Managing your finances doesn’t have to be complicated and with the right budget app on your iPhone, it can even be effortless. From tracking daily expenses and setting savings goals to syncing with bank accounts and analyzing spending habits, today’s budget apps offer powerful features in your pocket. In this guide, we’ve rounded up the best budget apps for the iPhone. Whether you’re new to budgeting or looking to optimize your money habits, there’s a tool here to fit your financial style.

Mastering your finances with the best budget apps for the iPhone? That’s a savvy move! But let’s think about smart meal planning. The ReciMe app makes it simple: grab recipes from Instagram, TikTok, or cookbooks in seconds, plan weekly meals to save money and reduce waste, and create grocery lists sorted by store aisle. Download ReciMe now, then keep rocking those money management picks!

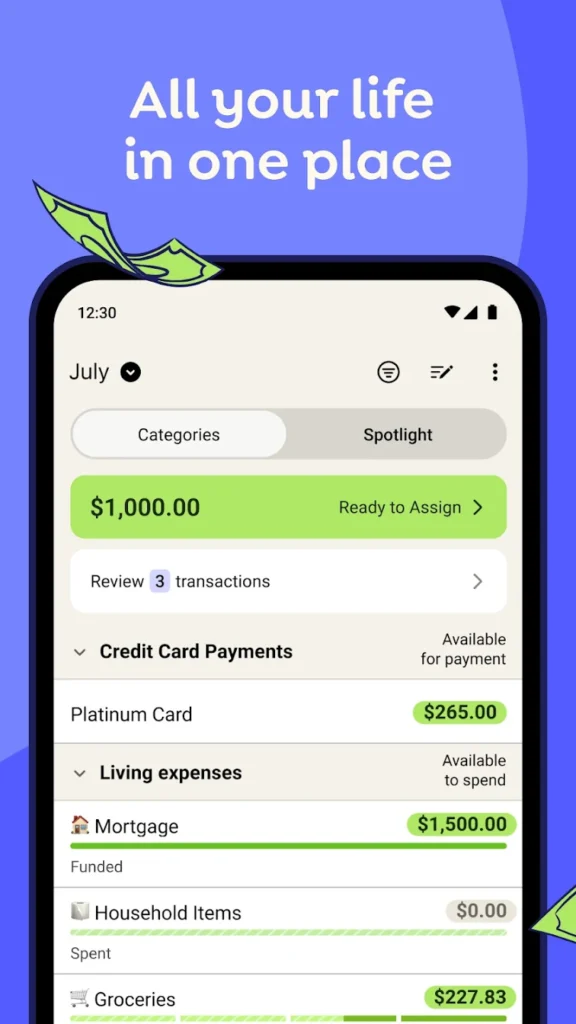

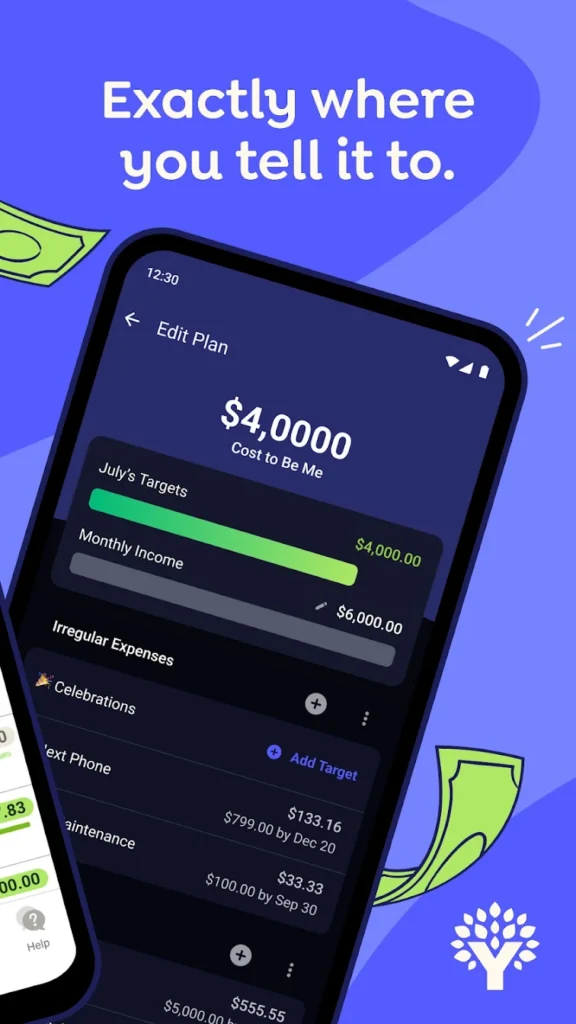

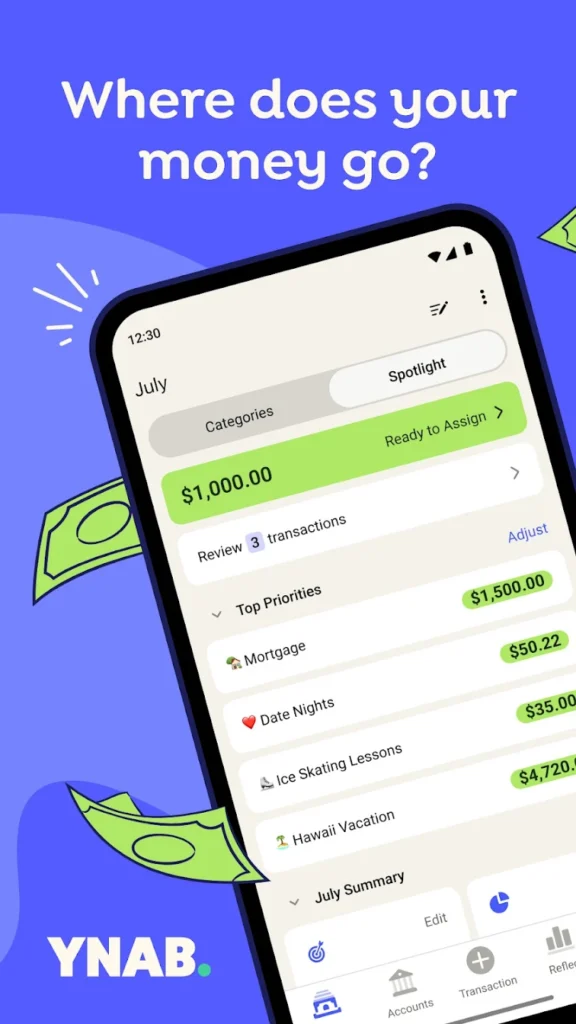

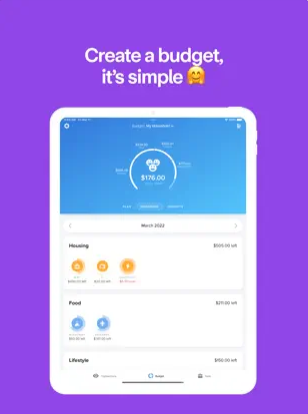

1. YNAB (You Need a Budget)

YNAB takes a proactive approach to budgeting, encouraging users to “give every dollar a job.” It focuses on building better financial habits by helping you allocate funds for future expenses, rather than just tracking what you’ve already spent. The app syncs with bank accounts or allows manual entry for full control.

YNAB’s learning curve is steeper than some apps, but its educational tools, financial philosophy, and detailed reports are excellent for long-term budgeting success. It’s especially great for users trying to break the paycheck-to-paycheck cycle.

Key Highlights:

- Zero-based budgeting system

- Syncs with banks or allows manual tracking

- Financial education resources built-in

Who it’s best for:

- Users looking to actively manage every dollar

- People wanting structure and discipline in budgeting

- Individuals working toward long-term financial change

Contact Information:

- App store: apps.apple.com/us/app/ynab

- Google Play: play.google.com/store/apps

- Website: app.ynab.com

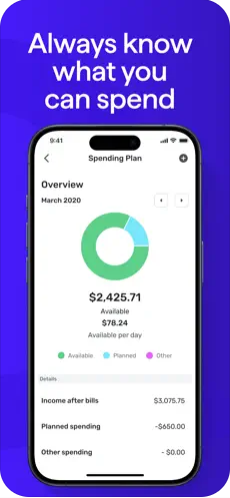

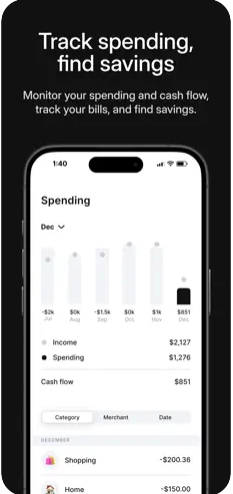

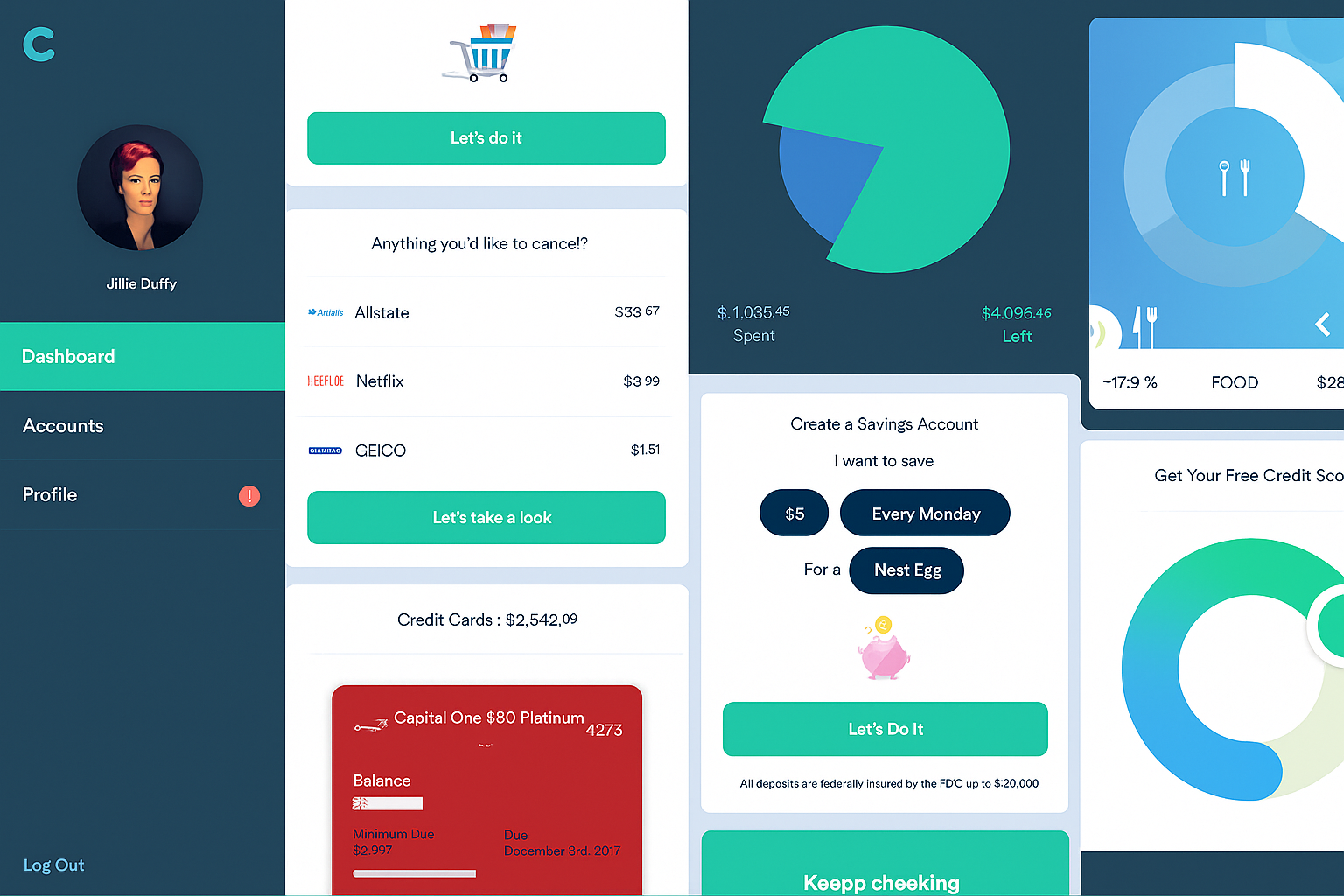

2. PocketGuard

PocketGuard simplifies budgeting by showing you exactly how much you have “in your pocket” after accounting for bills, savings, and spending goals. It automatically connects to your financial accounts and breaks down your spending into simple visuals and smart categories.

One of its standout features is the “In My Pocket” number, which tells you what’s safe to spend. It also helps you find subscriptions you may have forgotten about and suggests ways to lower bills. PocketGuard is perfect for users who want quick answers without overcomplicating their finances.

Key Highlights:

- Shows how much you can safely spend

- Tracks subscriptions and recurring payments

- Budget insights with easy-to-read charts

Who it’s best for:

- Busy users who want instant spending clarity

- People who often overspend without realizing

- Budgeters who need a quick daily money check-in

Contact Information:

- App store: apps.apple.com/us/app/pocketguard-money-bill-tracker

- Google Play: play.google.com/store/apps

- Website: pocketguard.com

- Facebook: www.facebook.com/pocketguardapp

- Twitter: x.com/PocketGuardApp

- Instagram: www.instagram.com/pocketguardapp

- LinkedIn: www.linkedin.com/company/pocketguard

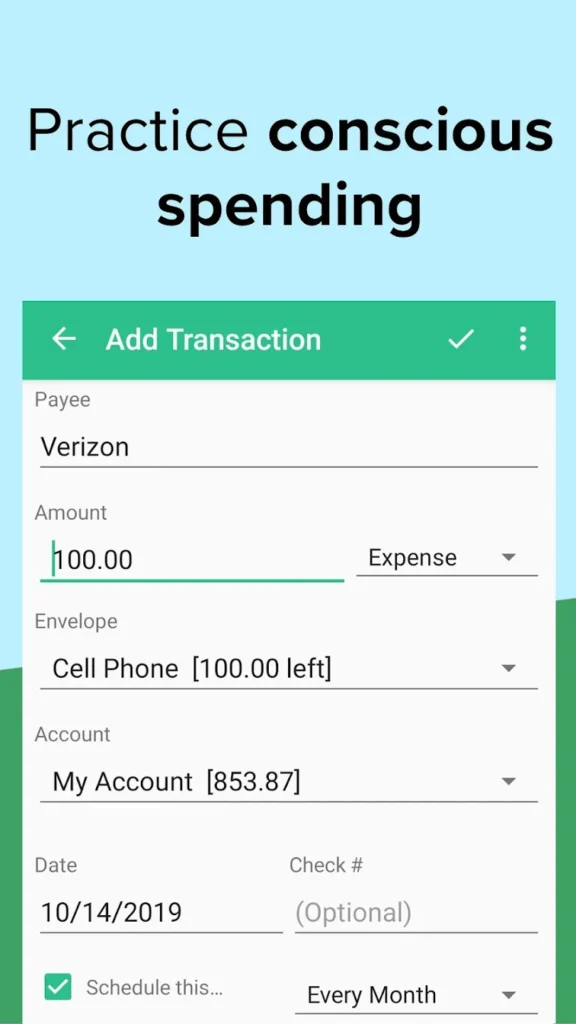

3. Goodbudget

Goodbudget uses the envelope budgeting method to help you plan spending instead of reacting to it. Unlike other apps, it’s based on manually assigning funds to digital “envelopes” for categories like groceries, rent, or entertainment. You can sync envelopes across devices and share budgets with family members or partners.

While it doesn’t automatically connect to bank accounts, this manual method can be empowering for users who want to be more intentional with their money. It’s a great choice for couples, families, or anyone practicing values-based budgeting.

Key Highlights:

- Envelope-style budgeting system

- Syncs across devices for shared budgets

- Manual entry promotes mindful spending

Who it’s best for:

- Couples and families budgeting together

- Users who prefer planning over automation

- People following a cash-envelope philosophy

Contact Information:

- App store: apps.apple.com/us/app/goodbudget-budget-planner

- Google Play: play.google.com/store/apps/details

- Website: goodbudget.com

- Facebook: www.facebook.com/eebacanhelp

- Instagram: www.instagram.com/goodbudgetapp

- Twitter: x.com/goodbudget

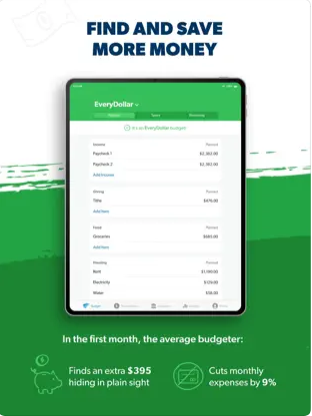

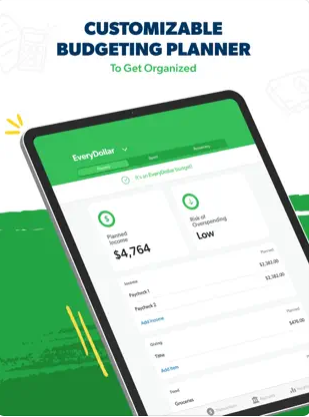

4. EveryDollar

EveryDollar is built around a simple, zero-based budgeting method inspired by Dave Ramsey’s financial system. You manually plan out your income and assign every dollar to a specific category before the month begins. The app makes this process fast and intuitive with a clean interface and drag-and-drop budgeting tools.

The free version offers limited bank syncing for transaction tracking, while the premium version provides enhanced bank syncing and additional features. EveryDollar is great for users who want complete control over their budgets and follow a goal-driven financial lifestyle.

Key Highlights:

- Zero-based budgeting with monthly planning

- Easy-to-use interface and category setup

- Optional bank sync with premium plan

Who it’s best for:

- Fans of Dave Ramsey’s budgeting method

- Users who want clear, goal-focused plans

- Budgeters who prefer planning over tracking

Contact Information:

- App store: apps.apple.com/us/app/everydollar-budget-management

- Google Play: play.google.com/store/apps/details

- Website: www.ramseysolutions.com

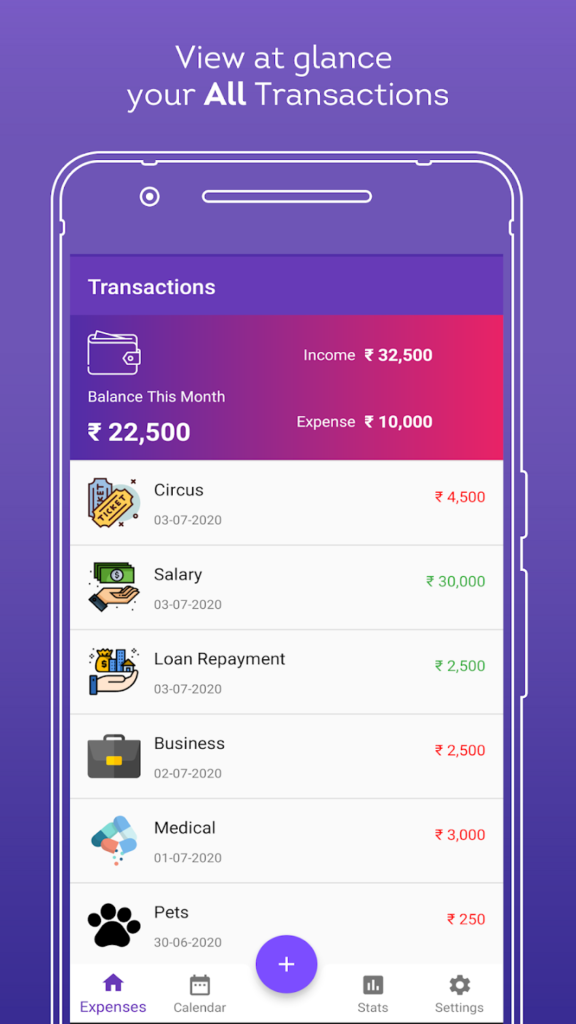

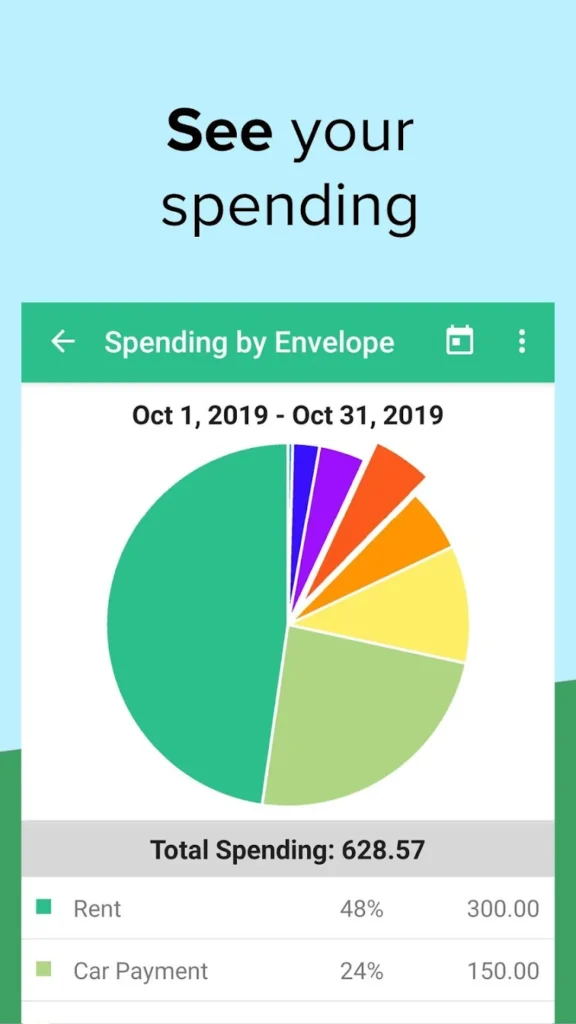

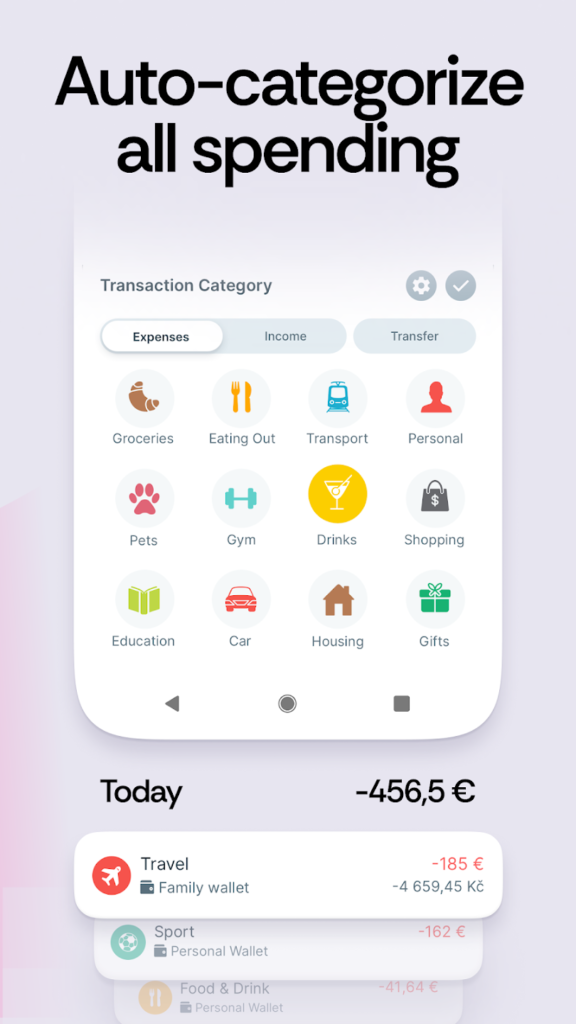

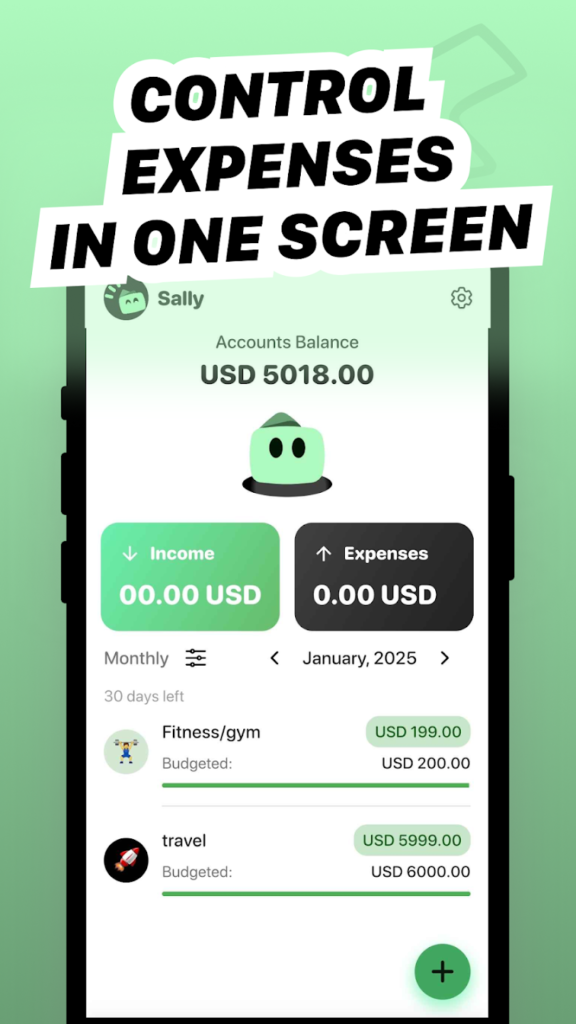

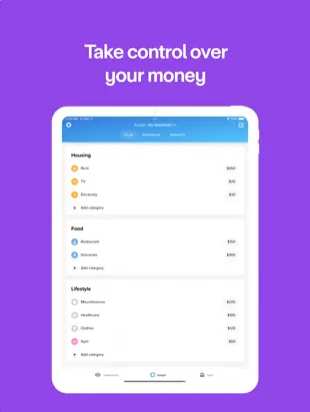

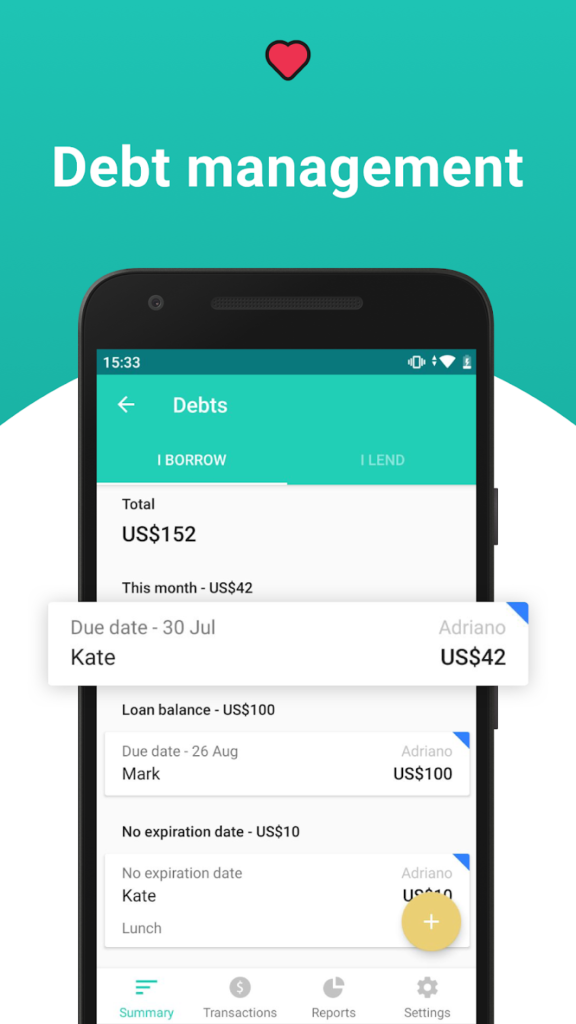

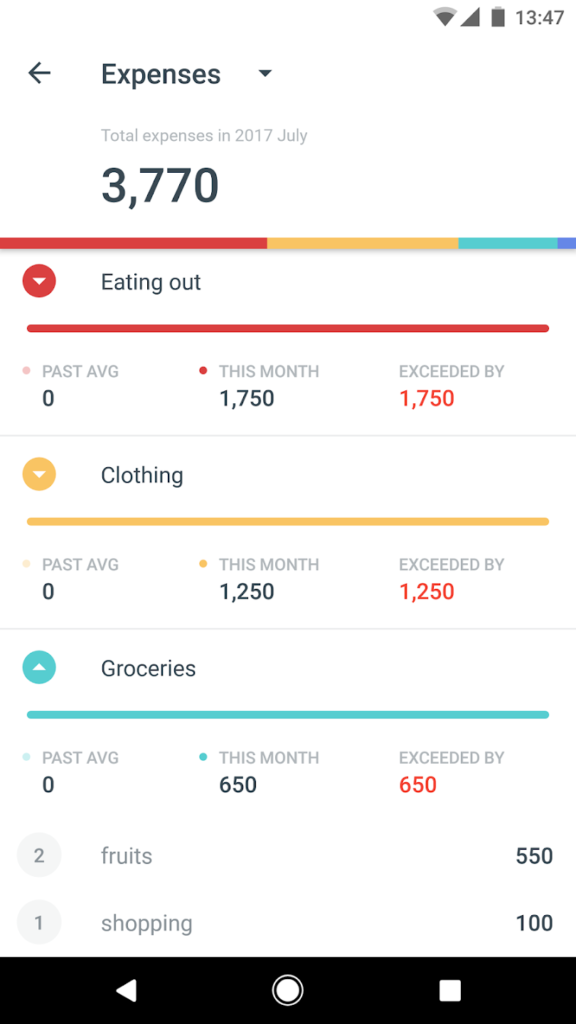

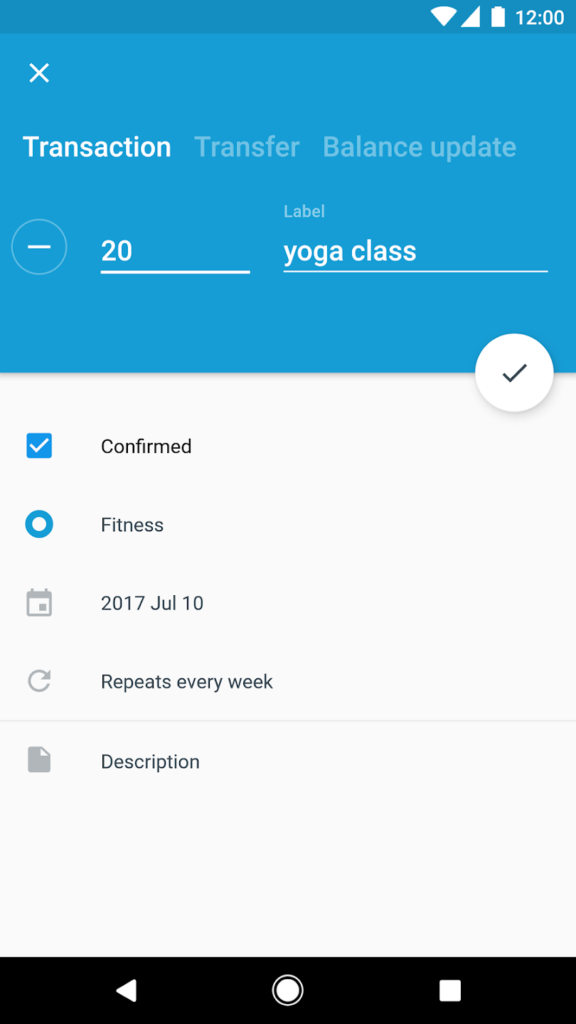

5. Spendee

Spendee combines visual design with powerful budgeting tools to help you track expenses and create customized budgets. The app supports bank sync with many financial institutions, but you can also manually add expenses and income. With vibrant charts and spending breakdowns, it’s ideal for users who want a more intuitive experience.

You can create shared wallets with family or friends, track cash spending, and categorize transactions easily. Spendee’s flexibility and attractive interface make budgeting less intimidating and more engaging, especially for visual learners.

Key Highlights:

- Beautiful charts and user-friendly design

- Supports shared wallets and manual entries

- Connects to bank accounts for automated tracking

Who it’s best for:

- Visual learners and casual budgeters

- Families or roommates sharing finances

- Users who want both aesthetics and substance

Contact Information:

- App store: apps.apple.com/us/app/spendee-budget-app-planner

- Google Play: play.google.com/store/apps/details

- Website: www.spendee.com

- Facebook: www.facebook.com/spendeeapp

- Instagram: www.instagram.com/spendeeapp

- Twitter: x.com/spendeeapp

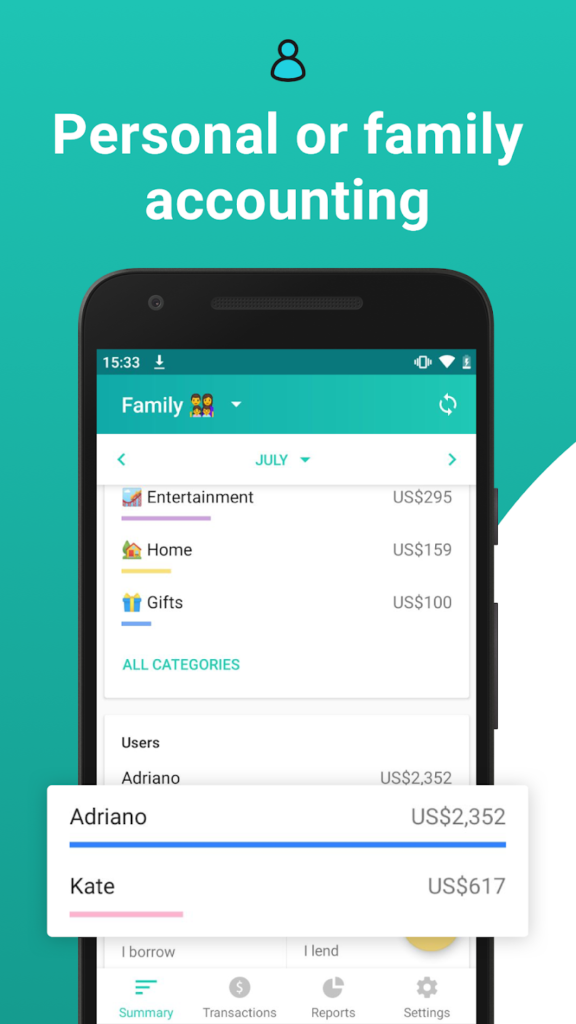

6. Zeta

Zeta is a budgeting app designed specifically for couples and families. It allows users to manage joint and individual accounts in one place, making it easy to track shared expenses while maintaining financial independence. The app includes real-time balance updates, bill splitting, and budgeting tools tailored to relationship dynamics.

You can also chat within the app, tag transactions, and set joint goals. Zeta is especially useful for couples planning together, whether you’re sharing rent, saving for a trip, or just trying to stay transparent with money.

Key Highlights:

- Designed for couples and families

- Real-time balance updates and bill tracking

- Shared goals and in-app chat

Who it’s best for:

- Couples managing both shared and separate finances

- Families creating joint budgets

- Partners aiming for better money communication

Contact Information:

- Website: secure.zbanco.com

- App store: apps.apple.com/us/app/zeta

- Google Play: play.google.com/store/apps/details

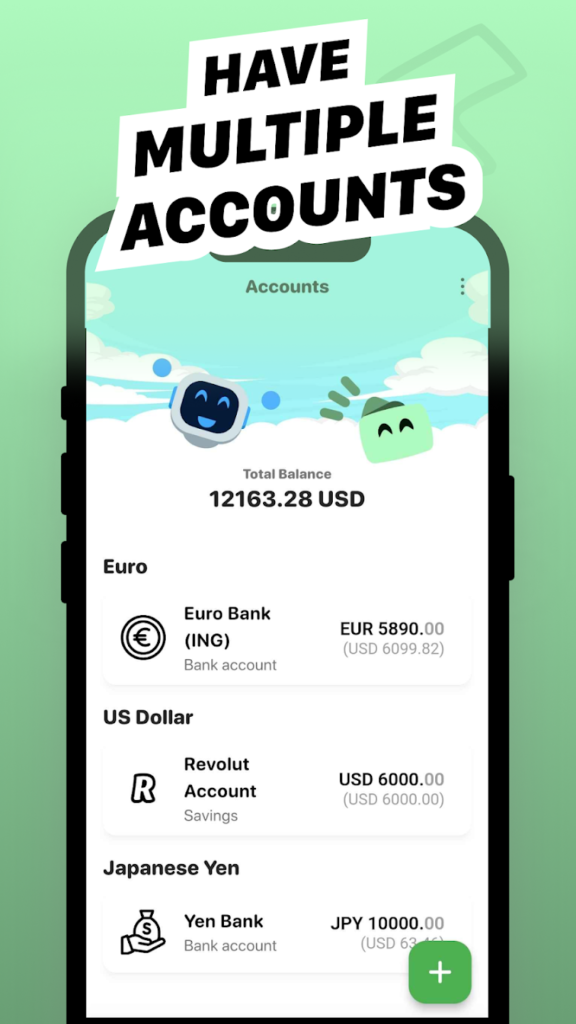

7. Wally

Wally is a personal finance app that focuses on detailed tracking and global currency support. It lets users manually log expenses, scan receipts, set daily or monthly budgets, and even track foreign spending. It’s great for travelers or users with international financial activity.

The app doesn’t rely heavily on bank sync but instead emphasizes awareness and manual control. Wally’s strength lies in its flexibility and depth, offering power-user features without overwhelming beginners.

Key Highlights:

- Supports multiple currencies and languages

- Tracks receipts, cash, and goals

- Manual tracking with rich analytics

Who it’s best for:

- International travelers and expats

- Users wanting granular control without automation

- People focused on receipt and category detail

Contact Information:

- App store: apps.apple.com/us/app/monthly-expenses-tracker-wally

- Google Play: play.google.com/store/apps/details

- Website: wallybudgeting.app

- LinkedIn: www.linkedin.com/company/wally-ai

- Instagram: www.instagram.com/wally_budgetapp

- Twitter: x.com/wallybudgeting

8. Simplifi by Quicken

Simplifi by Quicken offers smart budgeting with automatic categorization, real-time spending tracking, and a sleek user interface. It connects to your accounts, helps you set goals, and gives you a daily snapshot of your financial health. Unlike Quicken’s traditional software, Simplifi is designed specifically for mobile users.

You can track subscriptions, upcoming bills, and custom spending plans. With flexible tools and powerful automation, Simplifi is great for modern users who want hands-off control and smart suggestions.

Key Highlights:

- Smart tracking with personalized insights

- Monitors subscriptions and recurring expenses

- Modern alternative to legacy budgeting software

Who it’s best for:

- Busy professionals wanting financial visibility

- Users who enjoy automation with customization

- Anyone looking for a modern mobile-first budgeting app

Contact Information:

- App store: apps.apple.com/us/app/quicken-simplifi-budget-smart

- Google Play: play.google.com/store/apps/details

- Website: www.quicken.com

- Facebook: www.facebook.com/Quicken

- LinkedIn: www.linkedin.com/company/quicken-inc.

- Twitter: x.com/quicken

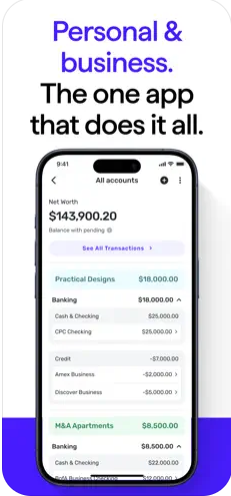

9. Monarch Money

Monarch Money is a premium budgeting app focused on long-term financial planning. It offers collaborative budgeting for households, customizable dashboards, and in-depth net worth tracking. You can connect bank accounts, investments, credit cards, and loans for a full financial overview.

The app supports goal setting for savings, debt payoff, and retirement planning. Monarch is ideal for users who want to see the big picture while staying grounded in their monthly budgets.

Key Highlights:

- Net worth and investment tracking

- Collaborative budgeting and account sharing

- Goal-oriented tools for long-term planning

Who it’s best for:

- Households managing complex finances

- Users focusing on long-term financial goals

- Professionals tracking wealth and budget together

Contact Information:

- App store: apps.apple.com/us/app/monarch-budget-track-money

- Google Play: play.google.com/store/apps/details

- Website: www.monarchmoney.com

- Instagram: www.instagram.com/monarch_money

- LinkedIn: www.linkedin.com/company/monarch-money

- Twitter: x.com/monarch_money

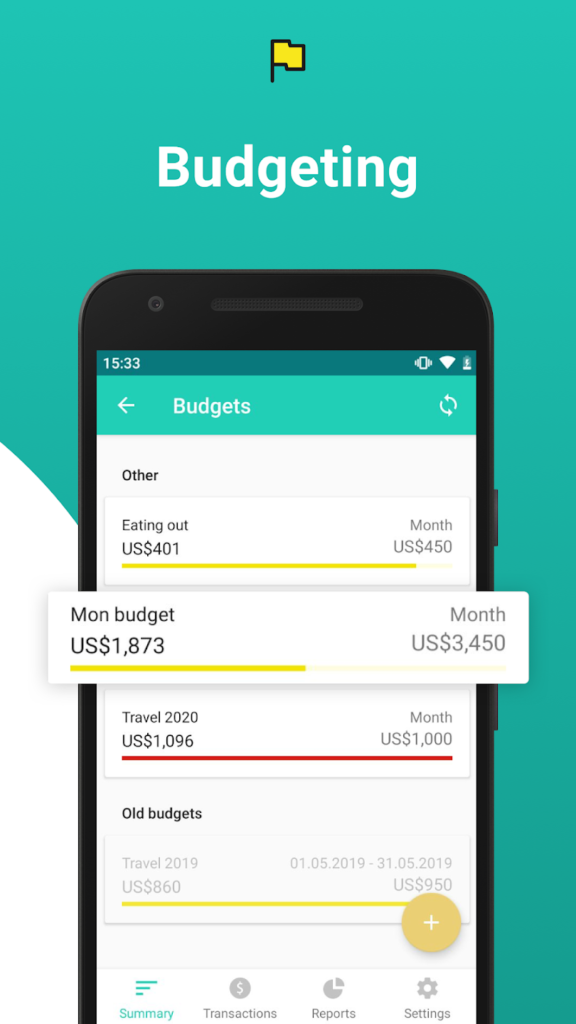

10. Toshl Finance

Toshl Finance brings a playful but powerful approach to budgeting. With a colorful interface and animated characters, it makes money tracking feel less stressful. The app supports multi-currency tracking, recurring expenses, bill reminders, and budget goals. It also offers bank syncing with over 13,000 institutions worldwide (in the Pro version).

Toshl allows users to create multiple budgets for categories, time periods, or custom goals and provides detailed reports on spending habits. It’s ideal for people who want a mix of fun, flexibility, and serious financial tracking.

Key Highlights:

- Supports multiple currencies and budget types

- Animated UI with fun reminders and tips

- Global bank sync available with Pro version

Who it’s best for:

- International users and digital nomads

- Budgeters who want both control and personality

- People who prefer a lighter, more engaging interface

Contact Information:

- Website: toshl.com

- App store: apps.apple.com/us/app/toshl-finance-best-budget

- Google Play: play.google.com/store/apps/details

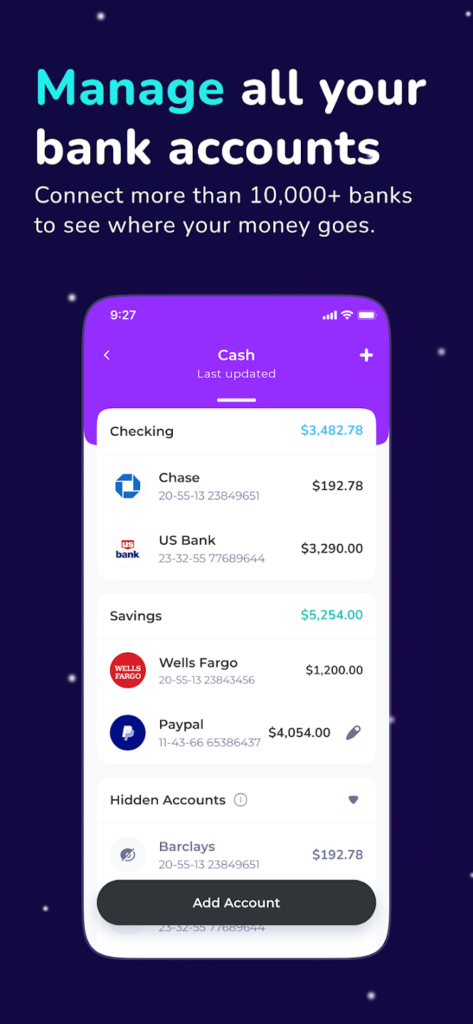

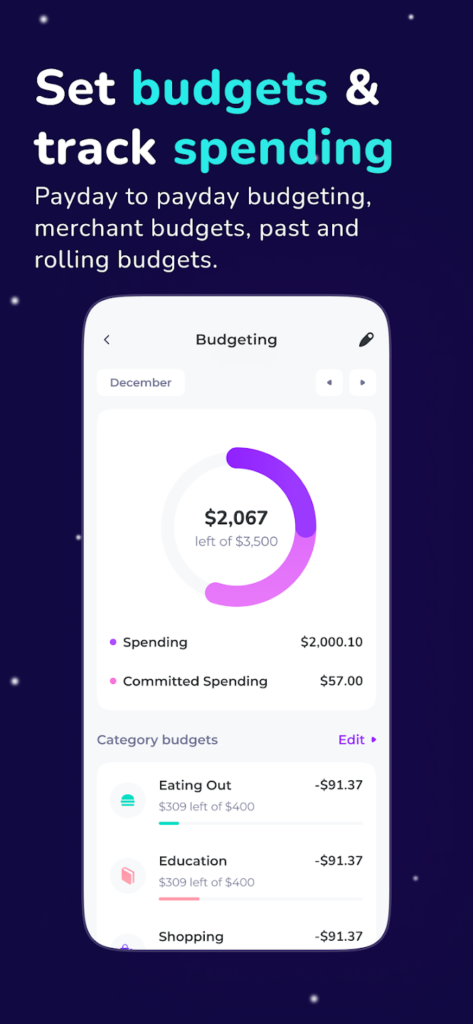

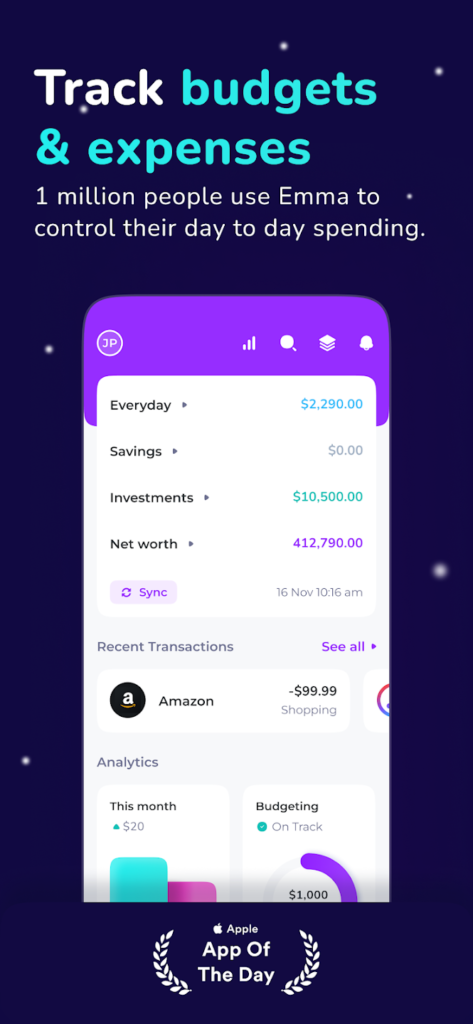

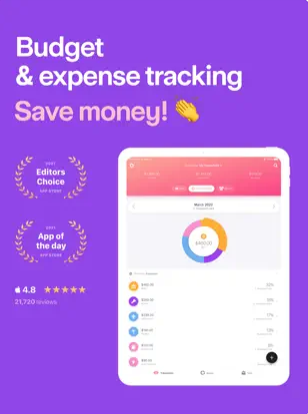

11. Emma – Budget & Save Money

Emma is a modern personal finance app focused on helping users avoid overdrafts, cancel wasteful subscriptions, and track spending effortlessly. It links to your bank accounts and credit cards to give a real-time snapshot of your financial life. The app also uses smart categorization and gives insights on where you’re overspending.

Emma’s clean interface and user-friendly features make it great for beginners. It also includes cash flow forecasts and budgeting tools that grow more accurate over time. For users who want a “smart friend” to guide their finances, Emma is a solid choice.

Key Highlights:

- Automatic bank sync and real-time updates

- Detects subscriptions and flags wasteful spending

- Smart tips and cash flow projections

Who it’s best for:

- New budgeters who want automated help

- Users trying to cut down on hidden fees or overspending

- People who prefer a guided, app-assisted approach

Contact Information:

- Google Play: play.google.com/store/apps

- App Store: apps.apple.com/gb/app/emma-budget-planner-tracker

- Website: emma-app.com

- Facebook: www.facebook.com/emmafinance

- Twitter: x.com/emma_finance

- Instagram: www.instagram.com/emma_finance

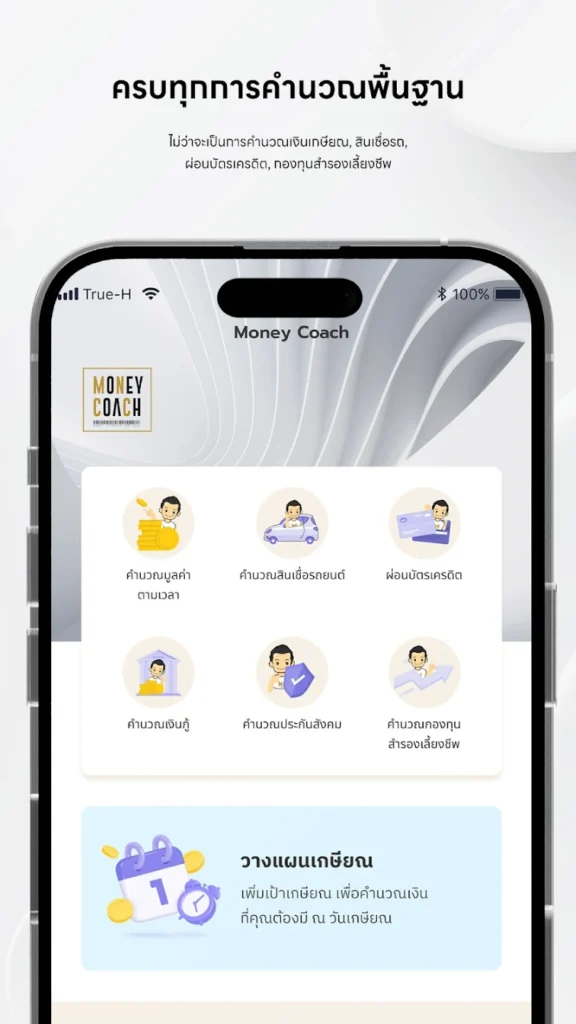

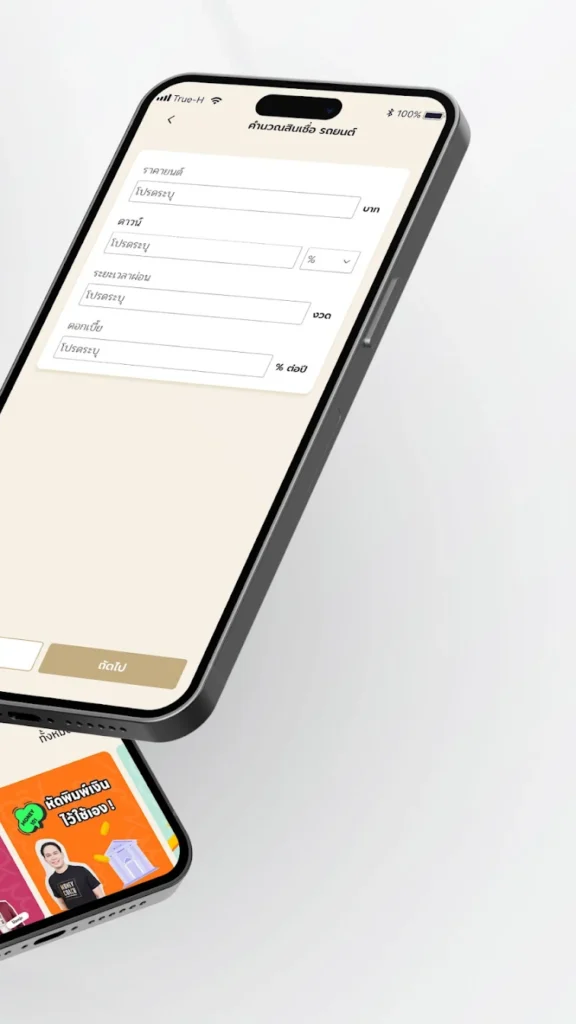

12. MoneyCoach

MoneyCoach is a beautifully designed budgeting app that focuses on habit-building and long-term financial behavior. It offers daily tracking, budgeting by category, expense tags, and real-time financial health indicators. The app also supports Siri Shortcuts, widgets, and Apple Watch functionality.

MoneyCoach emphasizes education and gradual improvement. With options to set daily limits, view weekly progress, and track financial habits, it’s ideal for users who want personal growth alongside financial discipline.

Key Highlights:

- Daily budget planning and financial habit tracking

- Apple Watch, Siri Shortcuts, and widget support

- Clean, motivational interface with in-app coaching

Who it’s best for:

- iPhone users focused on behavior change

- Budgeters who want consistent daily engagement

- Users seeking personal development through money management

Contact Information:

- App store: apps.apple.com/us/app/budget-planner-app-money-coach

- Website: moneycoach.ai

- Facebook: www.facebook.com/moneycoachapp

- Instagram: www.instagram.com/appmoneycoach

- Twitter: x.com/appmoneycoach

13. Buddy

Buddy is a fun and user-friendly app designed for shared and individual budgeting. It helps you log expenses, set spending limits, and track goals visually. What makes it special is the ability to budget together you can invite others to your plan, making it perfect for couples, friends, or housemates.

The app includes bill tracking, split expense features, and monthly overviews. Its minimalist and social approach to money makes budgeting more approachable for those who dislike complex tools.

Key Highlights:

- Shared budgeting and group planning

- Expense splitting and recurring bill tracking

- Simple, engaging design for easy use

Who it’s best for:

- Couples or roommates managing money together

- New budgeters intimidated by complex apps

- Users wanting a friendly and collaborative experience

Contact Information:

- App store: apps.apple.com/us/app/buddy-budget-planner-app

- Website: buddy.download

- Address: Vidargatan 5 BV, 113 27 Stockholm

- E-mail: hello@buddy.download

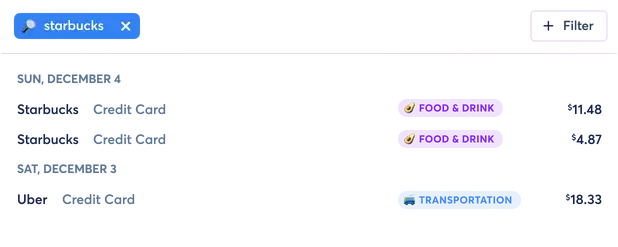

14. Copilot: The Smart Money App

Copilot is a data-rich budgeting and financial tracking app built for iPhone users who want precision and insights. It syncs with your accounts to deliver real-time net worth calculations, spending analysis, and income tracking. The app uses machine learning to categorize transactions and improve accuracy over time.

With beautiful charts and personalized breakdowns, Copilot is great for visualizing your money flow and adjusting habits. It’s a premium tool designed for professionals or detail-oriented users who want full financial awareness on mobile.

Key Highlights:

- Real-time net worth and spending analytics

- Smart transaction categorization with learning engine

- Rich visuals and daily insights

Who it’s best for:

- Professionals managing complex financial portfolios

- Users who want in-depth analytics and visual tools

- People serious about improving their financial literacy

Contact Information:

- App store: apps.apple.com/us/app/copilot-track-budget-money

- Website: copilot.money

- E-mail: hello@copilot.money

- Instagram: www.instagram.com/copilotmoney

- Twitter: x.com/copilotmoney

15. Moneon

Moneon is a clean and efficient budgeting app that focuses on manual expense tracking and envelope-style budgeting. It allows users to set spending limits per category, monitor financial goals, and maintain multiple wallets ideal for separating personal, business, or household budgets.

The app offers strong privacy, offline access, and detailed reports. Moneon is best suited for users who prefer to stay hands-on with their finances and want a distraction-free interface without complex automation.

Key Highlights:

- Envelope-based manual budgeting

- Multiple wallets and category limits

- Offline access and strong privacy settings

Who it’s best for:

- Manual budgeters who avoid bank syncing

- Users managing separate financial categories

- People who want full control and focus

Contact Information:

- Website: moneon.app

- App store: apps.apple.com/us/app/moneon-my-budget-expenses

- Google Play: play.google.com/store/apps/details

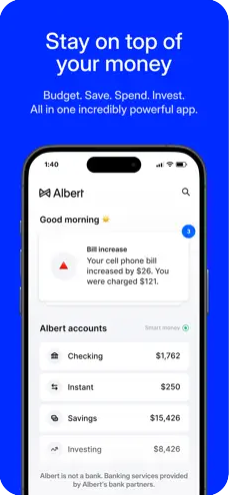

16. Albert

Albert is an all-in-one financial assistant that includes budgeting, automatic savings, and financial advice in one app. After connecting your bank accounts, Albert analyzes your spending patterns and offers personalized suggestions. It even features a team of human advisors called “Geniuses” to answer financial questions.

You can set up smart savings goals, track bills, and get alerts when your spending is off track. Albert is ideal for users who want a budget tool with the brains of a financial advisor and the simplicity of an app.

Key Highlights:

- Automatic savings and spending tracking

- Access to human financial advisors (premium)

- Bill tracking and smart alerts

Who it’s best for:

- Users who want guidance along with budgeting

- People looking to build savings automatically

- Beginners needing support and accountability

Contact Information:

- App store: apps.apple.com/us/app/albert-budgeting-and-banking

- Website: albert.com

17. Clarity Money (now part of Marcus by Goldman Sachs)

Clarity Money, discontinued in 2019, is no longer available as a standalone app, and its budgeting features are not fully integrated into the Marcus by Goldman Sachs app, which focuses on high-yield savings and banking services. It provides automated insights, expense tracking, and personalized saving tools. You can set spending categories, monitor balances, and connect multiple accounts.

Although not solely a budgeting app, Marcus now includes those core features with additional access to high-yield savings accounts. It’s a solid choice for users who want simple budgeting alongside smart banking.

Key Highlights:

- Tracks subscriptions and spending patterns

- Account syncing with goal-based tools

- Banking integration for saving and budgeting

Who it’s best for:

- Users who want budgeting + savings in one app

- People managing subscriptions or recurring expenses

- Individuals using Marcus banking services

Contact Information:

- Website: www.marcus.com

- App store: apps.apple.com/us/app/clarity

- Google Play: play.google.com/store/apps/details

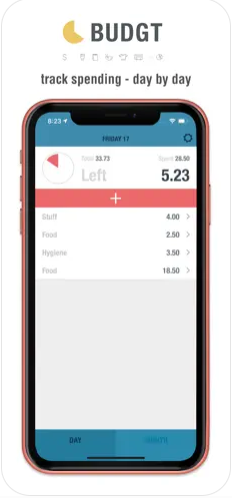

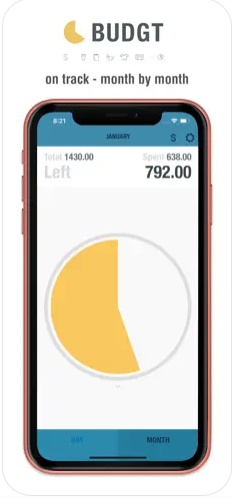

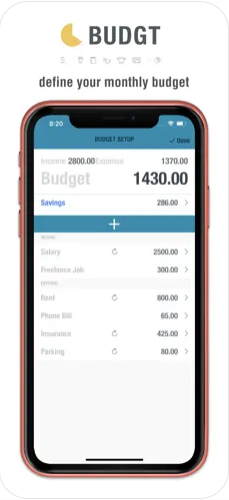

18. BUDGT

BUDGT is a lightweight, offline budget app made for people who want to enter expenses manually and get daily summaries without account syncing. You can plan monthly income, assign spending limits to categories, and quickly view how much you’ve spent and what remains.

With a no-frills interface, BUDGT is perfect for users who care about simplicity and don’t want their data tied to online services. It’s a fast and effective way to keep track of daily expenses with minimal setup.

Key Highlights:

- Fully offline with manual input

- Simple daily summaries and monthly planning

- Lightweight and fast for quick budgeting

Who it’s best for:

- Users who prefer privacy and simplicity

- Daily spenders tracking cash or card manually

- People avoiding complex financial apps

Contact Information:

- Website: www.budgt.ch

- App store: apps.apple.com/us/app/budgt-daily-finance

- Instagram: www.instagram.com/budgtfinance

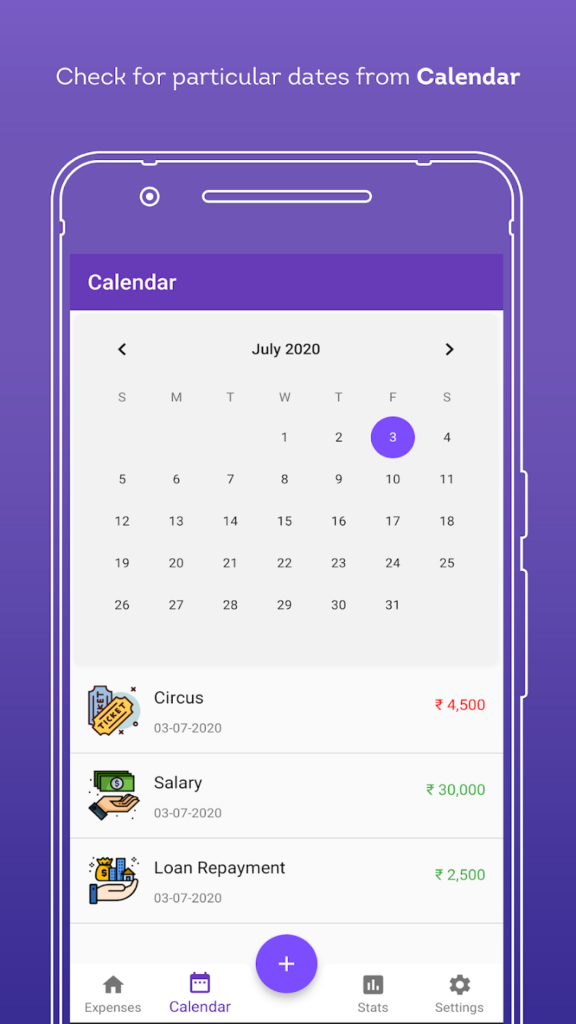

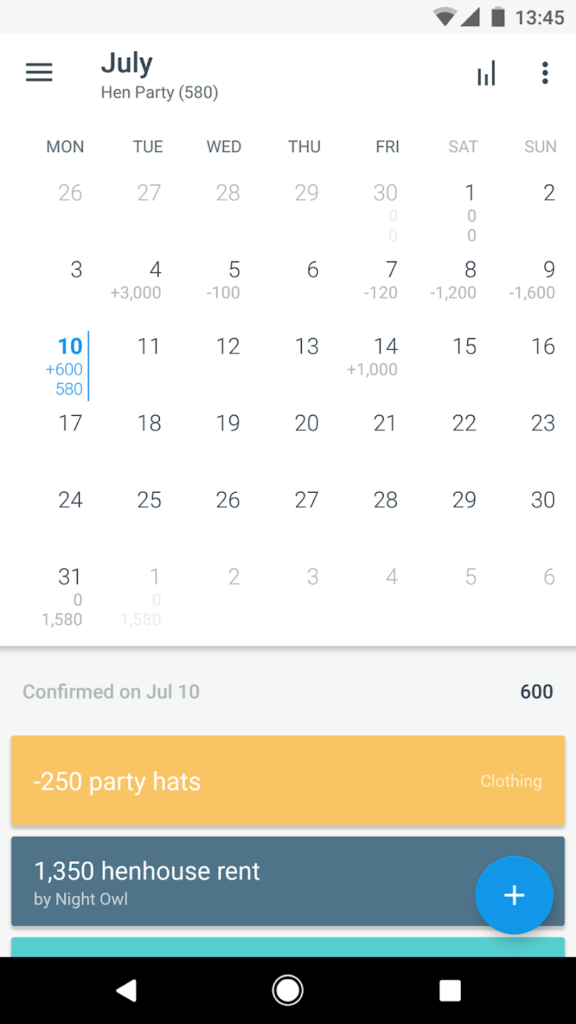

19. Dollarbird

Dollarbird combines budgeting with a unique calendar-based interface. Instead of lists or charts, it lets you plan and track expenses by date, great for users who like seeing money flow over time. You can create shared calendars, tag recurring bills, and view projected balances based on planned expenses.

Dollarbird is particularly helpful for freelancers, irregular earners, or anyone who wants to forecast their month visually. It’s intuitive and powerful for time-based financial planning.

Key Highlights:

- Calendar-style budgeting with cash flow projection

- Supports shared calendars and recurring bills

- Visual layout perfect for irregular incomes

Who it’s best for:

- Freelancers and gig workers with variable income

- Users planning expenses by date

- Visual thinkers tracking financial flow over time

Contact Information:

- Website: dollarbird.co

- App store: apps.apple.com/us/app/dollarbird-budget-calendar

- Google Play: play.google.com/store/apps/details

- Facebook: www.facebook.com/dollarbirdapp

- Twitter: x.com/dollarbirdapp

Conclusion

The best budget apps for iPhone combine convenience, automation, and insight to help you stay in control of your finances. Whether you prefer a simple expense tracker or a fully integrated financial planner, the right app can turn budgeting from a chore into a daily habit. Try a few from this list and discover which one helps you stay on track, spend wisely, and reach your goals faster.