.com/store/apps

- Website: www.nerdwallet.com

- Twitter: x.com/NerdWallet

- Instagram: www.instagram.com/NerdWallet

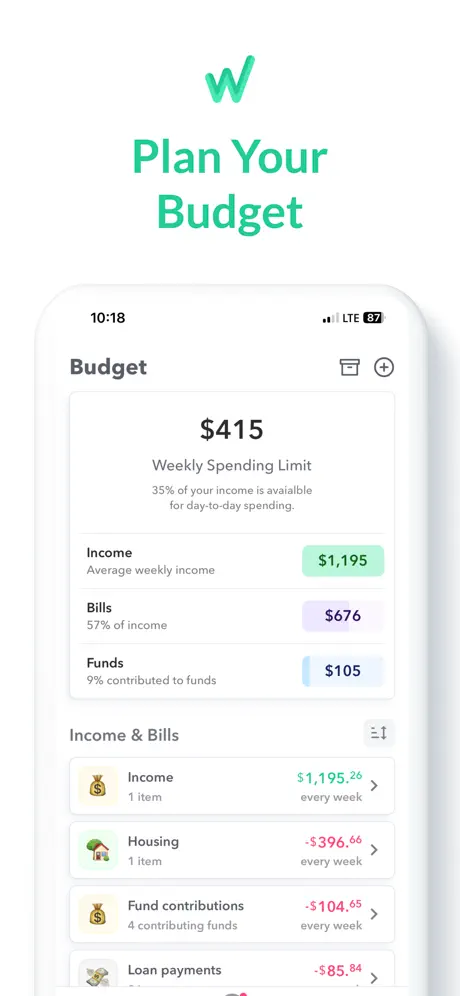

8. Weekly: Budget Planner App

Weekly is a budgeting app for iPhone and iPad users that calculates a weekly spending limit based on income, recurring expenses, and savings goals. It starts with a step-by-step budget setup where users input regular income and bills, then assigns a “safe-to-spend” amount for each week. Spending is tracked through manual entry or bank transaction imports via Plaid integration. The app also features tools for organizing and reviewing transactions by category, tracking savings funds, and managing upcoming bills.

Users can monitor account balances, view past spending patterns, and set contributions toward specific goals. Notifications help track bill due dates, while features like emoji categorization and one-tap transaction reviews provide a visual breakdown of activity. Weekly offers both free and paid versions, with premium features available via subscription. Some users report limitations with transaction sync timing and request flexibility in fund settings for irregular income patterns.

Key Highlights:

- Calculates weekly spending limit from budget inputs

- Manual and automatic transaction tracking

- Categorization tools for expenses and visual summaries

- Bill tracker with due date notifications

- Savings goal contributions managed weekly

- Account balances displayed in-app

- Custom emoji and label features for spending categories

- Requires iOS 15.0 or later

Who it’s best for:

- Users who prefer managing money on a weekly cycle

- Individuals with fixed or recurring income and expenses

- People looking to track day-to-day purchases in detail

- Users who want simple budgeting without full automation

- iOS users interested in manual control with optional transaction syncing

Contact Information:

- App store: apps.apple.com/us/app/weekly-budget-planner-app

- Instagram: www.instagram.com/weeklybudgeting

- Website: weeklybudgeting.com

- Twitter: x.com/weeklybudgeting

- E-mail: support@weeklybudgeting.com

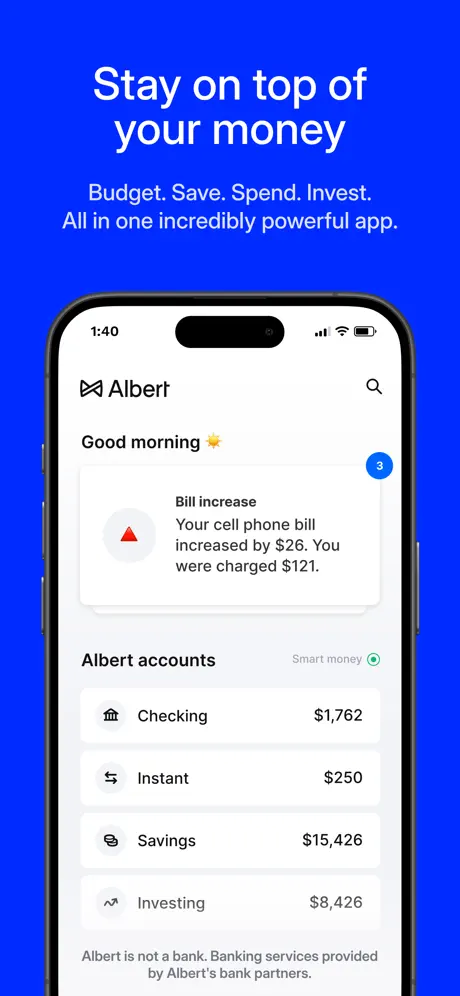

9. Albert: Budgeting and Banking

Albert is a finance app for iPhone and iPad users that combines tools for budgeting, saving, banking, and investing. It provides users with monthly budgets, tracks recurring bills, and offers suggestions for managing subscriptions or lowering expenses. Users can link external accounts to view all financial activity in one place and use automated features to transfer money into savings or investment accounts. The app also includes optional high-yield savings and investing options through affiliated financial institutions.

The app offers additional services such as 24/7 identity monitoring, credit score tracking, and cash-back rewards. Albert charges a monthly subscription fee after a 30-day trial, with pricing tiers depending on selected features. Banking services, debit cards, and savings accounts are issued through partner banks. Support is provided through text or email only, and user reviews mention mixed experiences with customer service, particularly around fund transfers and account access.

Key Highlights:

- Budget tracking and spending plan tools

- Subscription and recurring bill detection

- Direct deposit and early pay access via partnered banking services

- High-yield savings and investing features

- Credit score monitoring and fraud alerts

- Identity protection and account activity notifications

- In-app financial advice via subscription service

- Requires iOS 14.0 or later

Who it’s best for:

- Users managing multiple financial tools in one app

- Individuals looking to automate savings and investments

- People interested in bundled banking, budgeting, and security features

- iPhone or iPad users seeking early paycheck access or cash-back offers

- Those willing to use subscription-based financial services with in-app support only

Contact Information:

- App store: apps.apple.com/us/app/albert-budgeting-and-banking

- Website: albert.com

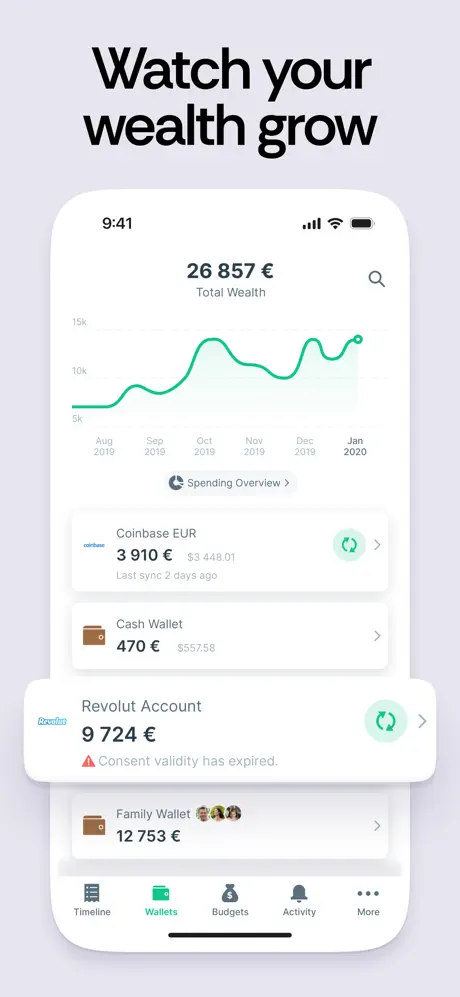

10. Empower Personal Dashboard™

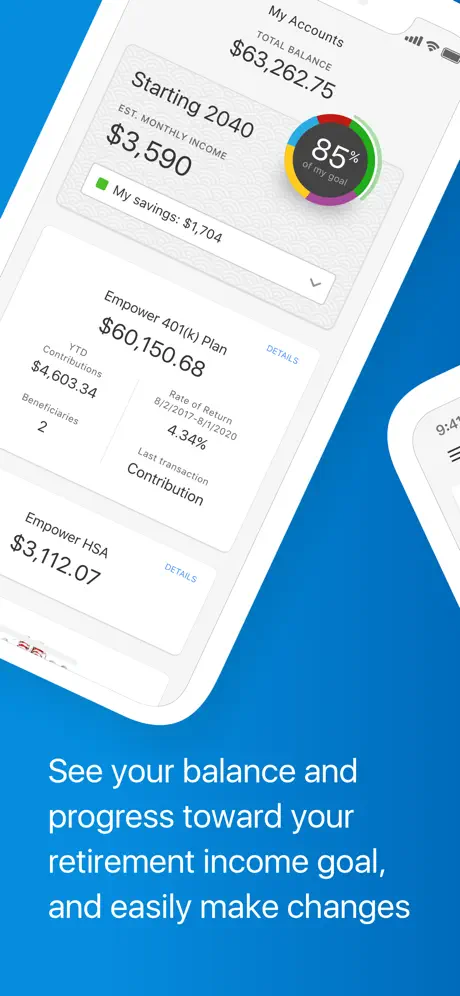

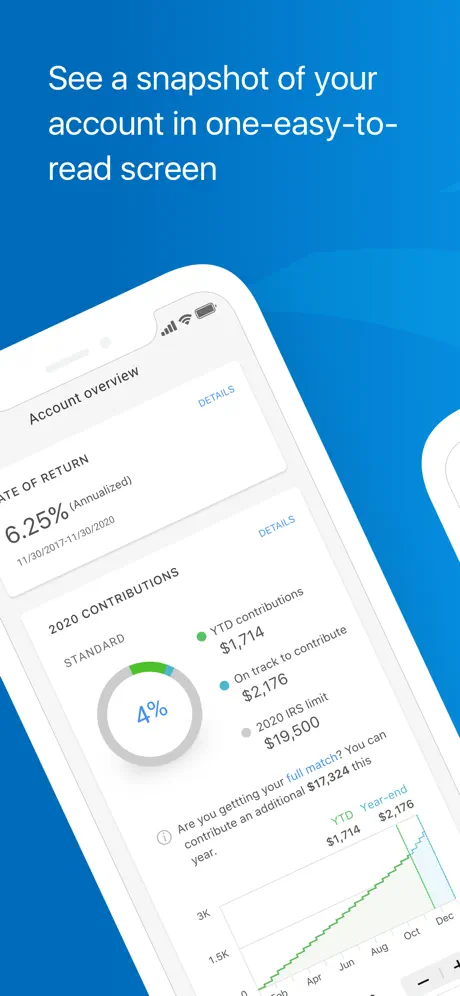

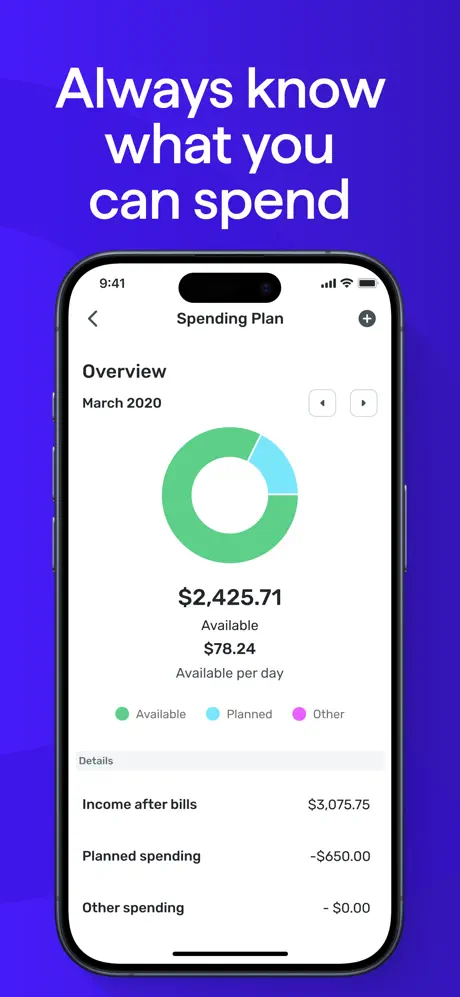

Empower Personal Dashboard™ is a financial app for iPhone, iPad, and Apple Watch users that consolidates personal finance and investment tracking. It integrates data from linked accounts such as bank accounts, credit cards, investment portfolios, and retirement plans to give users a real-time view of their net worth. The app includes tools for budgeting, expense categorization, and retirement forecasting. Users can view cash flow trends, portfolio allocations, and progress toward savings goals.

The platform offers financial planning features without requiring users to subscribe or pay a fee. Additional services, including investment advisory and wealth management, are available but optional. Some users report connection issues with certain financial institutions or tools like Venmo. Empower is operated by Personal Capital Corporation, which is part of Empower Holdings, LLC, and also provides regulated investment services under advisory and brokerage models.

Key Highlights:

- Aggregates financial data from various linked accounts

- Real-time net worth and cash flow tracking

- Budgeting tools with category-level breakdowns

- Retirement calculator with scenario planning

- Investment performance analysis and allocation tools

- Free to use with optional advisory services

- Compatible with iOS 13.0+ and iPadOS 13.0+

- Apple Watch support for quick financial overviews

Who it’s best for:

- Users looking for a broad overview of their finances in one app

- Individuals tracking investments alongside everyday expenses

- People planning for retirement with scenario-based projections

- Those who want a free budgeting and net worth tracking tool

- iOS users with multiple financial accounts to monitor together

Contact Information:

- App store: apps.apple.com/us/app/empower-personal-dashboard

- Google Play: play.google.com/store/apps/details

- Website: www.empower.com

- Facebook: www.facebook.com/officialempowertoday

- Instagram: www.instagram.com/officialempowertoday

- LinkedIn: www.linkedin.com/company/empowertoday

- Twitter: x.com/empowertoday

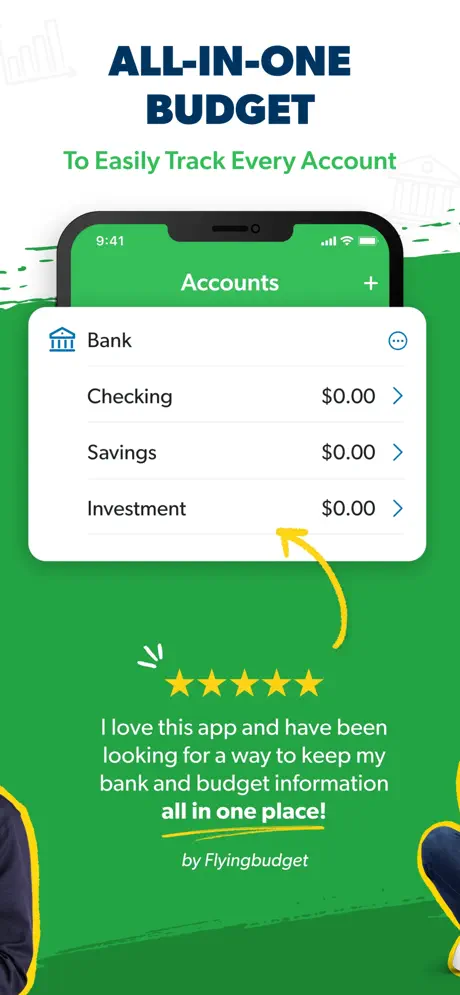

11. Quicken Simplifi: Budget Smart

Quicken Simplifi is a financial tracking app for iOS that combines budgeting, expense monitoring, savings planning, and business finance tools. It provides users with a view of their personal and business finances by linking bank accounts, credit cards, investment portfolios, and loans. The app supports real-time transaction tracking, categorization, spending plans, and custom watchlists to follow specific spending categories such as subscriptions or groceries.

Users can manage multiple businesses, generate invoices, and prepare reports for tax purposes. Quicken Simplifi integrates tools to track debt payoff, monitor net worth, and compare current cash flow with budgeted expectations. Some users report connection inconsistencies, syncing delays, and interface quirks when handling excluded transactions or adjusting category splits.

Key Highlights:

- Links to personal and business bank accounts, credit cards, and investments

- Real-time transaction updates with budget and savings tracking

- Offers watchlists and spending plans by category

- Tracks net worth and debt reduction progress

- Supports invoicing and basic tax prep for small business users

- Integration with Zillow for home value estimates

- iOS 15.1+ compatible

Who it’s best for:

- Users managing both personal and small business finances

- Individuals who prefer flexible budget structures without zero-based rules

- People tracking specific categories like subscriptions or food delivery

- Users who want side-by-side views of income, spending, and savings

- iPhone and iPad users looking for business invoicing alongside budgeting features

Contact Information:

- App store: apps.apple.com/us/app/quicken-simplifi-budget-smart

- Google Play: play.google.com/store/apps/details

- Website: www.quicken.com

- Facebook: www.facebook.com/Quicken

- LinkedIn: www.linkedin.com/company/quicken-inc.

- Twitter: x.com/quicken

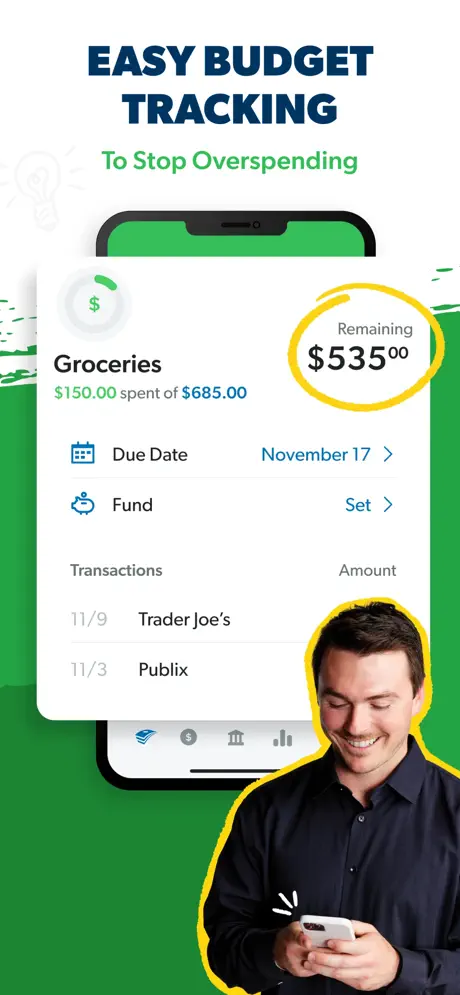

12. EveryDollar: Budget Management

EveryDollar is a budgeting app that helps users build monthly spending plans, track expenses, and manage income from one platform. It enables manual and automated transaction tracking, recurring bill planning, goal-based budgeting, and spending categorization. The app calculates spending limits and helps users monitor what is left to spend throughout the month. It also features tools for setting due dates, splitting transactions, and tracking progress toward financial goals.

In its free version, users manually manage transactions and budgeting. The paid version adds bank syncing, trend reports, export options, paycheck-based planning, and additional tracking features. Some users have noted challenges with income tracking flexibility, subscription pricing, and missing functions in goal planning. The app is built around monthly budgeting cycles and is available for iPhone and iPad.

Key Highlights:

- Custom budget creation with flexible categories

- Manual and automatic transaction tracking

- Monthly planning with recurring expense and income support

- Sinking fund management for saving toward specific goals

- Exportable financial data and reporting tools

- Paycheck tracking and financial roadmap features (paid version)

- Available customer support and live coaching options

Who it’s best for:

- Users seeking a structured monthly budgeting system

- Individuals who prefer detailed manual control or opt for bank sync via paid plans

- People aiming to track income, savings, and recurring bills in one place

- Families or couples managing shared household budgets

- Users interested in financial goal setting and expense categorization

Contact Information:

- App store: apps.apple.com/us/app/everydollar-budget-management

- Google Play: play.google.com/store/apps/details

- Website: www.ramseysolutions.com

13. Goodbudget Budget Planner

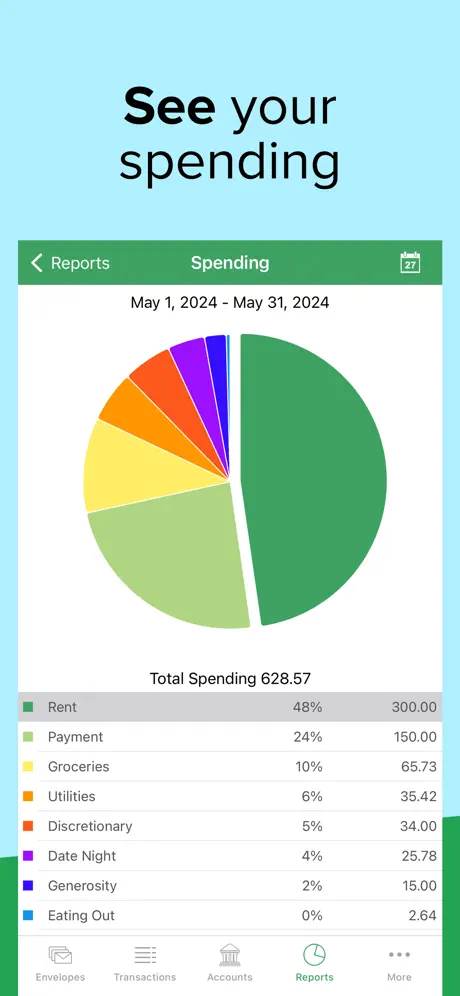

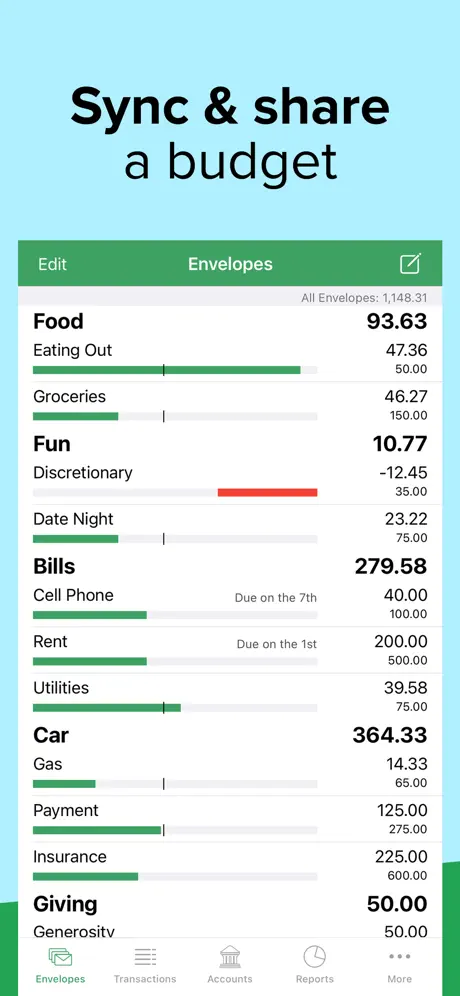

Goodbudget is a personal finance app built around the envelope budgeting method. It enables users to create digital envelopes for various spending categories, enter transactions manually, and sync data across multiple devices. The app provides tools for scheduling transactions, setting recurring payments, and analyzing income and expenses through built-in reports. It also supports tracking of both envelope balances and overall account balances.

The free version of Goodbudget includes access to a limited number of envelopes and basic budgeting tools. A subscription unlocks additional features like unlimited envelopes and accounts, automatic bank sync, and extended device sharing. Reports such as debt tracking, income versus spending, and envelope-specific charts are available in-app and on the web. Users can export data as CSV and use the web platform for reconciliation and historical analysis.

Key Highlights:

- Envelope-based budgeting system

- Sync across devices and access via web

- Manual or scheduled transaction tracking

- Debt payoff and spending reports

- CSV export option via web

- Subscription adds bank sync and additional features

Who it’s best for:

- Individuals or households using envelope-style budgeting

- Users who want to share budgets across multiple devices

- Those preferring manual entry with basic automation options

- People tracking both spending and debt repayment progress

- Users seeking a cloud-based alternative to physical cash envelopes

Contact Information:

- App store: apps.apple.com/us/app/goodbudget-budget-planner

- Google Play: play.google.com/store/apps/details

- Website: goodbudget.com

- Facebook: www.facebook.com/eebacanhelp

- Instagram: www.instagram.com/goodbudgetapp

- Twitter: x.com/goodbudget

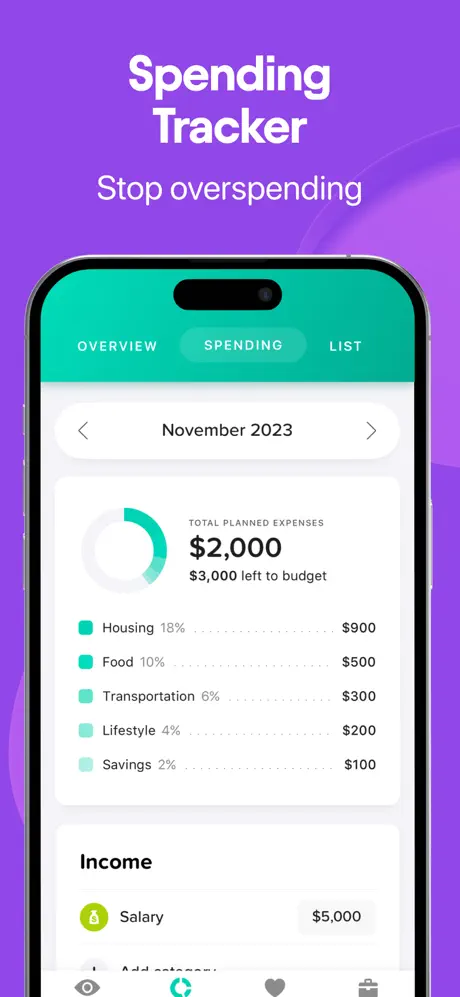

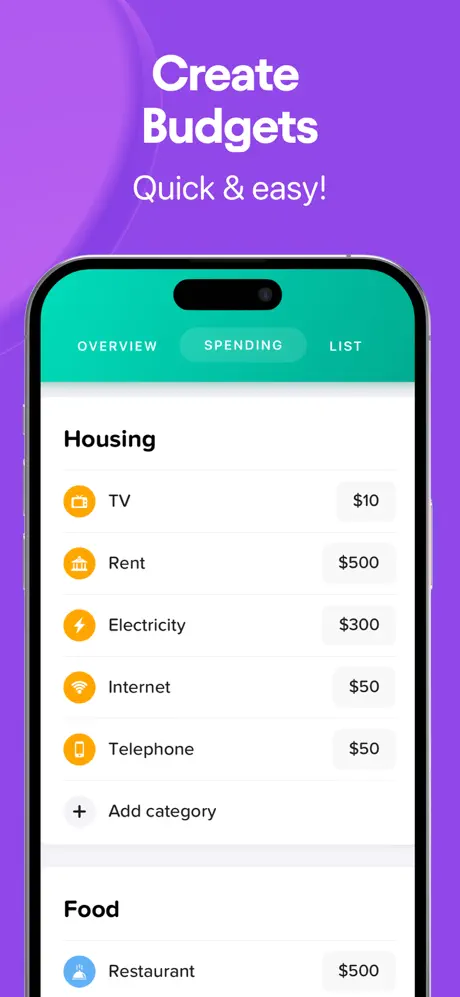

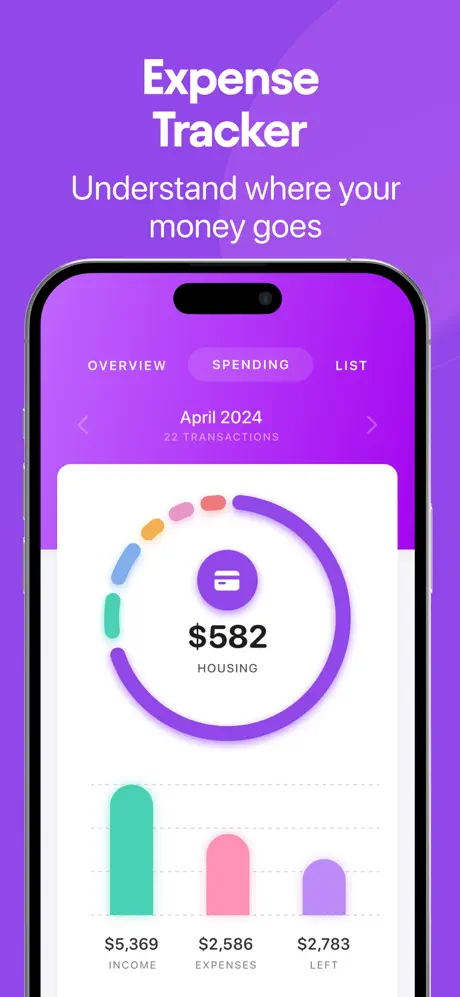

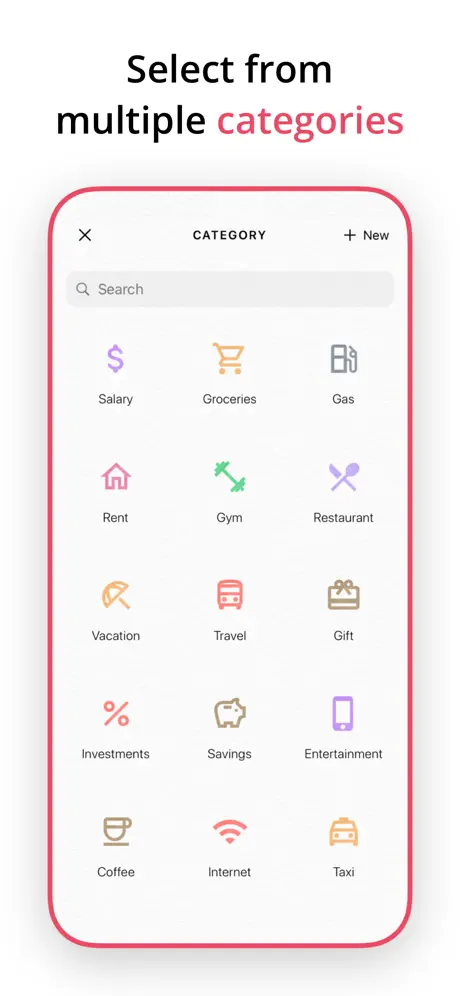

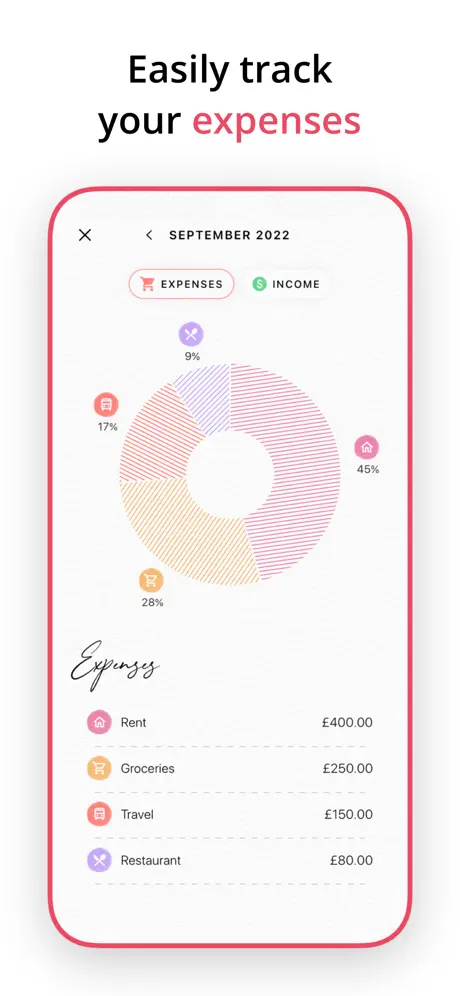

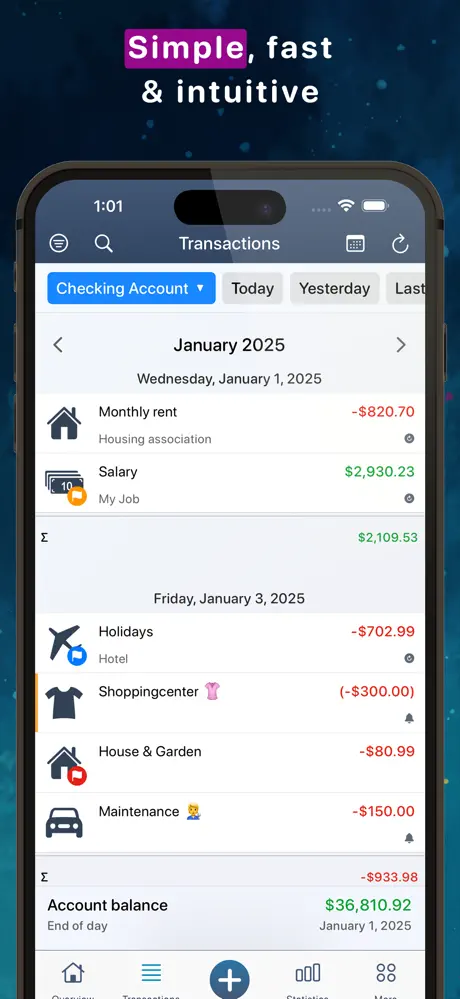

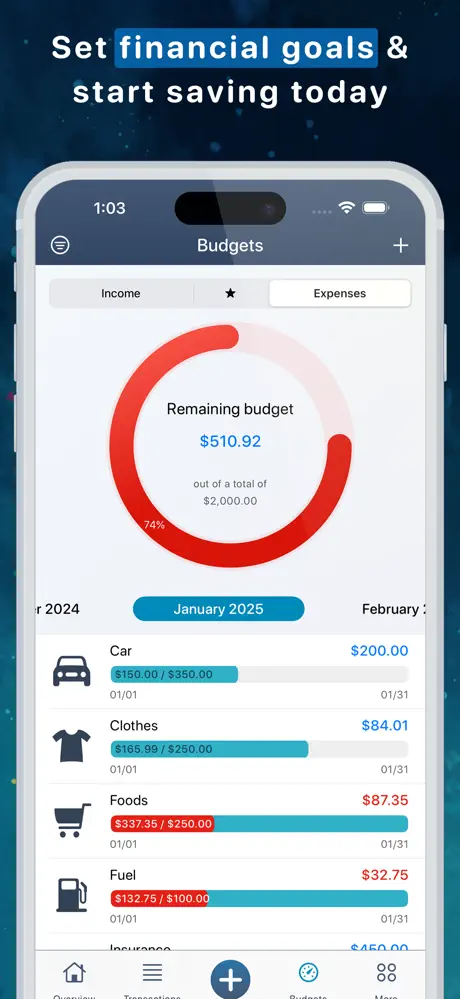

14. Budget App – Spending Tracker

Budget App by LightByte is a mobile finance tool designed to support users in tracking expenses, managing budgets, and organizing financial activity. It offers calendar-based visual budgeting, category-level planning, and various automation options such as AI-powered receipt scanning, voice input, and recurring transaction setup. The app supports shared ledgers, asset tracking, and multiple device sync with cloud backup. Users can customize categories, view spending patterns through charts, and manage both personal and collaborative finances.

Premium features include the ability to manage unlimited budgets and categories, track subscriptions, and use export functions for recordkeeping. The interface is designed for manual entry or bank import via CSV, and it includes tools like widgets and shortcut integration. The app supports multiple languages and platforms, including Apple Watch, and offers in-app purchases for extended access.

Key Highlights:

- Budget planning by category, sub-category, and ledger

- Calendar view with daily spending tracking

- AI voice input, receipt scan, and smart importing

- Shared ledger and subscription management

- Widgets and iOS shortcuts for quick transaction logging

- CSV import/export and cross-device sync

- Asset tracking for credit, debit, and investment accounts

Who it’s best for:

- Users managing multiple spending categories on a daily basis

- People who prefer visual tools like charts and calendars

- Households or teams needing shared budget access

- Users tracking recurring payments or subscriptions

- Individuals interested in AI-assisted finance input and manual control options

Contact Information:

- App store: apps.apple.com/us/app/spending-tracker

- Google Play: play.google.com/store/apps/details

- Website: www.mhriley.com

15. Budget Planner App – Fleur

Fleur is a finance app focused on personal budget tracking through manual input and straightforward tools. Users can record income, expenses, and recurring payments while organizing their transactions into custom categories. The app supports monthly budget setting, account tracking, debt management, and viewing of spending trends over time. It operates without account linking and instead relies on user-entered data for all financial records.

The app includes iCloud sync and works across iPhone, iPad, and Mac. Users can access past transactions, apply filters for search, and monitor financial behavior with visual insights. Fleur is structured around a one-time purchase model for lifetime premium access and does not require user sign-in.

Key Highlights:

- Manual transaction input with customizable categories

- Monthly budgeting and recurring transaction setup

- Transaction history with filters and search

- Budget and debt tracking per account

- iCloud sync across iOS and macOS devices

- No account linking or login required

Who it’s best for:

- Users who prefer manual expense tracking

- Individuals looking to avoid account-based financial apps

- People managing budgets across multiple devices

- Those focused on daily recording without automation

- Users interested in category-based spending insights without external data sync

Contact Information:

- App store: apps.apple.com/us/app/budget-planner-app-fleur

- Website: fleurbudget.com

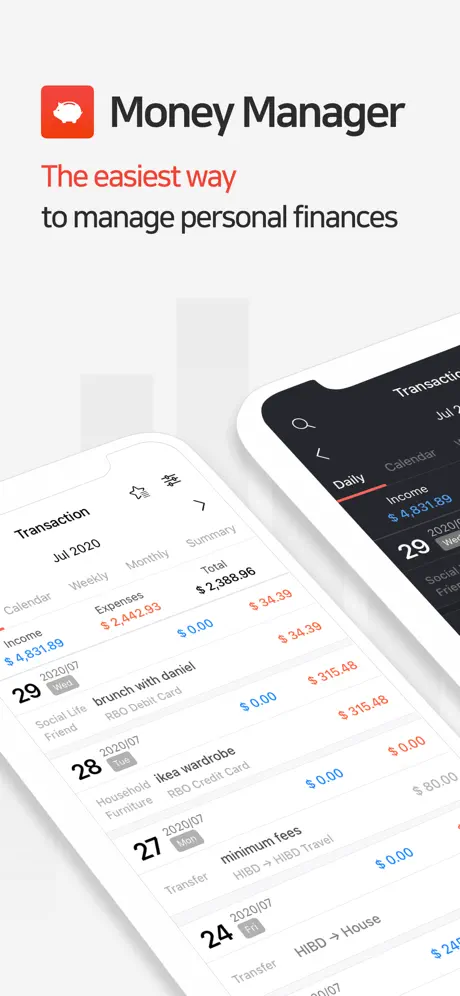

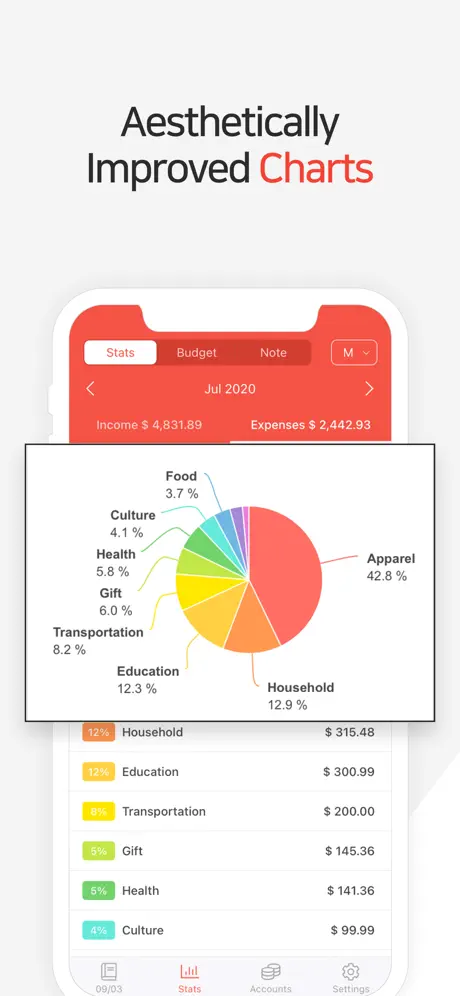

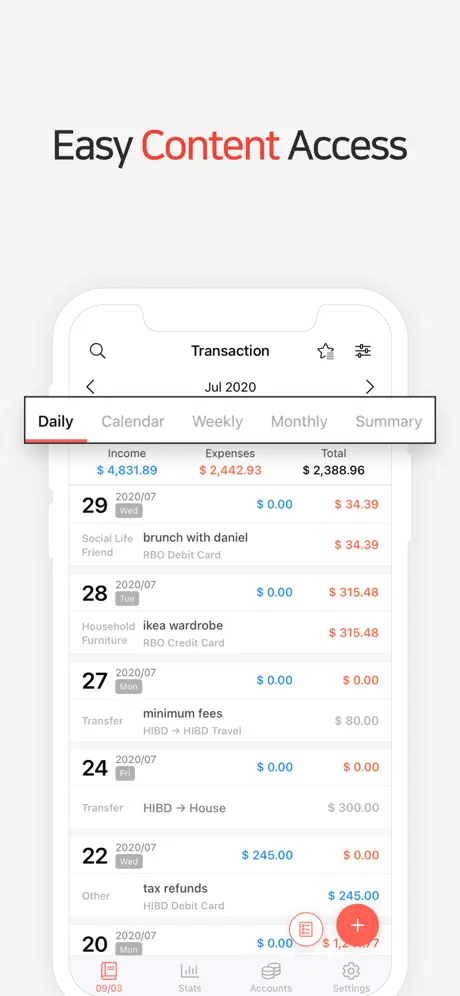

16. Money Manager Expense & Budget

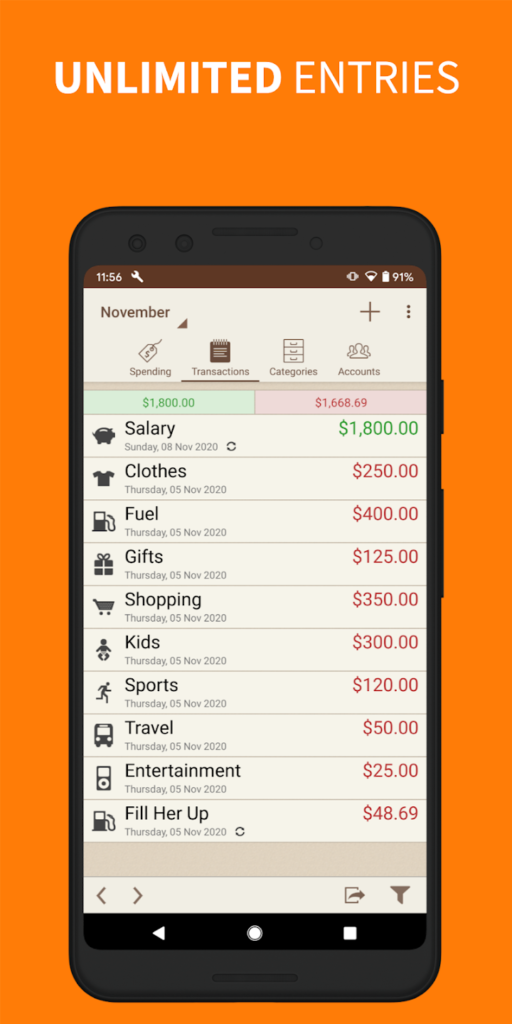

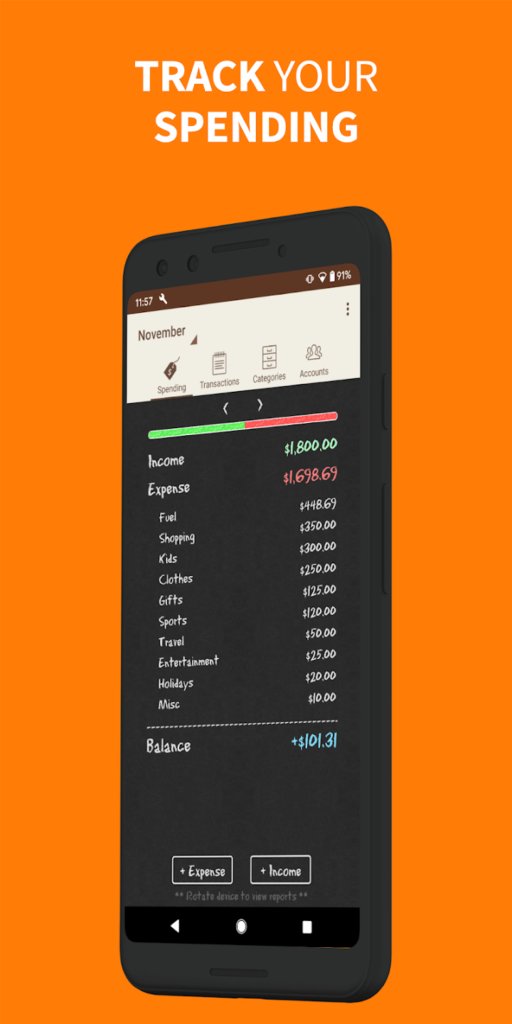

Money Manager Expense & Budget is a finance app designed for users who want to track income, expenses, and transfers across multiple accounts. It applies double-entry bookkeeping and allows users to manage various account types including cash, debit, credit, loans, and investments. The app supports transaction input with customizable categories, budget planning by week, month, or year, and visualization tools such as pie charts and graphs. It also includes features for sorting expenses by recipient and setting up recurring payments or transfers.

The app provides a calendar view, multi-currency options, and passcode protection. Users can back up data via iCloud, iTunes, or email and access a browser-based PC manager interface through Wi-Fi. Subscriptions offer access to unlimited accounts and data sync services. The interface includes payment profiles and expense tracking tools that support daily, weekly, and annual financial oversight.

Key Highlights:

- Double-entry bookkeeping with customizable categories

- Budget tracking for weekly, monthly, and annual periods

- Recurring transactions and scheduled transfers

- Multi-currency and multi-account support

- Graphical reports and calendar views

- Backup via email, iCloud, or iTunes

- Wi-Fi access to PC interface for desktop management

- Passcode lock for app access

Who it’s best for:

- Users managing multiple types of financial accounts

- Individuals needing structured double-entry tracking

- People looking for manual input with high customization

- Users who want offline functionality with optional PC sync

- Those managing household or small business budgets manually

Contact Information:

- App store: apps.apple.com/us/app/money-manager-expense-budget

- Google Play: play.google.com/store/apps/details

- Website: realbyteapps.com

17. MoneyStats – Budget Planner

MoneyStats – Budget Planner is a personal finance app built for users who want to track income, expenses, and savings goals with flexible reporting and visualization tools. It supports multiple accounts, categorization, transaction tags, and recurring entries. Users can manage their finances by creating budgets, monitoring trends with charts and forecasts, and accessing data across iPhone, iPad, and Mac. The app also supports manual and automatic data entry, import/export functions, and optional features like AI-powered receipt scanning and direct bank connection in select countries.

The app includes loan repayment planning, savings tracking, and the ability to analyze specific time periods. It supports multiple currencies and provides exchange rate data for international financial management. User privacy is emphasized, with data stored locally by default and additional protections available through app locks. Synchronization and some premium functions are available through one-time purchases or subscriptions.

Key Highlights:

- Budget planning, recurring transactions, and detailed charts

- Support for multiple accounts and currencies

- Forecasting tools and custom savings goals

- Manual or automatic transaction input

- iCloud sync and optional bank connections

- Import/export via CSV, QIF, TXT formats

- Data stored locally with optional privacy locks

- Includes loan repayment planner and exchange rate tracking

- Siri and iOS Shortcuts integration for automation

Who it’s best for:

- Users managing finances across multiple Apple devices

- Individuals who need manual and automatic tracking options

- People who want detailed reporting and forecast tools

- Users interested in managing multiple accounts in various currencies

- Those seeking local data storage and minimal third-party access

Contact Information:

- App store: apps.apple.com/by/app/moneystats-budget-planner

- Website: ttdeveloped.com

18. Spendee Budget App & Planner

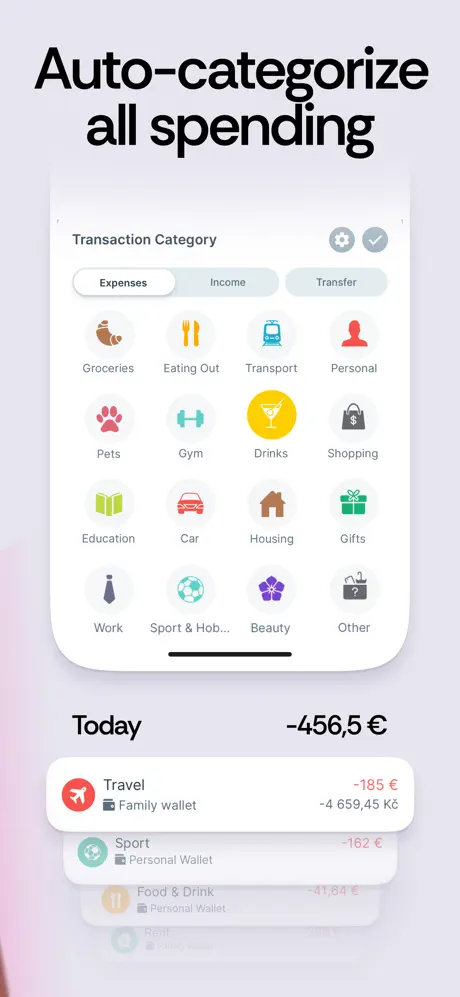

Spendee is a personal finance app that supports users in organizing income, tracking expenses, and creating budgets. The app connects to bank accounts, PayPal, and crypto wallets for consolidated financial views. Users can manage their spending with categorized transactions, track progress against budgeted amounts, and receive visual summaries through graphs and charts. Spendee also features shared wallets, subscription monitoring, and multi-currency support.

The app supports both manual and automatic transaction entry, and provides options to manage finances across different occasions, devices, and timeframes. Features include wallet customization, data labels, dark mode, and web access. Premium users have access to synced bank feeds and detailed insights, while free users manage their data manually within limited wallets.

Key Highlights:

- Bank, PayPal, and crypto-wallet integration

- Budget creation and real-time tracking

- Automatic transaction categorization

- Visual charts for income and expenses

- Shared wallets for group budgeting

- Recurring expense support

- Multi-currency compatibility

- Dark mode and web version access

Who it’s best for:

- Individuals tracking spending across multiple platforms

- Users managing household or shared expenses

- People handling multiple currencies or travel budgets

- Budgeters seeking automatic data sync and categorization

- Users who want to compare spending across different time periods

Contact Information:

- App store: apps.apple.com/us/app/spendee-budget-app-planner

- Google Play: play.google.com/store/apps/details

- Website: www.spendee.com

- Facebook: www.facebook.com/spendeeapp

- Instagram: www.instagram.com/spendeeapp

- Twitter: x.com/spendeeapp

19. MoneyCoach My Budget Planner

MoneyCoach offers a range of personal finance tools focused on manual expense tracking, budgeting, and long-term goal setting. Users can input transactions, set up budgets, monitor real-time net worth, and view reports based on spending data. The app includes support for recurring transactions, exchange rates, savings accounts, and detailed categorization of income and expenses. It also provides access across multiple Apple devices, including Mac, iPad, iPhone, Apple Watch, and Apple Vision.

The app emphasizes financial habit-building through daily input and review features. While it does not include automatic bank synchronization, it supports manual data entry with features like CSV import and personalized financial goals. Premium options expand features such as syncing across devices, unlimited budgets and accounts, advanced reporting tools, and multi-currency tracking.

Key Highlights:

- Manual transaction entry with CSV import

- Personalized budgets and goal-setting features

- Net worth tracking and real-time financial overviews

- Multi-device support with iCloud sync

- Recurring expense and income management

- Custom reporting, filtering, and export options

- Supports multiple currencies and exchange rate updates

- Access to features via widgets, Touch ID, and keyboard shortcuts on Mac

Who it’s best for:

- Users who prefer manual input over automatic syncing

- Individuals building financial tracking habits from scratch

- People using multiple Apple devices across platforms

- Users who want personalized budget and goal customization

- Those seeking detailed financial tracking without linking bank accounts

Contact Information:

- App store: apps.apple.com/us/app/budget-planner-app-money-coach

- Website: moneycoach.ai

- Facebook: www.facebook.com/moneycoachapp

- Instagram: www.instagram.com/appmoneycoach

- Twitter: x.com/appmoneycoach

20. Emma – Budget Planner Tracker

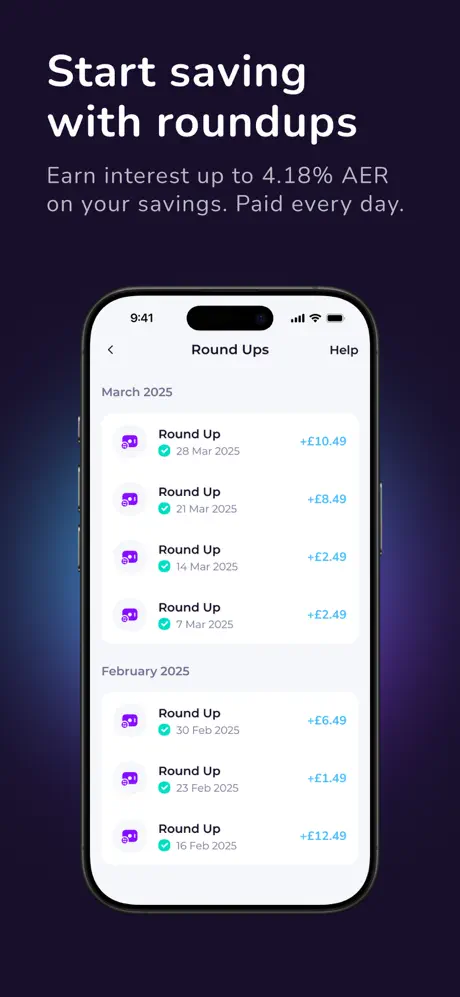

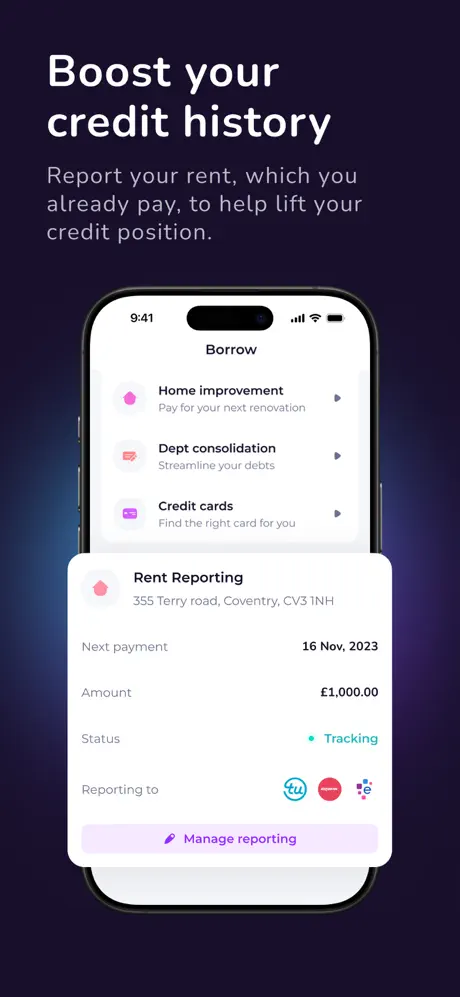

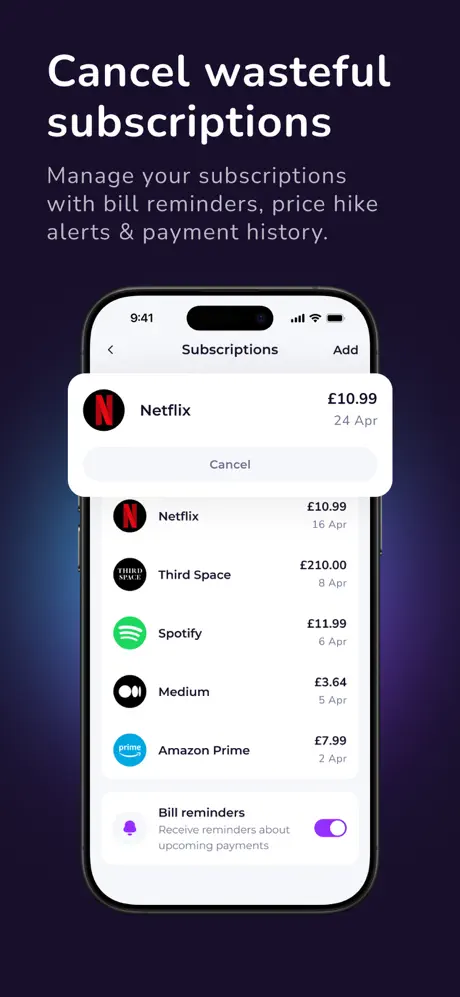

Emma brings together multiple financial management features into one app by linking users’ accounts, subscriptions, and budgets in a single dashboard. The app supports connections to traditional bank accounts, PayPal, and some crypto wallets, giving users access to balances, spending patterns, and recurring charges. Users can set budgets, review weekly reports, and receive daily balance updates or overdraft alerts based on their transaction activity.

The app also offers paid tiers with more in-depth features like bill reminders, transaction renaming, custom categories, offline account tracking, and smart automation rules. For users managing multiple financial sources or looking to track shared finances with others, Emma supports account grouping and provides separate analytics for each space. The app is designed to be used across iOS, iPadOS, macOS, and Apple Vision devices with a consistent interface.

Key Highlights:

- Links multiple bank accounts, e-wallets, and crypto accounts

- Tracks subscriptions and bills with alerts for price changes

- Offers budget creation and daily balance notifications

- Includes export options, custom categories, and transaction splitting

- Provides security features like biometric login and SSL encryption

- Optional smart rules to automate manual expense tracking

- Supports shared wallets and account grouping for separated budgets

Who it’s best for:

- Users managing multiple bank or financial service accounts

- People who want to track recurring subscriptions and reduce hidden expenses

- Individuals seeking to build and monitor custom budgets

- Users who prefer automatic bank syncing over manual entry

- Households or roommates sharing financial responsibilities across accounts

Contact Information:

- Google Play: play.google.com/store/apps

- App Store: apps.apple.com/gb/app/emma-budget-planner-tracker

- Website: emma-app.com

- Facebook: www.facebook.com/emmafinance

- Twitter: x.com/emma_finance

- Instagram: www.instagram.com/emma_finance

Conclusion

Finding the best iPhone budget app really depends on what someone needs to keep their money organized. Some people want a tool that just tracks daily spending, while others might be juggling subscriptions, shared budgets, or trying to plan for long-term goals. With so many options out there, it’s not about which app has the most features but which one actually fits a person’s lifestyle and financial habits.

For anyone trying to get a better handle on their finances, whether that’s just seeing where their money goes or building smarter saving routines, there’s likely an app on this list that does the job without overcomplicating things. The key is to try a few, see what clicks, and go with the one that makes budgeting feel like less of a chore.

Leave a Reply

You must be logged in to post a comment.