Managing money as a couple can be a weird mix of “we’ve got this” and “wait, what did you spend $87 on?” Whether you’re splitting bills, saving for a big move, or just trying to avoid surprise credit card charges, having a shared budgeting app can make a huge difference. The right app keeps both people in the loop – no spreadsheets, no guilt trips, just smart money habits that actually stick.

And since syncing up your financial goals often starts with syncing up your grocery list, ReciMe fits into the mix naturally. Our app pulls recipes from TikTok, Instagram, and Pinterest, builds easy meal plans, and creates aisle-sorted grocery lists that help couples cut back on food waste and spending. Grab ReciMe now, power up your grocery game, and let’s get into the top budgeting apps for couples.

Download for free from the App Store on iPhone and iPad

ReciMe Android App

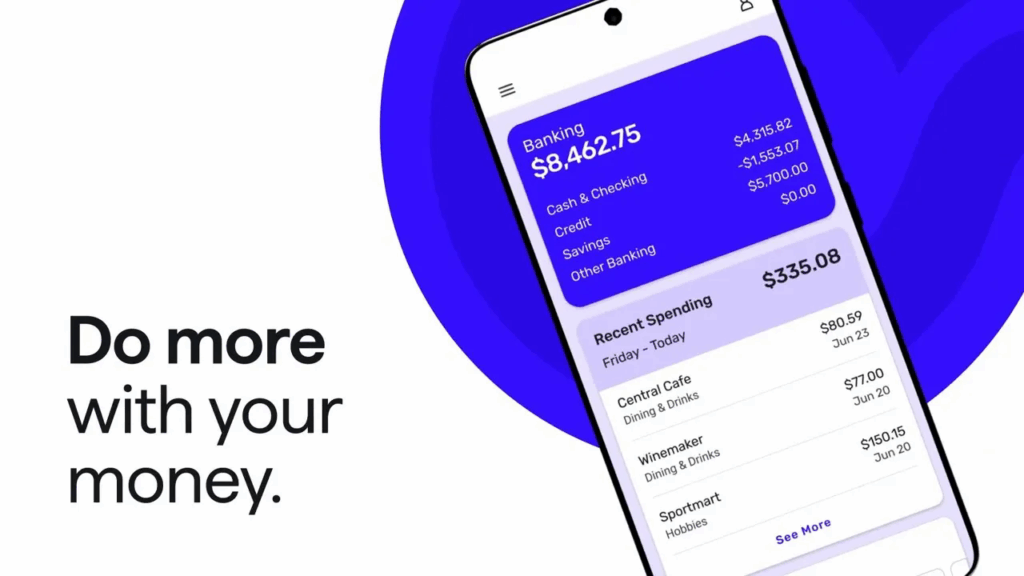

1. Monarch Money

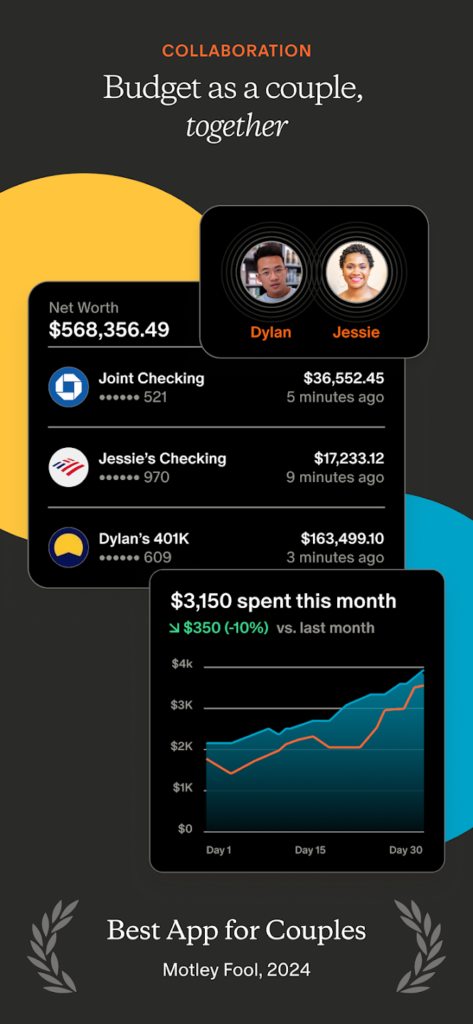

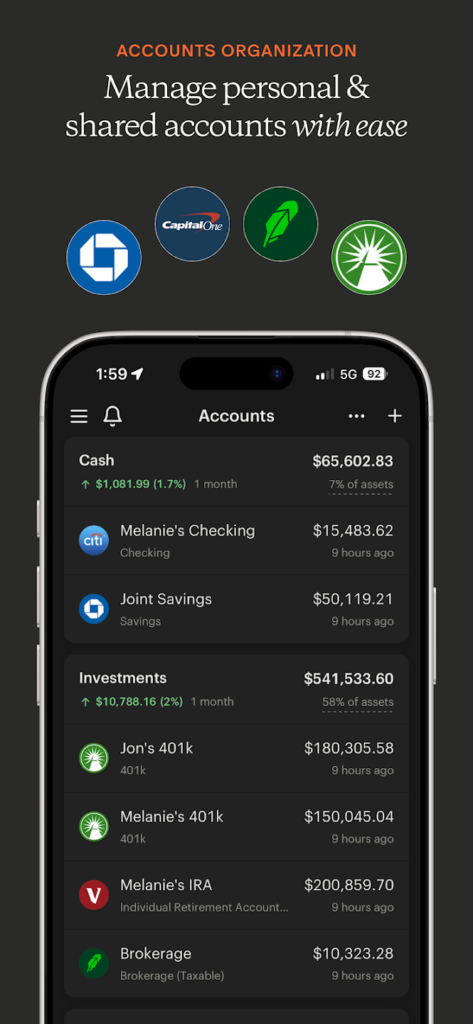

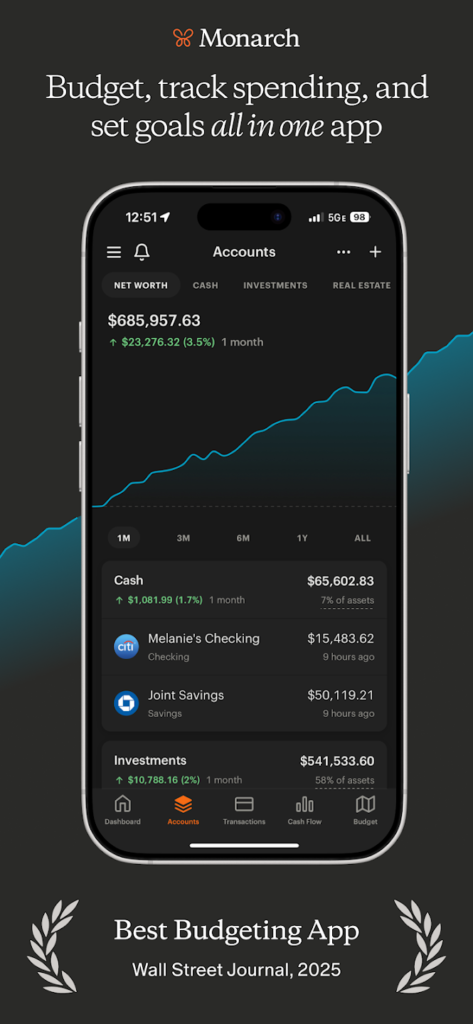

Monarch make it pretty easy for couples to get a bird’s-eye view of their money situation. You can both link your accounts and check out everything from spending habits to savings goals in one place. It breaks stuff down automatically, so you’re not digging through statements trying to remember what that $18 charge was. Plus, you can set up shared goals – like travel, paying off debt, or finally upgrading the couch.

Budgets are flexible, and you can tweak them as life changes. It also keeps an eye on subscriptions, which helps catch those “we still pay for that?” moments. Whether you’ve merged finances or are still keeping things semi-separate, it’s built to work either way. And it runs smoothly on both web and mobile.

Key Highlights:

- One dashboard to see all your money stuff

- Goal setting for whatever you’re working toward

- Transactions sorted automatically

- Keeps track of subscriptions and recurring charges

- Works on both desktop and mobile

Who it’s best for:

- Couples managing money together (or halfway there)

- Partners with both shared and individual accounts

- Anyone who likes seeing where every dollar goes

- People who want a flexible budget that grows with them

Contact Information:

- Website: www.monarchmoney.com

- App Store: apps.apple.com/us/app/monarch-budget-track-money

- Google Play: play.google.com/store/apps/details

- E-mail: support@monarchmoney.com

- Facebook: www.facebook.com/MonarchMoney

- Twitter: x.com/monarch_money

- LinkedIn: www.linkedin.com/company/monarch-money

- Instagram: www.instagram.com/monarch_money

2. Honeydue

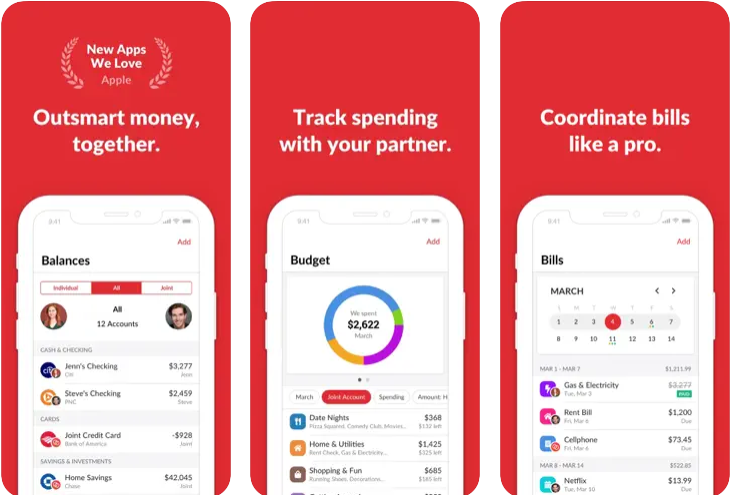

Honeydue is great for couples who want to stay on top of shared expenses but aren’t quite ready to merge everything. You each get to choose what accounts or info you share (or don’t), and the app helps keep tabs on bills and upcoming payments. It categorizes stuff automatically so you can quickly see where your money’s going without a bunch of digging.

There’s even a built-in chat, so instead of texting “Hey, did you buy $40 worth of snacks?” you can just tag the transaction and ask in the app. It’s a no-fuss, mobile-first setup that’s more about keeping things easy than getting super deep into financial planning.

Key Highlights:

- Pick what financial info you share

- Tracks bills and due dates

- In-app messaging to talk about money stuff

- Super simple, mobile-friendly layout

- Great for tracking shared daily spending

Who it’s best for:

- Couples who like keeping some things private

- Partners splitting bills but not merging accounts

- Anyone looking for a lightweight money app

- Budgeting beginners who want something simple

Contact Information:

- Website: www.honeydue.com

- App Store: apps.apple.com/us/app/honeydue-couples-finance

- Google Play: play.google.com/store/apps/details

- Facebook: www.facebook.com/honeydueapp

- Twitter: x.com/gethoneydue

- LinkedIn: www.linkedin.com/company/honeydue

3. YNAB (You Need A Budget)

YNAB’s a bit more hands-on than most apps, but that’s kind of the point. Instead of just tracking where your money went, it helps you plan ahead by assigning every dollar a job. You and your partner can budget together, prioritize your goals, and tweak things as income or expenses change.

It’s not as “plug and play” as some other apps – you’ll probably need to spend some time getting it set up – but once it’s rolling, it gives you a ton of control. It works whether you sync your accounts or enter stuff manually. If you’re both serious about getting ahead financially, it can be a game-changer.

Key Highlights:

- Budgeting that focuses on planning, not just tracking

- Totally customizable categories and rules

- Option to sync accounts or log things manually

- Tools for saving and paying off debt

- Use it on web or mobile

Who it’s best for:

- Couples who want full control of their finances

- Partners working toward big financial goals

- People who like to be hands-on with their money

- Users willing to stay engaged with budgeting regularly

Contact Information:

- Website: www.ynab.com

- App Store: apps.apple.com/us/app/ynab

- Google Play: play.google.com/store/apps/details

- Facebook: www.facebook.com/ynabofficial

- Twitter: x.com/ynab

- Instagram: www.instagram.com/ynab.official

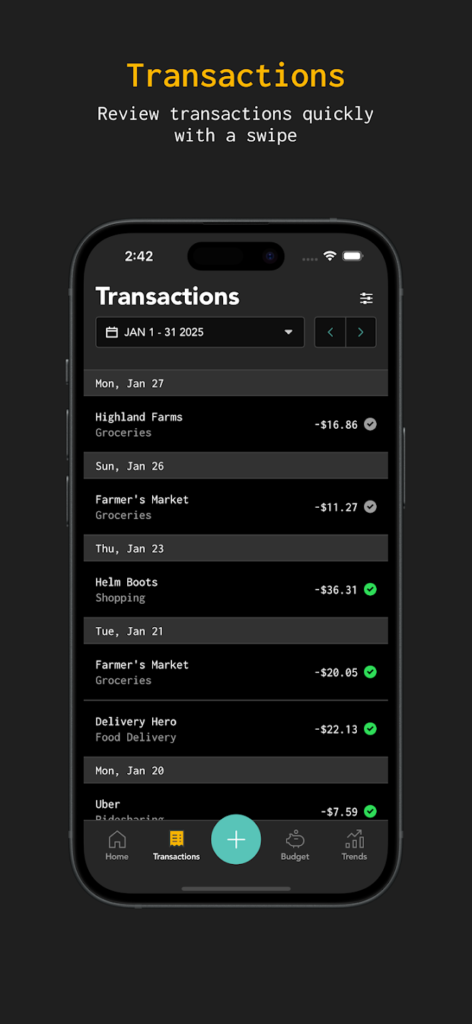

4. PocketGuard

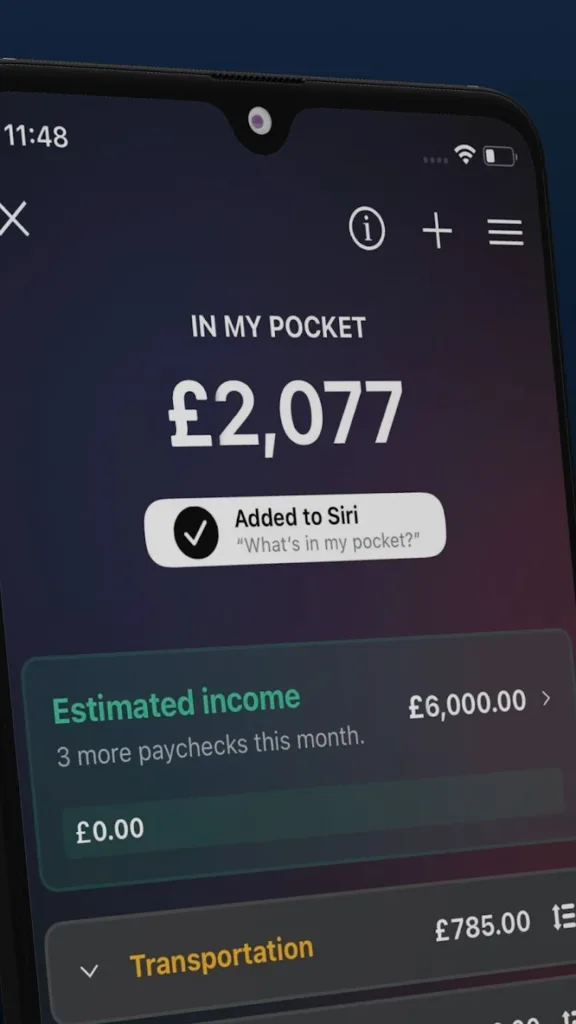

If you and your partner are constantly wondering where your money actually goes each month, PocketGuard can help clear that up. It links to your bank accounts and keeps tabs on everything – spending, bills, subscriptions – so you can both see what’s coming in, what’s going out, and how much you really have left to play with. No math required.

It’s got a clean, easy-to-read interface that shows you what’s “in your pocket” after all the essentials are covered. You can also track financial goals, chip away at debt, or just get a better sense of your cash flow. And since it syncs in real time, you’re both always up to date, no spreadsheets or late-night budgeting marathons needed.

Key Highlights:

- Syncs your accounts and updates in real time

- Automatically sorts your spending into categories

- Shows how much money is safe to spend

- Includes tools for debt payoff and savings goals

Who it’s best for:

- Couples who need a clearer picture of daily spending

- Partners who share bills and want to stay in sync

- People who prefer automation over doing it all by hand

- Anyone juggling debt payments with everyday budgeting

Contact Information:

- Website: pocketguard.com

- App Store: apps.apple.com/us/app/pocketguard-budget-tracker-app

- Google Play: play.google.com/store/apps/details

- Facebook: www.facebook.com/pocketguardapp

- Twitter: x.com/PocketGuardApp

- LinkedIn: www.linkedin.com/company/pocketguard

- Instagram: www.instagram.com/pocketguardapp

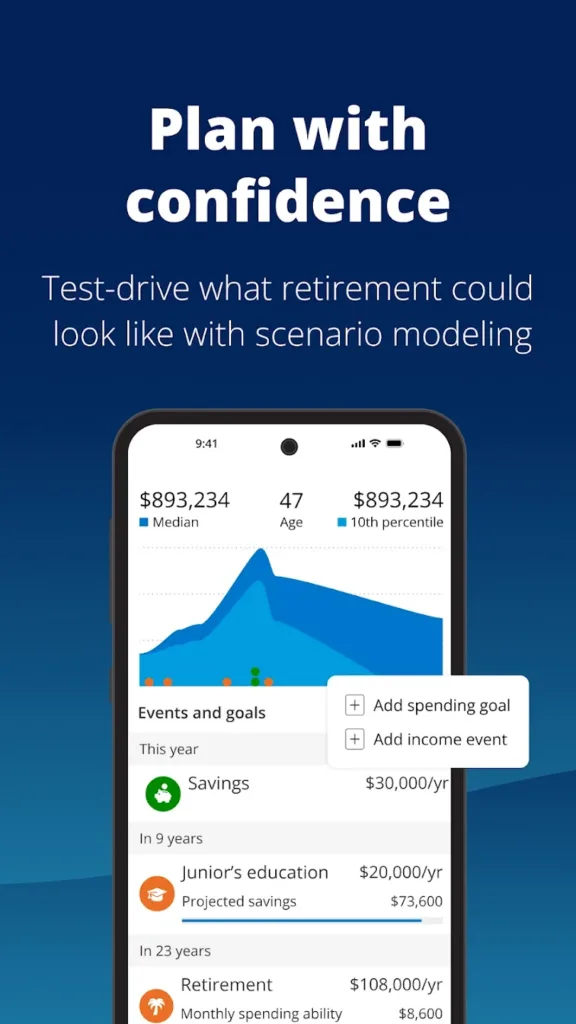

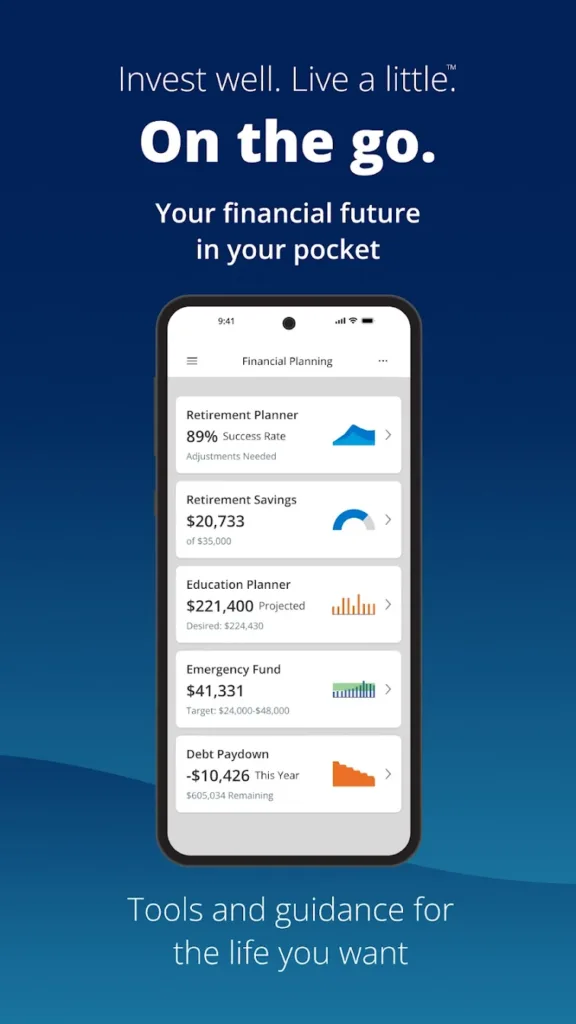

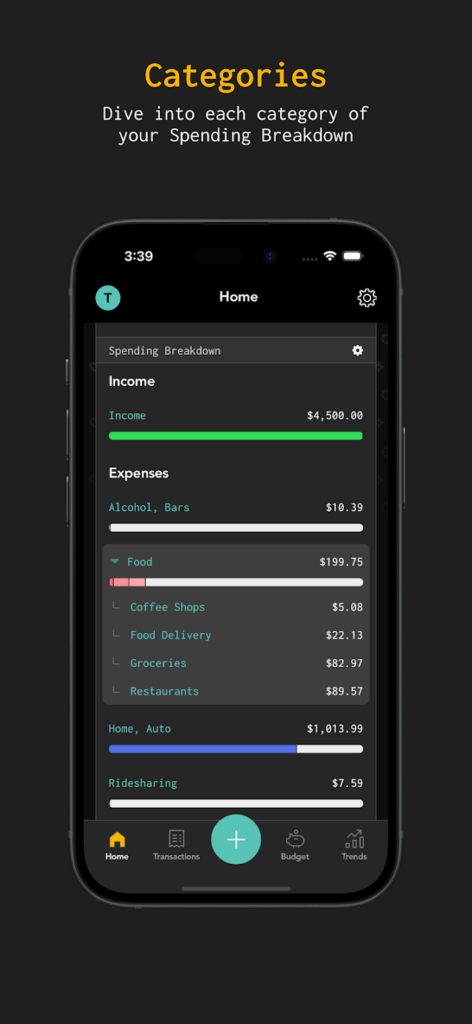

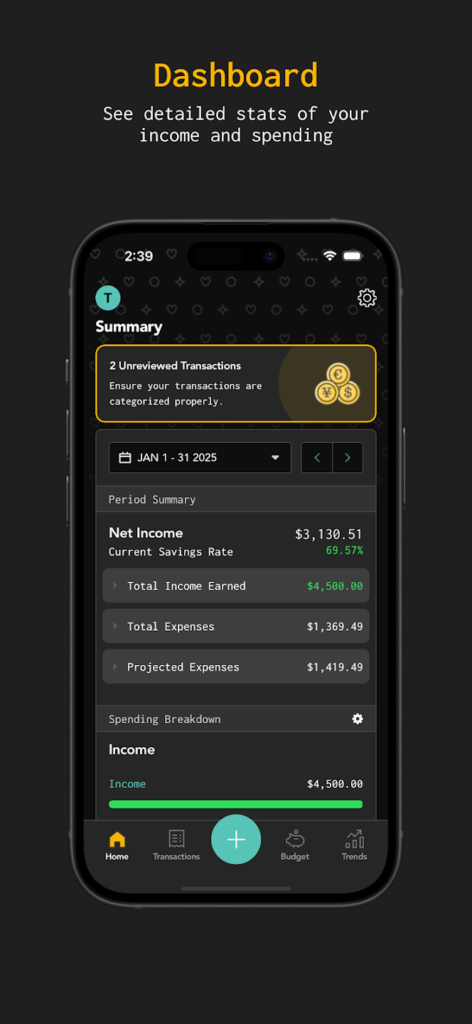

5. Empower

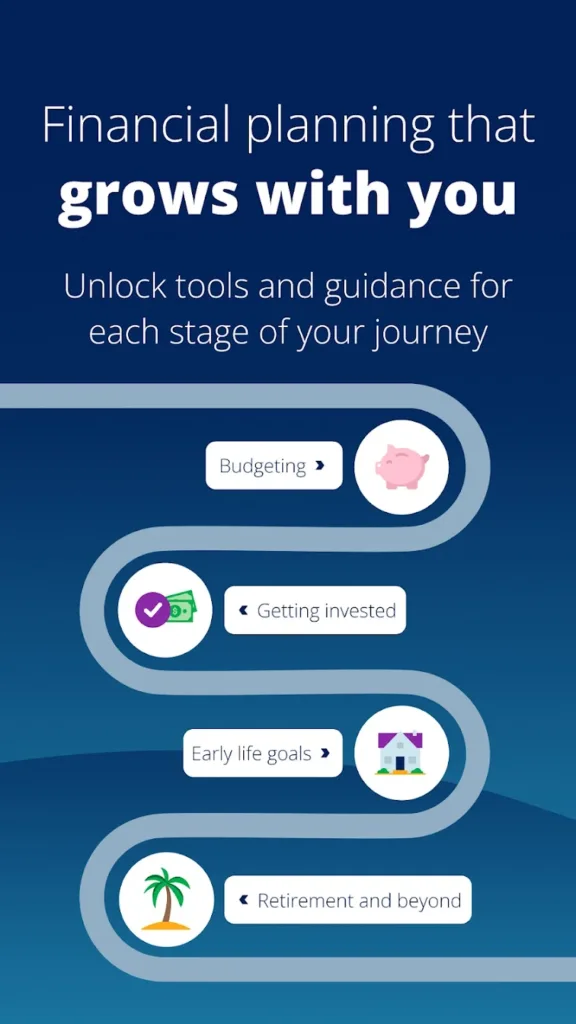

Empower goes a bit beyond the usual budgeting app. It’s more like your financial life – past, present, and future – all in one place. You and your partner can connect checking, savings, credit cards, and even investment accounts, and everything shows up on a single dashboard. It’s a solid way to see the big picture without jumping between apps or spreadsheets.

It leans more toward long-term planning than day-to-day budgeting. So if you’re thinking about retirement, building wealth, or just figuring out where all your money’s going, it’s worth a look. The design is clean and data-heavy (in a good way), which works well for people who like graphs, numbers, and knowing exactly where they stand.

Key Highlights:

- Combines banking, credit, and investment accounts

- Tracks cash flow and total net worth

- Helps plan for long-term goals like retirement

- Extra security features built in

Who it’s best for:

- Couples thinking beyond just this month’s budget

- Partners who like to keep tabs on multiple accounts

- People planning for the future (not just paying bills)

- Anyone who wants money tracking and investing tools in one place

Contact Information:

- Website: www.empower.com

- App Store: apps.apple.com/us/app/empower

- Google Play: play.google.com/store/apps/details/Empower

- Facebook: www.facebook.com/officialempowertoday

- Twitter: x.com/empowertoday

- LinkedIn: www.linkedin.com/company/empowertoday

- Instagram: www.instagram.com/officialempowertoday

- Address: 8515 E. Orchard Road, Greenwood Village, CO 80111

- Phone: 855-756-4738

6. Goodbudget

Goodbudget is kind of like the digital version of stuffing cash into envelopes – only you don’t have to carry a bunch of paper around. You and your partner split up your income into different spending categories (or “envelopes”), and track how much you’ve got left in each one as the month goes on.

It doesn’t connect to your bank, so you’ll have to enter things manually or import them. But some couples actually prefer that – it gives you a chance to slow down, talk things through, and be more intentional with where your money goes. It’s simple, effective, and great if you’re trying to build better habits together.

Key Highlights:

- Envelope-based budgeting system

- Manual transaction entry or file imports

- Shared access across devices

- Focus on savings goals and debt payoff

Who it’s best for:

- Couples who want more control and less automation

- Partners who like sitting down to plan and talk through spending

- People who prefer simple tools without too many bells and whistles

- Anyone who doesn’t want to link their bank accounts directly

Contact Information:

- Website: goodbudget.com

- App Store: apps.apple.com/us/app/goodbudget-budget-planner

- Google Play: play.google.com/store/apps/details

- E-mail: support@goodbudget.com

- Facebook: www.facebook.com/eebacanhelp

- Twitter: x.com/goodbudget

- Instagram: www.instagram.com/goodbudgetapp

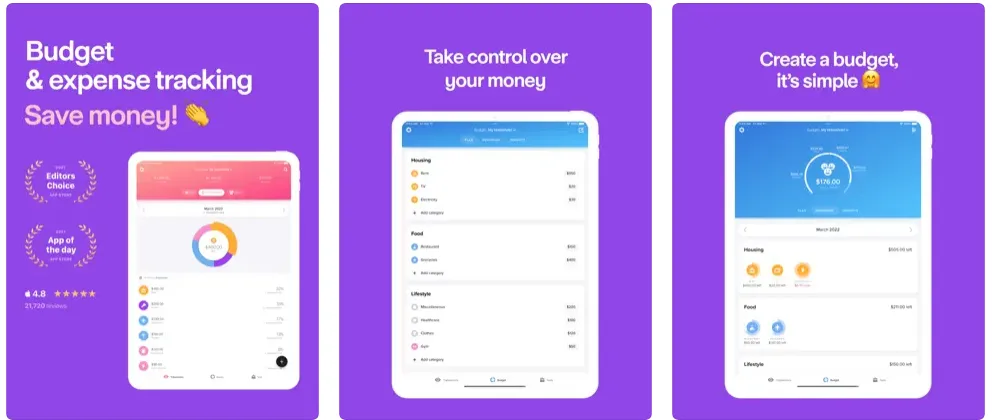

7. Buddy

Buddy is a great pick for couples who want to budget together but still like to do things a bit more manually. You can plan out your spending by category, enter transactions, and keep tabs on how you’re doing throughout the month. It’s got a clean interface that doesn’t overwhelm you with features but still gives you what you need to stay on track.

The cool thing is you can share one budget between you and your partner, and everything syncs up – even if you’re both adding stuff from different phones. There’s no automation here, so you’ll need to enter things yourself (or import them), but for some people, that’s part of the process. It gives you full control without linking to any bank accounts.

Key Highlights:

- Shared budgets that sync between users

- Manual transaction entry or file imports

- Custom categories and different account types

- Easy-to-read summaries of how much is left

- Straightforward interface with simple layouts

Who it’s best for:

- Couples who like tracking expenses together, hands-on

- People who organize their budgets by category

- Anyone who doesn’t need fancy features or automation

- Partners who want a collaborative tool without connecting their banks

Contact Information:

- Website: buddy.download

- App Store: apps.apple.com/us/app/buddy-budget-planner-app

- E-mail: hello@buddy.download

- Address: Vidargatan 5 BV, 113 27, Stockholm

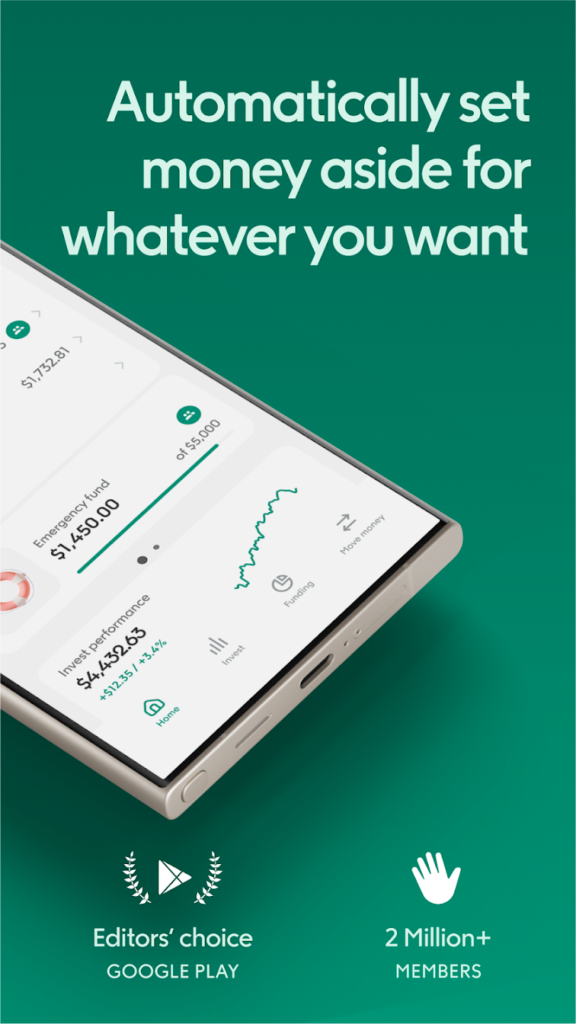

8. Qapital

Qapital is kind of like the “set it and forget it” app for couples who want to stay on top of their goals without micromanaging every penny. You can link your accounts, set savings goals, and let the app move money around based on rules you create – like rounding up every coffee purchase or saving a few bucks every time you hit the gym (yes, really).

You can also team up with your partner in a shared space where both of you can check in on progress or chip in toward something big. It’s not super detailed when it comes to breaking down past spending, but that’s not really what it’s built for. Qapital shines when you’re focused on where you want your money to go, not obsessing over where it’s already been.

Key Highlights:

- Budgeting based on goals and automation rules

- Shared space for tracking and managing goals together

- Automatic savings based on conditions you choose

- Connects with external bank accounts

- Designed for mobile-first use

Who it’s best for:

- Couples working toward shared financial goals

- People who like automation doing the heavy lifting

- Users who don’t want to manually update everything

- Those more focused on future planning than past tracking

Contact Information:

- Website: www.qapital.com

- App Store: apps.apple.com/us/app/qapital-set-forget-finances

- Google Play: play.google.com/store/apps/details

- Facebook: www.facebook.com/Qapital

- Twitter: x.com/qapitalapp

- LinkedIn: www.linkedin.com/company/qapital

- Instagram: www.instagram.com/qapital

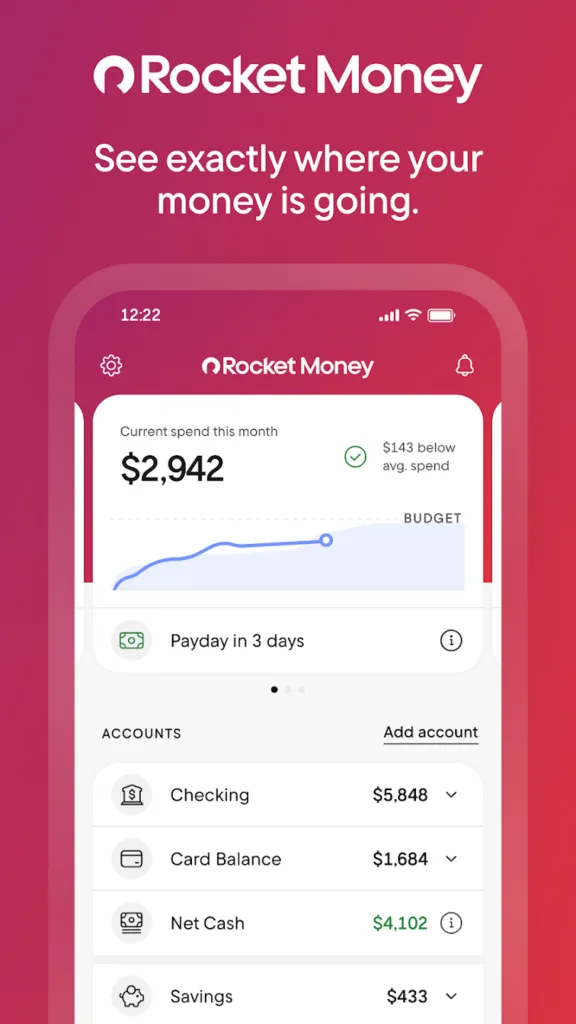

9. Rocket Money

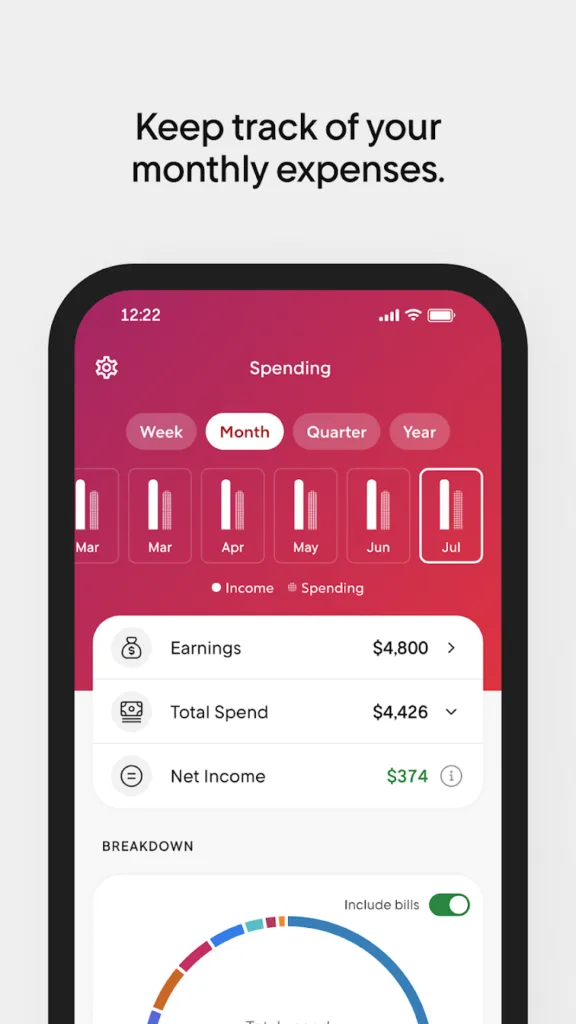

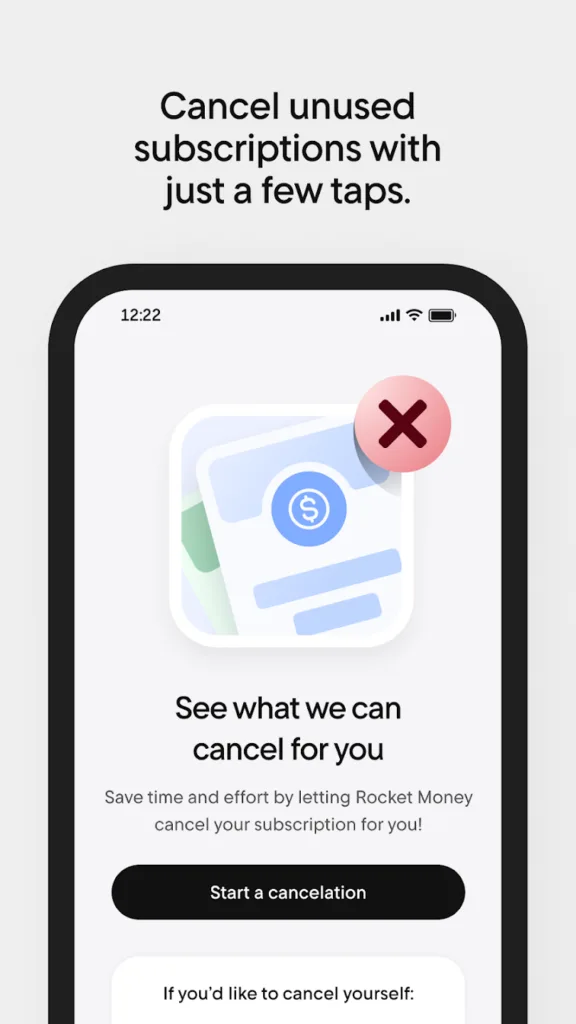

Rocket Money is like that friend who notices you’re still paying for three streaming services you forgot about. It pulls together all your financial accounts – bank, credit cards, subscriptions – into one place so you can actually see where your money’s going. It automatically finds recurring charges, helps you cancel unused stuff, and shows your spending trends.

Couples can each link their own accounts and check spending patterns together or separately, but the app doesn’t have a joint budgeting setup by default. Still, it’s useful if you’re both just trying to get a better grasp on your finances. Some of the cooler features (like auto-savings or canceling subscriptions for you) are behind a paywall, but the free version still does plenty.

Key Highlights:

- Combines all your accounts into one easy view

- Finds and flags recurring charges you might miss

- Helps with basic budgeting and spending goals

- Sends balance alerts and spending summaries

- Extra features available if you upgrade

Who it’s best for:

- Couples who want a clearer picture of where their money’s going

- People juggling multiple accounts or subscriptions

- Anyone looking for a low-effort way to track spending

Contact Information:

- Website: www.rocketmoney.com

- App Store: apps.apple.com/us/app/rocket-money-bills-budgets

- Google Play: play.google.com/store/apps/details

- E-mail: support@rocketmoney.com

- Twitter: x.com/rocketmoneyapp

- LinkedIn: www.linkedin.com/company/rocketmoney

- Instagram: www.instagram.com/rocketmoney

10. Quicken Simplifi

If you and your partner want to see everything in one spot – income, bills, savings, whatever – Simplifi does a solid job of pulling it all together. It connects to your bank and credit accounts, sorts your spending automatically, and even helps you spot trends over time. You can set up your own rules and filters too, which is nice if you want to keep certain categories separate or customize things a bit.

The timeline view is especially helpful if you’re juggling multiple accounts or trying to keep an eye on your cash flow week to week. While you’ll each need your own login, couples can still share access or sync mutual accounts to work together. It’s not flashy, but it’s super practical.

Key Highlights:

- Automatically tracks income and spending

- Links to multiple accounts and updates in real-time

- Custom savings goals and a projected balance timeline

- Budgeting tools that feel easy to manage

Who it’s best for:

- Couples with shared finances who want one clear view

- People who like customizing their categories and budgets

- Partners with a mix of accounts (checking, savings, investments)

Contact Information:

- Website: www.quicken.com

- App Store: apps.apple.com/us/app/quicken-simplifi-budget-smart

- Google Play: play.google.com/store/apps/details

- Facebook: www.facebook.com/Quicken

- Twitter: x.com/quicken

- LinkedIn: www.linkedin.com/company/quicken-inc.

11. Lunch Money

Lunch Money is kind of the budgeting app for people who don’t totally trust budgeting apps. It’s web-first, lets you import transactions manually or via CSV files, and gives you total control over how everything is categorized. That’s ideal if you and your partner like to keep a tighter grip on your data – and don’t want to hand over full access to your bank.

It has helpful features like recurring expense tracking, multi-currency support (great if one of you gets paid in a different currency), and even a net worth tracker. Each person logs in separately, but you can share dashboards so you’re always on the same page. It’s detailed, flexible, and works best for folks who are a little more hands-on with their money.

Key Highlights:

- Manual transaction entry and CSV support

- Rule-based automation for recurring expenses

- Tags and categories for organizing everything

- Clean web interface with mobile access if needed

Who it’s best for:

- Couples who like full control over their budget

- Partners with international or mixed income sources

- People who split expenses by category or tag

- Users who prefer desktop budgeting tools over mobile apps

Contact Information:

- Website: lunchmoney.app

- App Store: apps.apple.com/us/app/lunch-money

- Google Play: play.google.com/store/apps/details

- E-mail: support@lunchmoney.app

- Twitter: x.com/lunchmoney_app

- LinkedIn: www.linkedin.com/company/lunchmoney

- Instagram: www.instagram.com/lunchmoneyapp

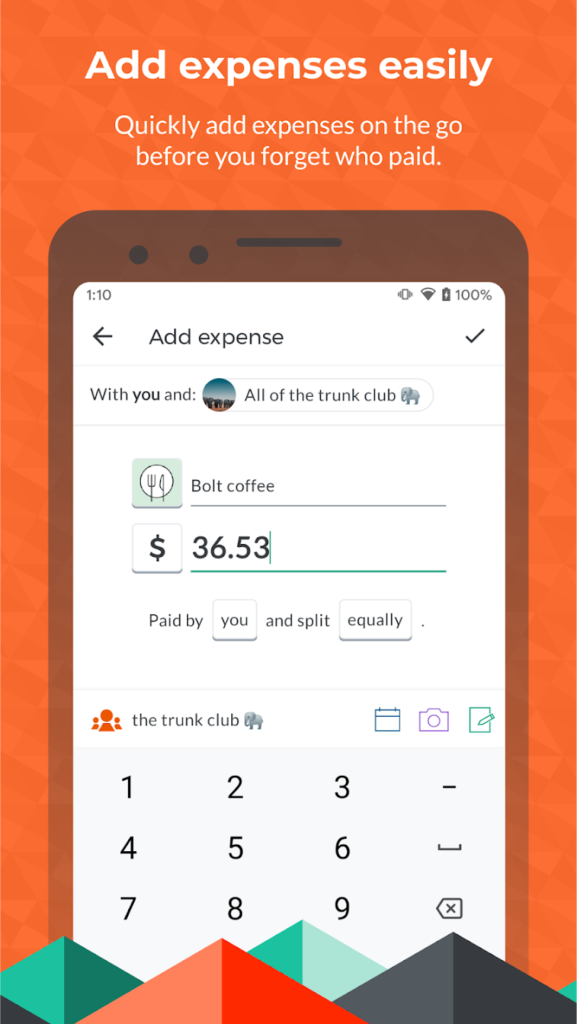

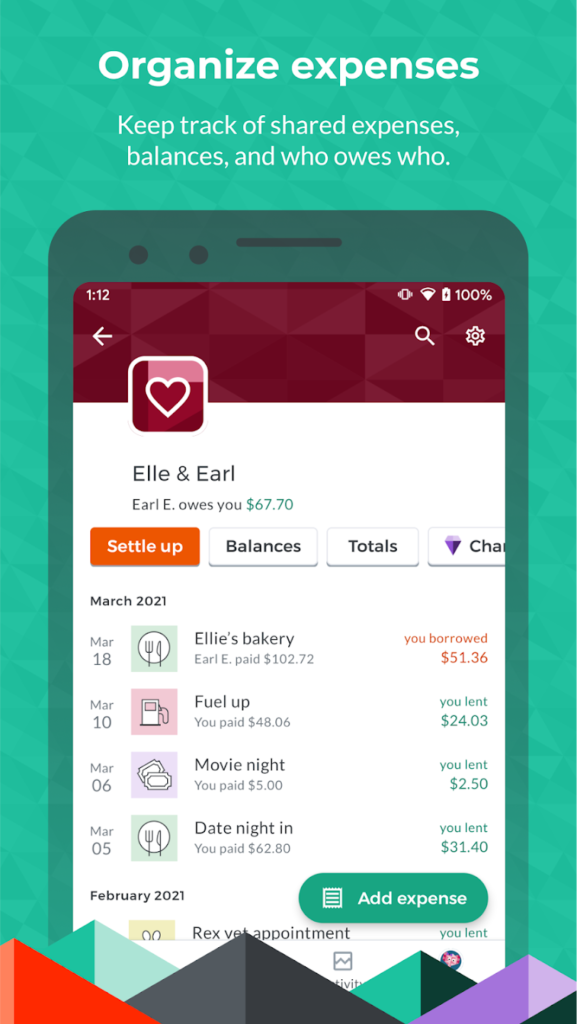

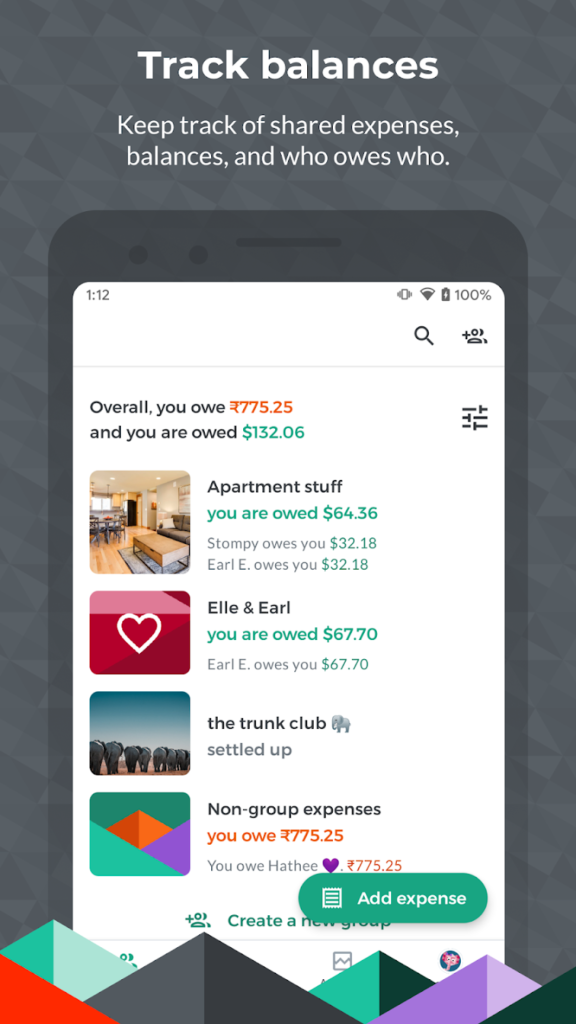

12. Splitwise

Splitwise is the go-to app for “you paid for dinner, I’ll get the next one” couples. It’s all about splitting things evenly – or unevenly, if needed – and keeping a running tab of who owes what. You can add shared expenses, track balances, and settle up whenever it makes sense. It doesn’t come with deep budgeting tools, but it’s perfect for keeping day-to-day spending fair.

It also supports recurring expenses, like rent or subscriptions, and lets you sort things into categories. It’s super simple and doesn’t overwhelm you with charts or goals or any of that. If you’re not merging finances but still share costs, it works well.

Key Highlights:

- Splits expenses and calculates who owes who

- Supports equal or custom splits

- Handles recurring bills and categorized costs

- Syncs between both your devices

- Works for couples, roommates, or friend groups

Who it’s best for:

- Couples who split costs but don’t fully combine finances

- Partners living together and tracking shared expenses

- People who want a lightweight, no-fuss app

- Users who don’t need detailed reports or trend analysis

Contact Information:

- Website: www.splitwise.com

- App Store: apps.apple.com/us/app/splitwise

- Google Play: play.google.com/store/apps/details

- E-mail: support@splitwise.com

- Facebook: www.facebook.com/splitwise

- Twitter: x.com/splitwise

- Instagram: www.instagram.com/splitwise

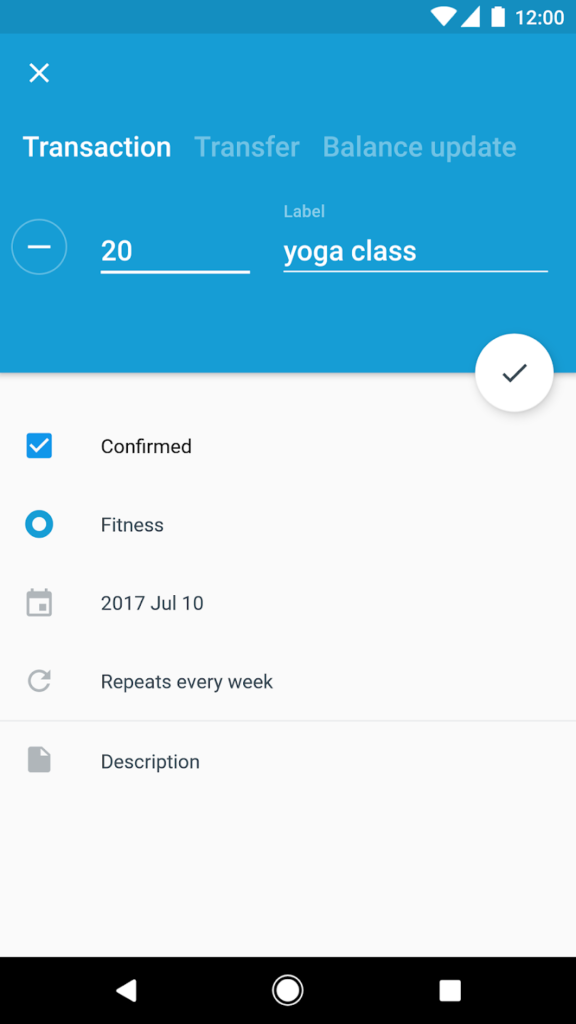

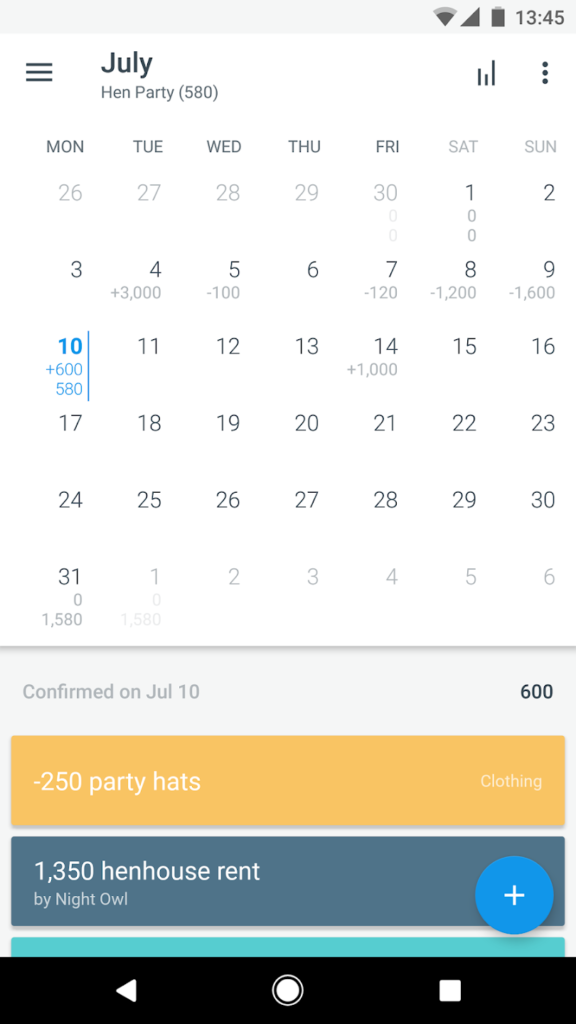

13. Dollarbird

Dollarbird is kind of like a budget calendar – literally. You enter income and expenses day by day, and it builds a timeline of where your money’s going. It’s not automatic – you’ll have to log things manually – but that also means you’ve got complete control. You can even go back and fill in past expenses if you’ve got a backlog.

What’s nice is that couples can share a calendar, so both of you can see what’s coming up or where things went off track. It doesn’t connect to banks, so you’re doing it all yourself – but if you like visual layouts and don’t want to mess with syncing, it’s worth a look.

Key Highlights:

- Calendar-style budget tracking

- Daily entries with running balance estimates

- Supports shared budgeting calendars

- Manual logging of past, present, and future transactions

- Works on web and mobile

Who it’s best for:

- Couples who want to visually map out their finances

- People who don’t mind entering everything by hand

- Users who care more about simplicity than syncing

- Anyone who prefers a calendar view over spreadsheets

Contact Information:

- Website: dollarbird.co

- App Store: apps.apple.com/us/app/dollarbird-budget-calendar

- Google Play: play.google.com/store/apps/details

- E-mail: hello@dollarbird.co

- Facebook: www.facebook.com/dollarbirdapp

- Twitter: x.com/dollarbirdapp

Conclusion

Let’s be honest – figuring out a budgeting app as a couple isn’t just about downloading the one with the best reviews. You’ve got to find something that actually fits how the two of you deal with money. Maybe you split everything 50/50, maybe one of you handles bills while the other handles groceries, or maybe you’re still figuring it out. Totally normal.

The apps here run the full spectrum – some are all about future planning, some just help you stay organized week to week, and a few are built for people who’d rather do things manually. None of them are magic fixes, but the right one can seriously cut down the friction when it comes to managing money together. Whether you’re saving for a big trip, tracking rent and utilities, or just trying not to Venmo each other for the same thing twice, a shared system helps keep the peace. No drama, no spreadsheets (unless you’re into that). Just something that works for you.