Keeping tabs on your credit score might sound like a chore, but thanks to today’s tech, it’s easier than ever. Whether you’re planning to buy a house, apply for a loan, or just want to be smarter about your money, knowing your credit score is a must. That’s where credit score apps come in. These handy tools do more than just show you a number. They help you understand what’s behind it, offer tips to improve it, and alert you when something changes. This article breaks down the best credit score apps out there so you can choose the one that fits your lifestyle and financial goals.

Before we dive into the best credit score apps to keep your finances in check, let’s bring some balance to your daily grind. Cooking at home is a smart way to save money and stay grounded, and ReciMe makes it a breeze. This app lets you pull recipes from TikTok or Pinterest, plan your weekly meals, and create grocery lists sorted by aisle in seconds. Install ReciMe now, master your meal prep, and then tackle those credit score apps!

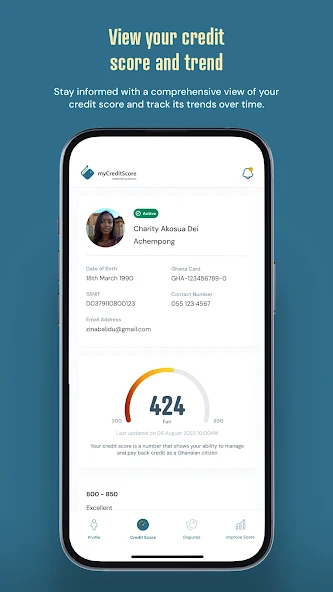

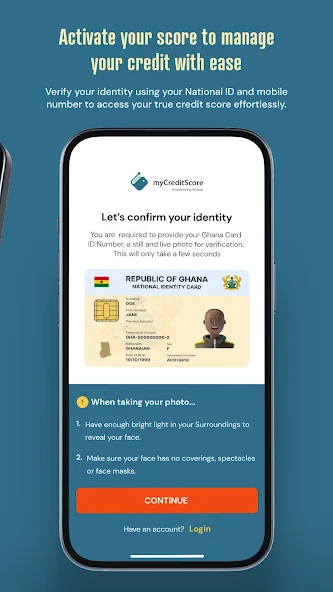

1. Credit Tracking with myCreditScore

They provide users with access to their credit score through the myCreditScore.com.gh platform. The app includes tools to view score trends over time and offers simple, personalized tips to help users understand the factors that may influence their credit status. Notifications alert users when their score changes or when disputes are listed by creditors.

Users can also review creditor claims that may impact their score, giving them insight into potential discrepancies. The app collects personal and financial data, which may be shared with partners for analytics and processing, based on developer disclosures. Updates have focused on improving how users access and view their credit profiles and login process stability.

Key Highlights:

- View current credit score and track changes over time

- Access basic tips tailored to the user’s credit situation

- Get alerts when credit score changes

- See creditor dispute records

- No data collected or shared with third parties

- Credit profile PDF available for download

Who it’s best for:

- Individuals interested in monitoring their credit score regularly

- Users who want to track dispute activity

- Those looking for basic insights into score trends

- People concerned about data privacy when using financial apps

Contact Information:

- Website: mycreditscore.com.gh

- App store: apps.apple.com/gh/app/mycreditscore-credit-check

- Google Play: play.google.com/store/apps/details

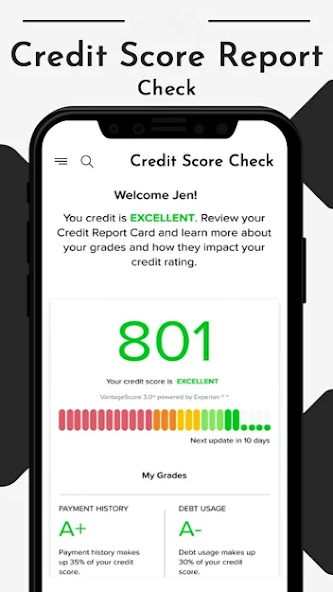

2. Credit Score Check & Report

This app functions as an interface that lets users access credit information from external sources such as CIBIL, Paisabazaar, and other government portals. It is not an official credit score provider and does not generate scores independently. The purpose is to help users understand what a credit score is and how it reflects their financial behavior in relation to debts, loan repayments, and penalties.

According to the app, credit scores in India, such as the CIBIL TransUnion score, typically range from 300 to 900 and are a common reference used by lenders. Users are reminded that this app does not store personal data and does not affiliate with any bank or financial institution. All data presented comes from third-party websites and services.

Key Highlights:

- Displays credit score data from external sites

- Introduces users to the concept of credit scoring in India

- Explains factors that may influence a credit score

- Does not collect or store user data

- No affiliation with banks or credit institutions

Who it’s best for:

- Individuals seeking general awareness of credit score concepts

- Users interested in viewing data from sites like CIBIL or Paisabazaar

- Those who prefer not to share personal data within an app

- People researching loan eligibility factors based on score ranges

Contact Information:

- Google Play: play.google.com/store/apps/details

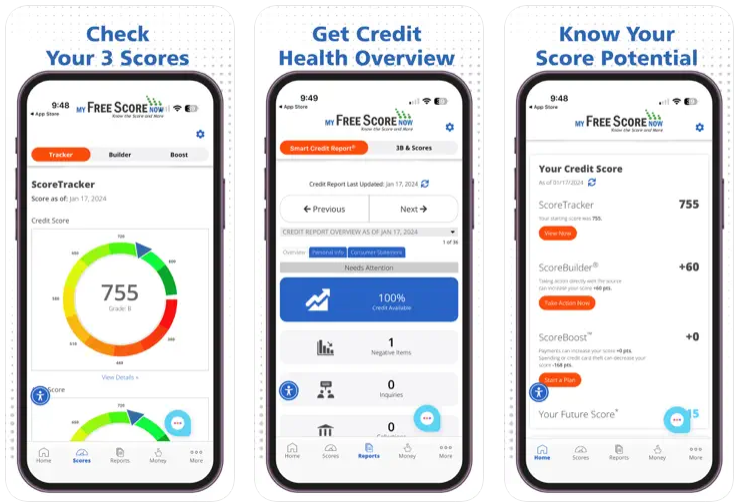

3. Check Credit Score Now

This app gives users a way to monitor their credit restoration progress, including updates on score changes, disputed records, and item deletions. It offers estimated credit score information based on available data and states that official reports should still be obtained through authorized bureaus. The app is intended for informational use and does not serve as financial advice.

In addition to credit score tracking, users have access to a set of financial calculators. These tools include options like gross profit calculations. The app works online and offline, collects some device-related identifiers, and encrypts data in transit. Users cannot request deletion of the data once collected.

Key Highlights:

- Tracks credit score changes, disputes, and deletions

- Offers credit score estimates for general reference

- Includes financial calculators such as gross profit tools

- Usable with or without an internet connection

- Collects device identifiers

- Data is encrypted during transmission

- Does not allow data deletion

Who it’s best for:

- Users interested in tracking credit restoration activity

- Individuals needing access to basic financial calculators

- People seeking credit score estimates without official reports

- Those who want an app that functions both online and offline

Contact Information:

- Website: www.myfreescorenow.com

- App store: apps.apple.com/us/app/myfreescorenow

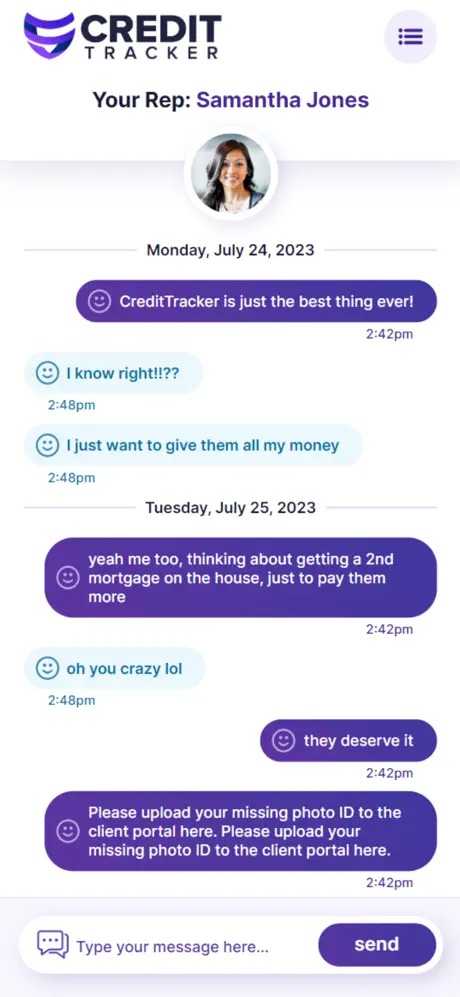

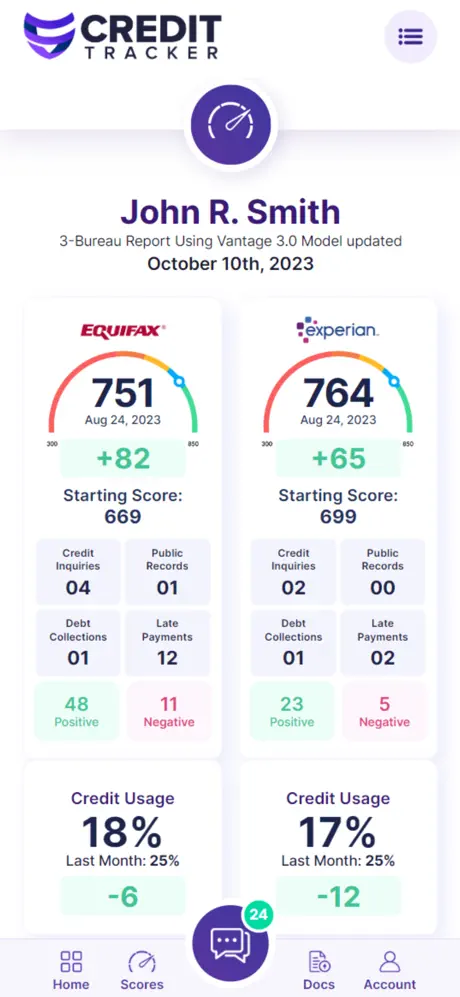

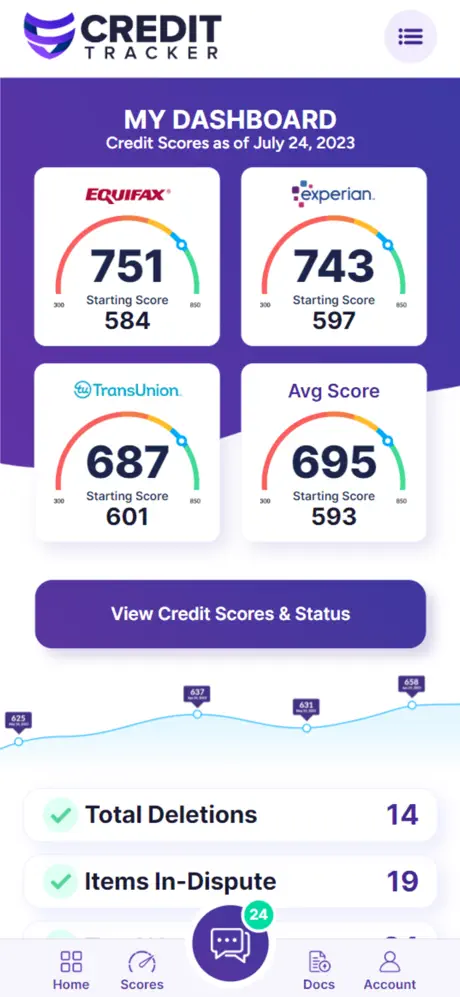

4. Credit Tracker

This app focuses on helping users monitor their credit restoration status. It provides updates on credit score progress, flags disputed items, and tracks any deletions related to the user’s credit profile. Users can also submit required documents and messages directly through the app interface as part of their credit recovery process.

The app collects certain types of data, including photos, documents, and device identifiers. According to developer statements, this data is encrypted during transmission but cannot be deleted once submitted. No data is shared with third parties. The app has undergone updates to improve stability and performance.

Key Highlights:

- Tracks credit score restoration progress

- Displays disputed items and deletions

- Users can submit documents and messages

- Collects photos, files, and device identifiers

- Data is encrypted during transfer

- Data deletion not available

- No third-party data sharing reported

Who it’s best for:

- Individuals managing their credit recovery process

- Users tracking disputed credit items

- People needing to send financial documentation through an app

- Those looking for status updates on credit-related changes

Contact Information:

- App store: apps.apple.com/us/app/credit-tracking

- Google Play: play.google.com/store/apps/details

5. Credit Score Check & Report AI

This app uses artificial intelligence to generate estimated credit scores and guide users through understanding credit reports. It includes features designed to support those looking to learn more about their credit standing or explore credit repair options. The app outlines how credit scores are calculated based on factors like payment history, past reports, and income level. It also presents explanations of how lenders use credit reports to assess borrower reliability. Data is encrypted during transfer and cannot be deleted once submitted. A recent update introduced new AI-based tools related to credit repair, boosting, and guidance.

Key Highlights:

- Offers AI-generated credit score estimates

- Includes explanations of credit scoring and reporting concepts

- Provides features aimed at credit repair and score improvement

- No user data is collected, based on developer statements

- Device and performance data may be shared with third parties

- Data is encrypted in transit

- No option to delete submitted data

Who it’s best for:

- Users seeking estimated credit scores without formal reports

- Individuals interested in AI-based credit guidance

- People looking to explore credit repair concepts

- Those who want an app with educational elements about credit usage

Contact Information:

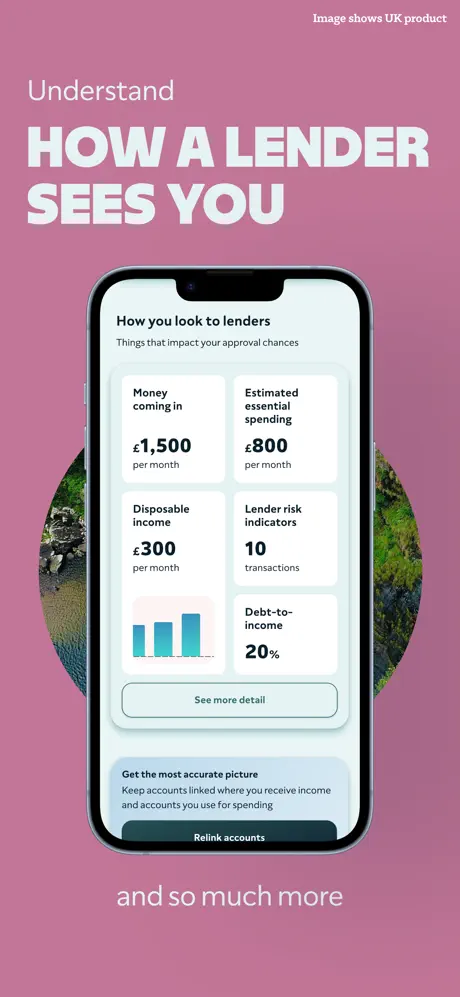

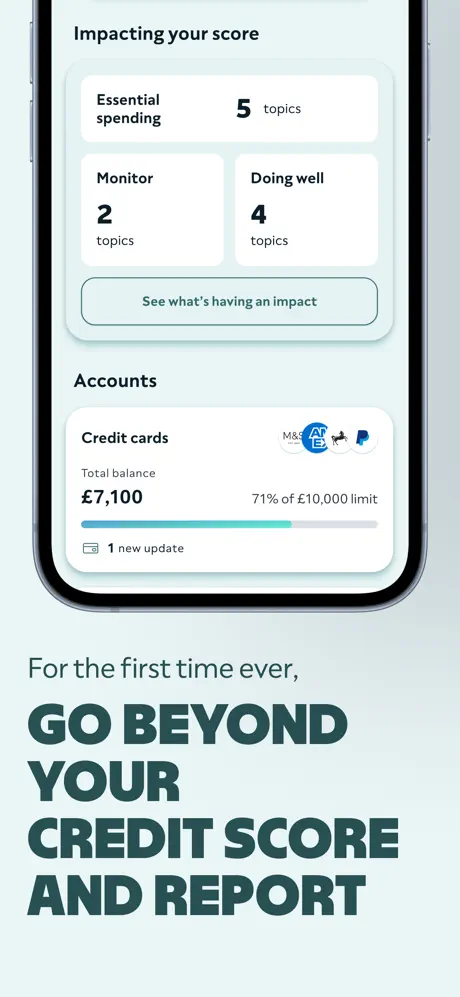

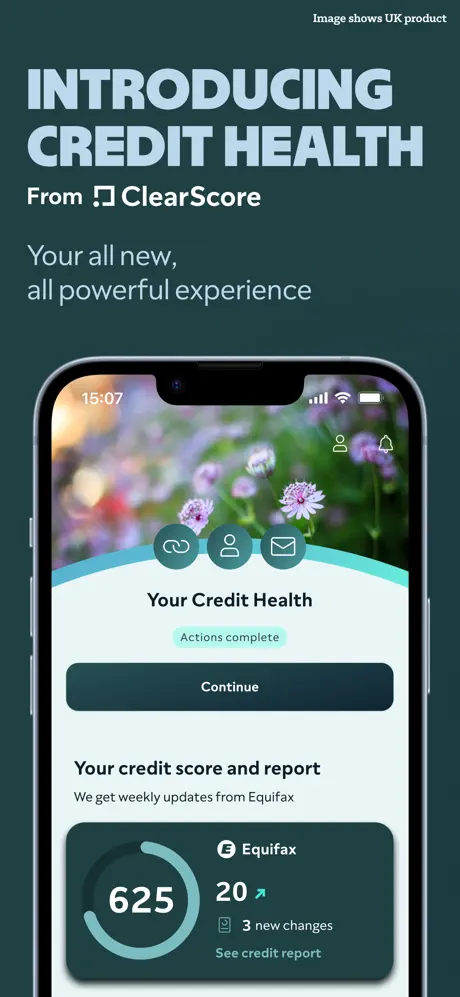

6. ClearScore: Credit Score Check

This app offers users access to their credit score and detailed credit reports, along with tools for monitoring financial health over time. In addition to displaying account histories and outstanding balances, it provides overviews that reflect how users may appear to lenders. Users can view their disposable income, current debt levels, and receive notifications of any unusual credit activity. The app includes a paid feature for expanded credit monitoring.

ClearScore also features educational content through short videos and guides aimed at helping users understand credit basics. It presents personalized loan and credit card offers based on user data and credit profiles. According to the developer, the app encrypts data, allows users to request data deletion, and shares select personal and financial information with third parties.

Key Highlights:

- Provides free access to credit score and credit report

- Displays account history, debts, and disposable income

- Includes tools for credit monitoring and fraud alerts

- Offers educational content focused on improving credit awareness

- Paid option available for advanced monitoring features

- Personalized offers from financial partners included

- Shares financial and personal data with third parties

- Data is encrypted and can be deleted upon request

Who it’s best for:

- Users who want a full credit report overview

- Individuals tracking changes in financial status

- People interested in credit monitoring tools

- Those who prefer guidance content related to credit health

- Users open to receiving tailored credit product offers

Contact Information:

- Website: www.clearscore.com

- App store: apps.apple.com/gb/app/clearscore-credit-score-check

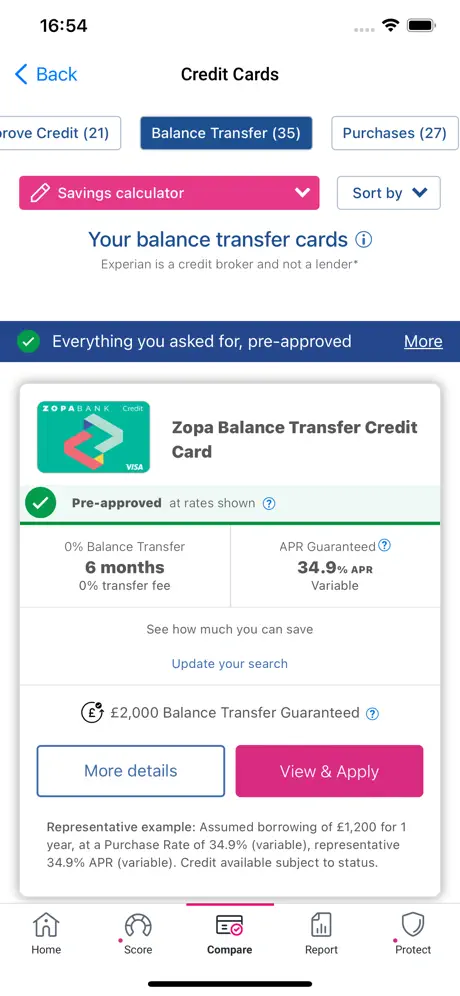

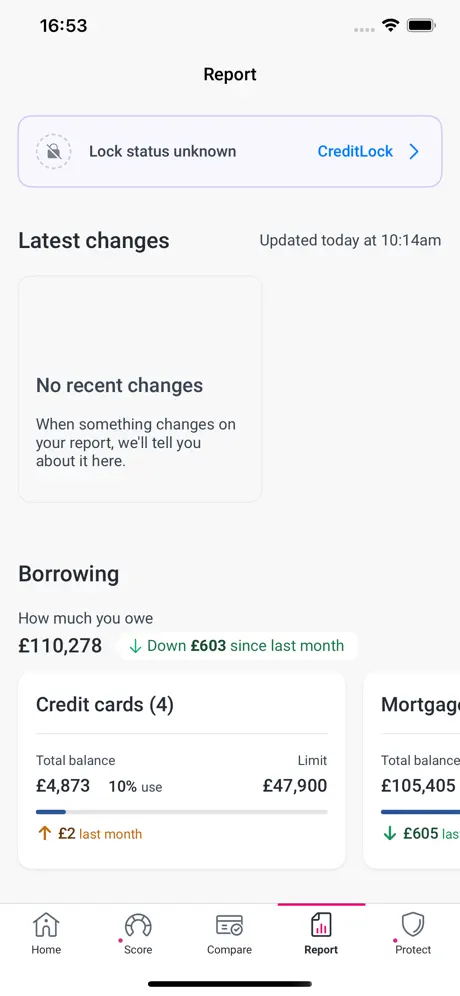

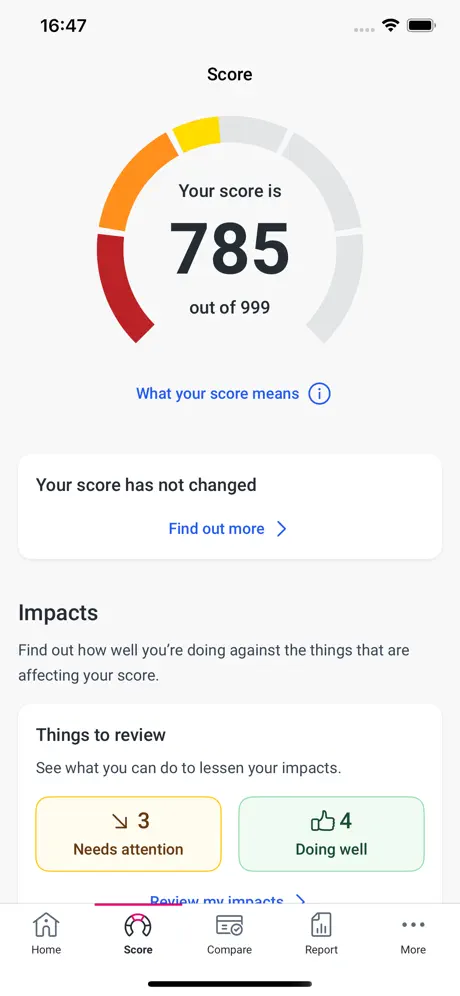

7. Experian: Credit Score

This app gives users in the UK access to their Experian credit score and report, alongside features to compare credit cards and personal loans. It displays a summary of outstanding credit accounts and offers an indication of how likely a user is to be accepted for various financial products. The app acts as a credit broker, not a lender, and presents results from selected lenders and other brokers.

Users can view their score history, receive alerts for credit changes, and explore learning resources through tips and videos. There is also a paid subscription option that includes daily score updates, web monitoring, and fraud support. The app collects and may share financial and personal information, with encrypted data transmission and a data deletion request feature available.

Key Highlights:

- Free access to credit score and report

- Comparison tools for credit cards and loans

- Credit eligibility estimates based on user profile

- Educational content and credit guidance included

- Paid plan offers daily updates, fraud alerts, and timeline tracking

- Data may be shared with third parties

- Supports data encryption and deletion requests

Who it’s best for:

- UK users looking to check and monitor their credit score

- Individuals comparing financial product offers

- People interested in viewing credit history trends and alerts

- Users seeking educational support around credit topics

- Those willing to explore paid options for extended monitoring features

Contact Information:

- Website: www.experian.com

- App store: apps.apple.com/us/app/experian

- Google Play: play.google.com/store/apps/details

8. Credit Score Report Check

This app operates as a third-party interface, presenting credit information sourced from external websites such as Paisabazaar and CIBIL. It does not generate or verify credit scores itself and has no affiliation with banks or credit institutions. The purpose is to offer users a simple way to view data already available through other platforms.

According to the developer, the app does not collect or transmit personal data. It also does not encrypt user data or provide a method for users to request data deletion. The app is described as a general reference tool and does not store user credentials or act as an official credit scoring service.

Key Highlights:

- Displays credit information from external platforms

- Not connected to any bank or financial institution

- Does not collect or share user data

- No encryption or data deletion options

- Designed for reference purposes only

Who it’s best for:

- Users seeking a basic interface to access third-party credit score websites

- Individuals looking for a non-intrusive app without data collection

- People wanting a lightweight option for occasional credit reference checks

- Those not in need of official reports or direct data handling

Contact Information:

- Google Play: play.google.com/store/apps/details

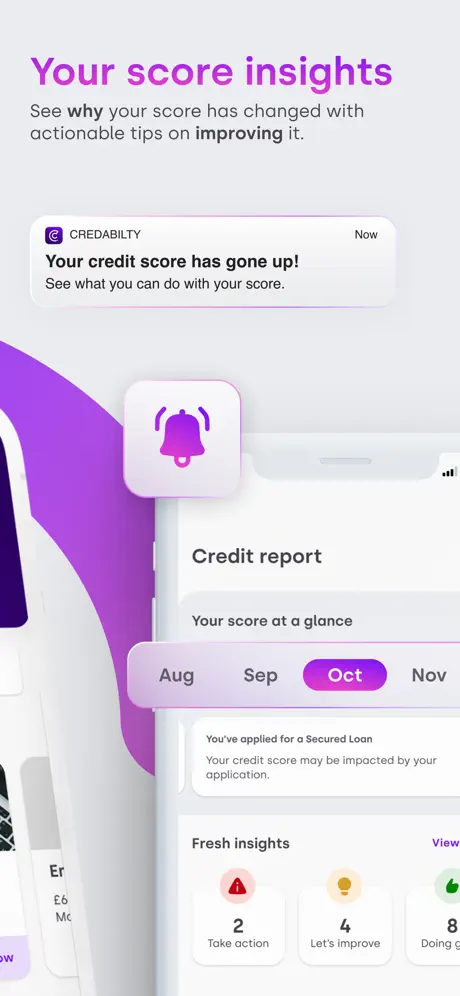

9. CredAbility – Credit Score

This app offers users access to a weekly updated credit report along with tools to view and track their credit accounts in one place. It shows what lenders may see, highlights recent changes, and breaks down positive and negative influences on the user’s score. Users can compare credit cards and loan options with estimated eligibility shown before applying, and these checks do not affect credit ratings.

The app also includes a personal dashboard to monitor progress and basic financial goals. Data collected includes financial and contact information, identifiers, and usage activity, some of which is linked to the user’s identity. Certain data, like location and diagnostics, may be collected without being linked to personal identifiers.

Key Highlights:

- Weekly updates of credit reports

- Dashboard view of all credit accounts

- Breakdown of score influences

- Pre-qualification estimates for loans and cards

- Quick login using Touch ID or Face ID

- Free access to credit tools and insights

- Collects and links financial and usage data to the user

- Non-linked data includes location and diagnostics

Who it’s best for:

- Users tracking credit score changes on a weekly basis

- People comparing borrowing options based on credit eligibility

- Individuals seeking insights into credit score factors

- Those who want a mobile dashboard to review credit status

- Users who want pre-application guidance without impacting their credit file

Contact Information:

- Website: credability.co.uk

- App store: apps.apple.com/gb/app/credability-credit-score

- Google Play: play.google.com/store/apps/details

- Instagram: www.instagram.com/credabilityapp

- Facebook: www.facebook.com/CredAbilityUK

- LinkedIn: www.linkedin.com/company/credabilityltd

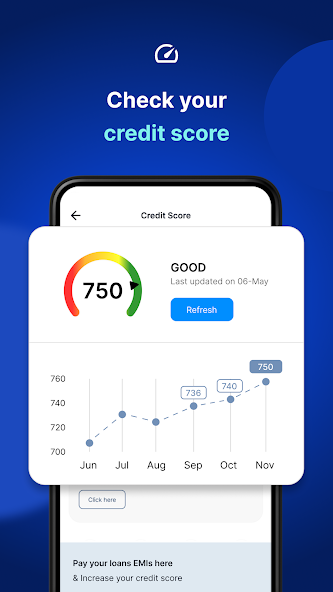

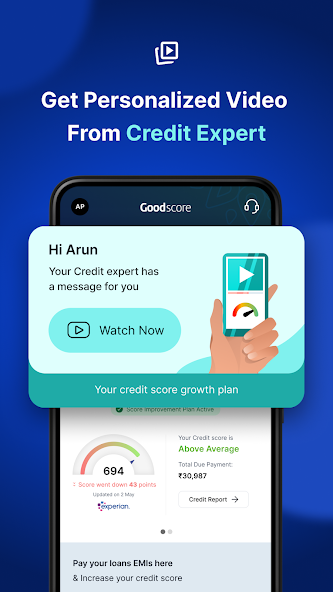

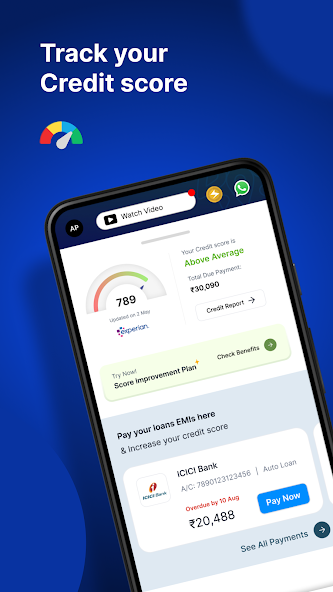

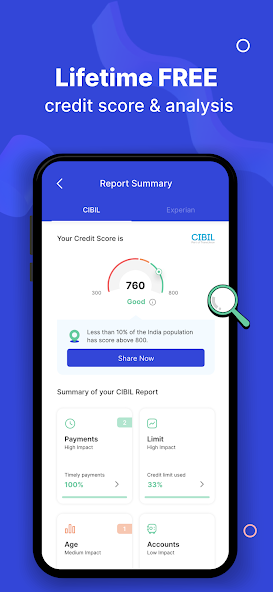

10. GoodScore: Credit Score App

This app provides access to credit scores from Experian and CRIF High Mark, two credit bureaus authorized in India. Users receive a full credit report and personal analysis that includes video explanations and recommendations based on their credit behavior. The app tracks active and closed credit accounts and offers a monthly overview of credit-related decisions. It does not include credit repair services and is intended for educational purposes only.

GoodScore also offers features such as bill reminders and a dashboard to monitor credit accounts. The app collects personal data and may share device identifiers with third parties. Data is encrypted during transfer, and users can request deletion of stored information. Permissions related to SMS access are used for monitoring transactional messages.

Key Highlights:

- Access Experian and CRIF High Mark credit scores

- Monthly credit tracking with full report

- Personalized credit insights in video format

- Monitors active and closed credit accounts

- Credit usage and payment history analysis

- Includes bill and EMI reminder tools

- SMS permission required for credit tracking

- Encrypts data in transit and supports data deletion requests

- Shares device identifiers with third parties

Who it’s best for:

- Indian users looking to monitor Experian and CRIF credit scores

- Individuals interested in educational feedback on credit behavior

- People managing multiple credit accounts and seeking monthly updates

- Users who want to track payments and set reminders within one app

- Those who prefer detailed breakdowns of credit profile activity

Contact Information:

- Website: www.goodscore.app

- App store: apps.apple.com/in/app/goodscore-credit-score-app

- Google Play: play.google.com/store/apps/details

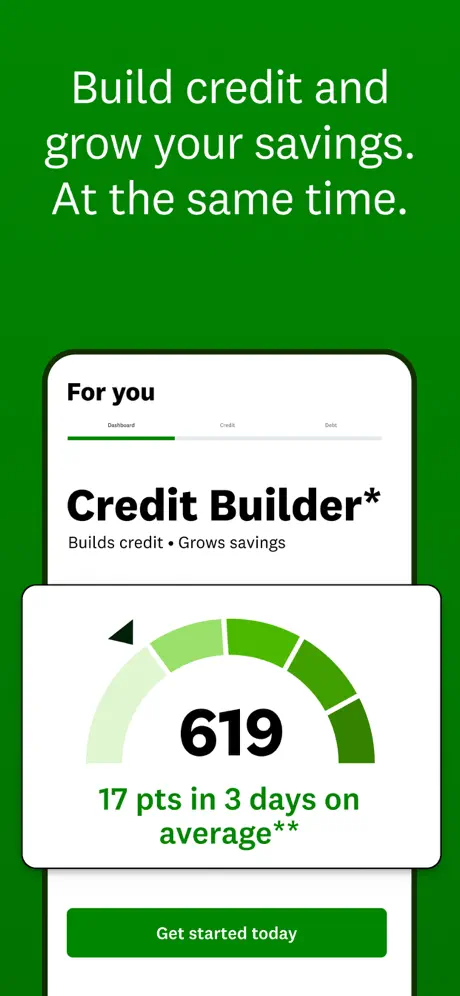

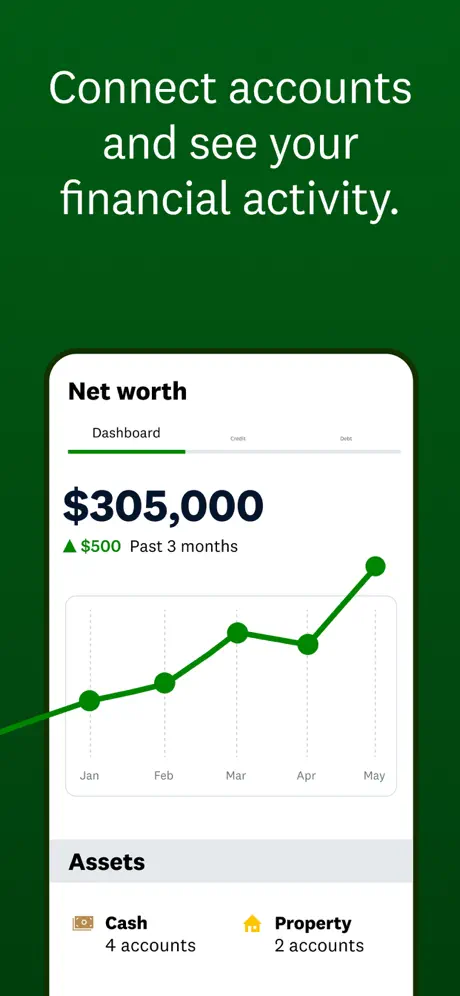

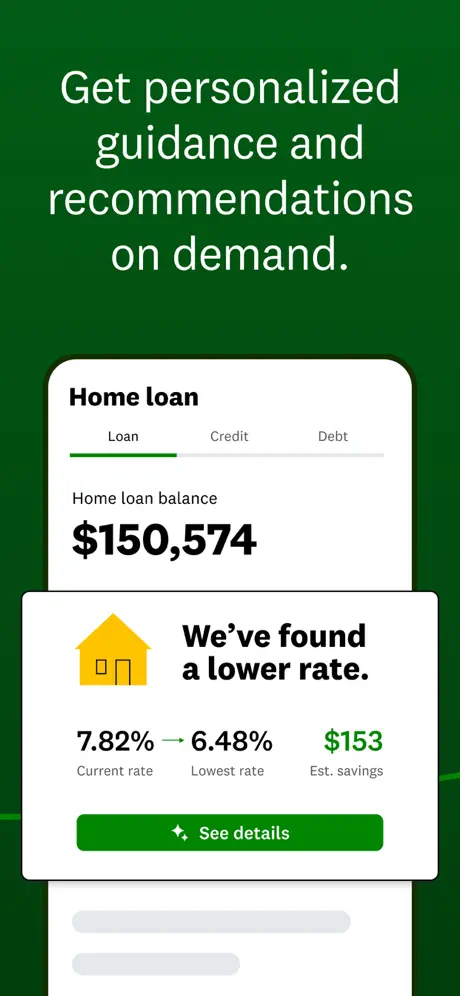

11. Intuit Credit Karma

This app combines credit score tracking with broader personal finance tools. Users can view changes in their credit score, receive alerts about rate shifts, and monitor identity activity. The app also connects to financial accounts for real-time transaction tracking, spending analysis, and bill management. Loan and credit card offers are displayed with estimated approval odds based on the user’s profile, though these are not guaranteed.

Additional features include free tax filing tools, optional banking services through partner institutions, and access to car insurance comparison tools. The app collects financial, location, and usage data, some of which is linked to the user. It also gathers non-linked data such as diagnostics and purchases. Banking and credit builder products are provided in partnership with external financial institutions.

Key Highlights:

- Tracks credit score changes with notifications

- Offers loan and credit card comparisons with approval odds

- Connects to financial accounts for transaction monitoring

- Provides optional banking and credit-building features

- Supports free tax filing tools

- Offers car insurance comparisons based on user profile

- Collects and links financial, usage, and contact data

- Additional non-linked data includes purchases and diagnostics

Who it’s best for:

- Users who want credit tracking alongside personal finance insights

- Individuals looking to monitor spending and financial activity in one place

- People comparing multiple financial product options

- Users interested in integrated services like tax filing or credit builder tools

- Those who prefer alerts on rate changes, score shifts, and account activity

Contact Information:

- Website: www.creditkarma.com

- App store: apps.apple.com/us/app/intuit-credit-karma

- Facebook: www.facebook.com/CreditKarma

- Twitter: x.com/CreditKarma

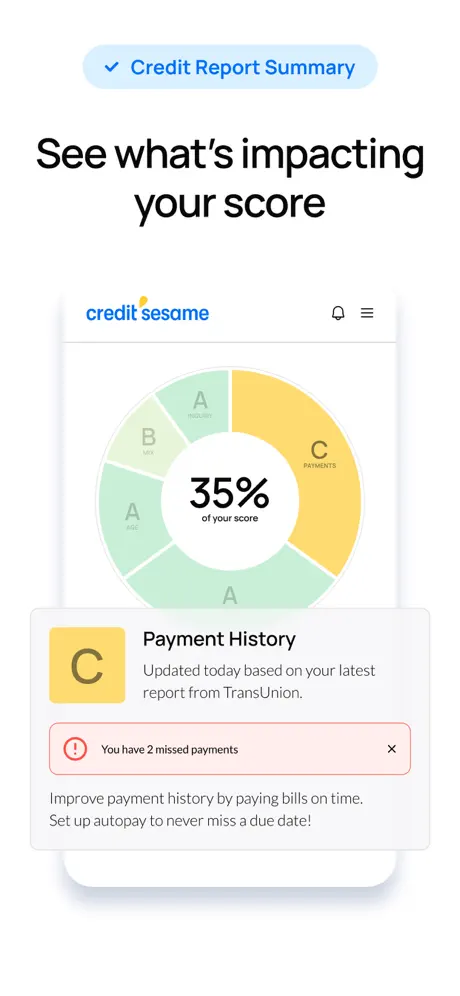

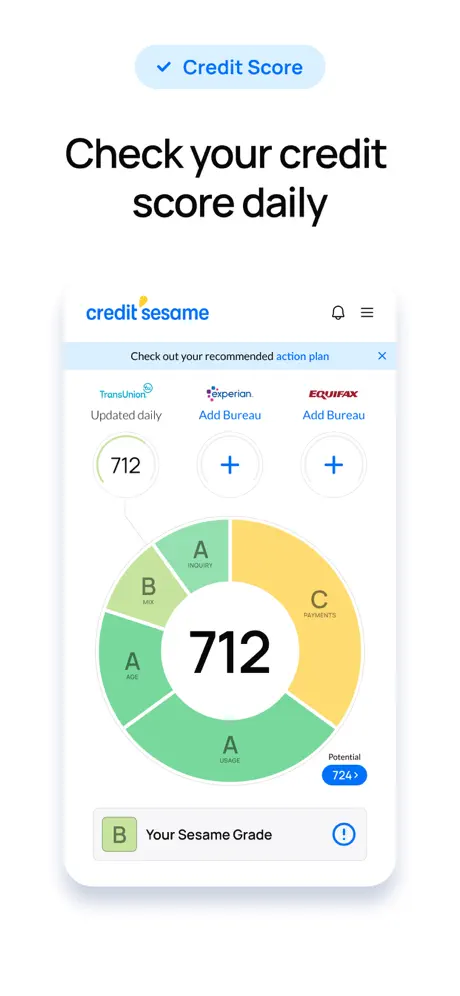

12. Credit Sesame: Grow Your Score

This app combines credit score tracking, financial analysis, and credit management features. Users can check their credit score for free, view a weekly summary with a simplified grade, and get alerts about report changes. The app also estimates how financial decisions might impact future scores. For users who subscribe to premium, additional tools are included such as access to credit scores from three bureaus, rent reporting, dispute support, and a debit card intended to support credit growth.

Credit Sesame also offers a credit builder card and displays credit product recommendations based on user profiles. Some of the app’s data collection is linked to user identity, including financial and contact information, while other data such as usage and diagnostics is not directly connected. Features vary based on the plan and the user’s eligibility.

Key Highlights:

- Free credit score checks and weekly credit report summaries

- Real-time alerts for credit changes

- Score simulator and credit impact insights

- Rent payment reporting to build credit history

- Access to 3-bureau credit data with premium subscription

- Dispute support for credit report errors

- Credit builder card for score improvement

- Data collection includes identifiers, financial, and usage data

Who it’s best for:

- Users seeking free access to their credit score and summaries

- Individuals looking to track or improve their credit with guided tools

- People interested in using rent history to build credit

- Subscribers who want broader access to multiple credit bureaus

- Users who want alerts for report changes and score shifts

Contact Information:

- App store: apps.apple.com/us/app/credit-sesame-grow-your-score

- Google Play: play.google.com/store/apps/details

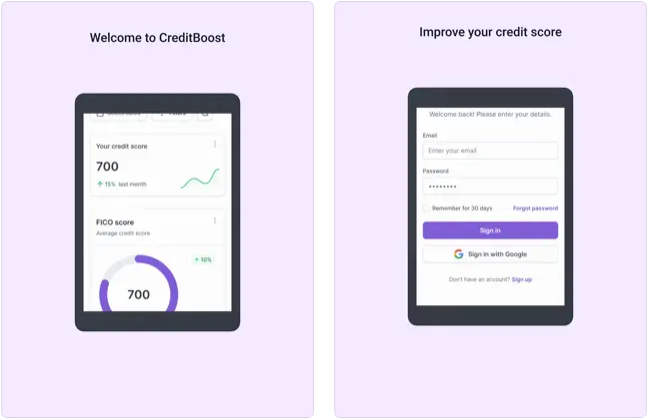

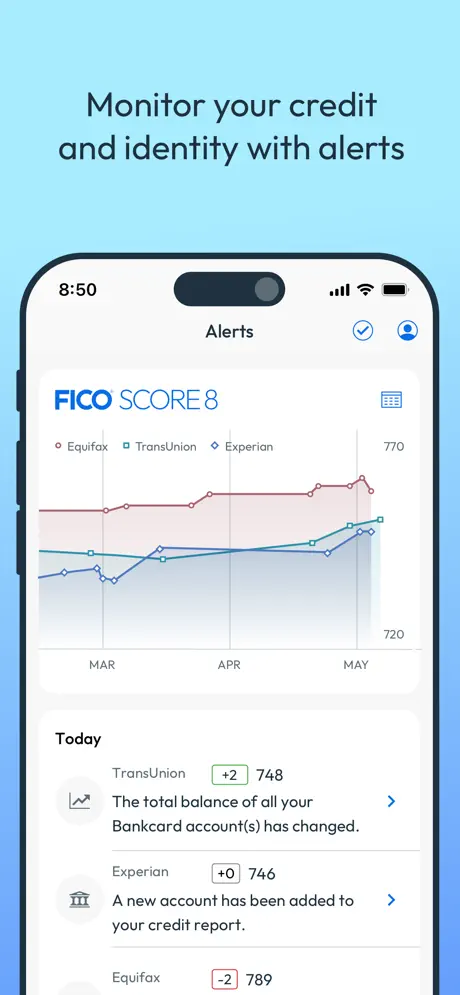

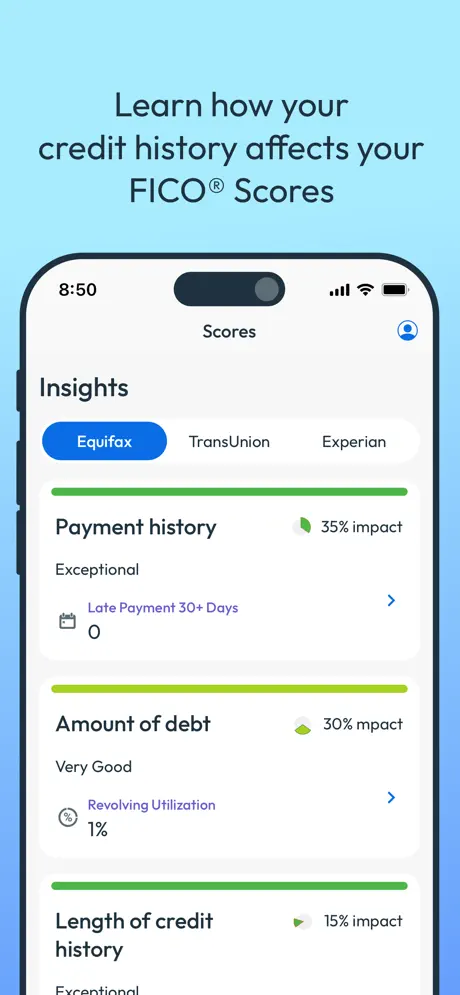

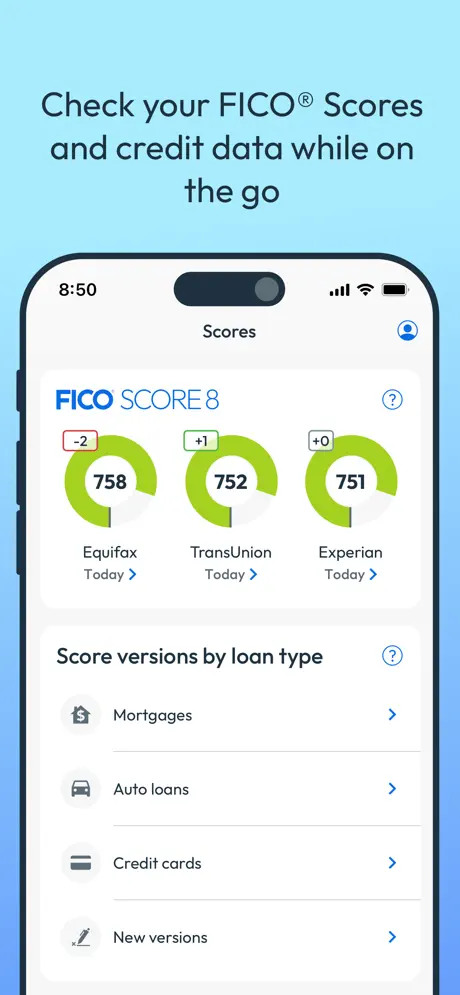

13. myFICO – FICO Score Monitoring

This app gives users access to their official FICO Scores from all three major credit bureaus – Experian, TransUnion, and Equifax. It includes multiple versions of FICO Scores that are often used in different lending scenarios, such as for mortgages, auto loans, and credit cards. The app features alerts for score changes, identity monitoring, and tools to view score history. Users can compare bureau data side by side and use simulations to estimate how financial decisions might affect their scores.

The app includes educational content and secure login options, such as biometric authentication and two-step verification. Data collection includes financial and contact information, device identifiers, usage activity, and diagnostics. Some of this data is used for tracking across other apps and websites. Certain features, including full credit report access and score simulations, are only available with a paid subscription.

Key Highlights:

- Access FICO Scores used in lending decisions

- View scores and credit reports from all three major bureaus

- Receive alerts for changes to credit or identity data

- Use score simulators to model financial decisions

- Track FICO Score 8 over time

- Includes biometric login and two-step verification

- Educational content about credit scoring

- Collects and tracks personal and usage data

Who it’s best for:

- Users seeking FICO Scores for specific loan types

- People comparing bureau reports and credit history

- Individuals monitoring changes that may affect loan eligibility

- Those using simulations to plan financial decisions

- Subscribers looking for full access to credit and identity monitoring features

Contact Information:

- Website: www.myfico.com

- App store: apps.apple.com/us/app/myfico-fico-score-monitoring

- Google Play: play.google.com/store/apps/details

- Twitter: x.com/myfico

- Facebook: www.facebook.com/myFICO

- Instagram: www.instagram.com/myficoofficial

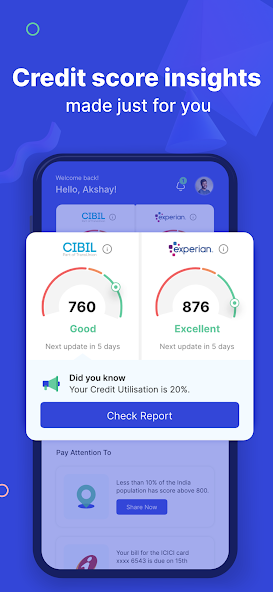

14. OneScore: Credit Score Insight

OneScore combines credit score monitoring with access to instant personal loan offers through its partner platform OnePL. The app displays credit scores from Experian and CIBIL, highlights changes in credit history, and provides insights into what factors may be affecting a user’s score. It includes tools like a credit score simulator, payment reminders, and a dashboard to track loan and credit card activity. Users can also report credit record inaccuracies through the app.

In addition to credit management features, the app provides personalized loan offers based on credit data and other eligibility factors. Loan terms, interest rates, and processing fees vary by lending partner. Personal and financial data is collected and linked to the user. Some information is also gathered without direct identification. The app may share user data, such as financial information and identifiers, with third parties for analytics and personalized offers.

Key Highlights:

- Tracks credit scores from Experian and CIBIL

- Offers real-time notifications for score changes

- Includes a score simulator and credit score planner

- Displays open and closed credit accounts in one view

- EMI calculator and bill reminder functions

- Allows users to report errors in credit records

- Personal loan offers from multiple lending partners

- Collects and links financial and usage data to the user

Who it’s best for:

- Users interested in monitoring Experian and CIBIL credit scores

- Individuals comparing personal loan options based on credit standing

- People who want insights on score changes and goal planning tools

- Users tracking credit card and loan accounts in one place

- Those using reminders and calculators to manage repayments

Contact Information:

- Website: www.onescore.app

- App store: apps.apple.com/in/app/onescore-credit-score-insight

- Google Play: play.google.com/store/apps/details

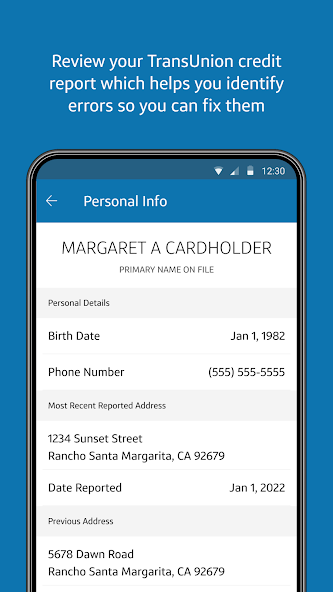

15. Capital One CreditWise

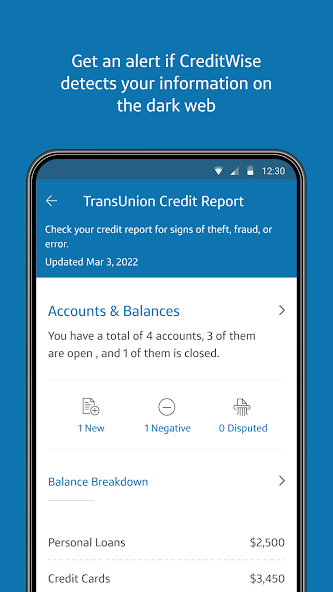

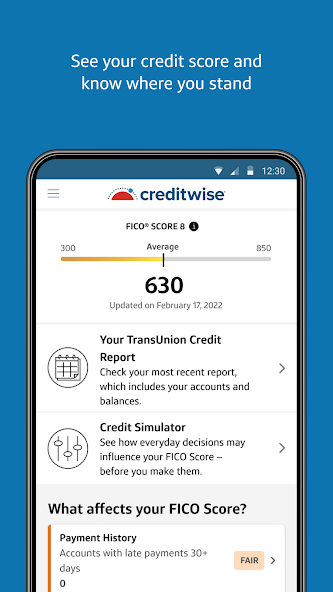

This app provides users with free access to their TransUnion VantageScore 3.0 credit score and credit report, updated as often as daily. It includes a credit simulator to estimate the impact of financial decisions and alerts users to changes on their TransUnion or Experian reports. Identity monitoring features are also built in, such as dark web alerts and notifications if a user’s Social Security number appears on a credit application.

CreditWise also offers a breakdown of the main factors influencing credit scores and gives guidance based on those inputs. No credit card is required to sign up, and the app does not affect a user’s credit score. It collects various types of personal and usage data, some of which is used for tracking across other platforms. The service is available to US residents aged 18 or older with a credit file at TransUnion.

Key Highlights:

- Provides free TransUnion VantageScore 3.0 credit score

- Access to TransUnion credit report

- Credit simulator to model potential score changes

- Identity monitoring features including dark web alerts

- Score factor breakdowns with improvement suggestions

- Alerts for credit report activity and identity changes

- No impact on credit score from usage

- Tracks and links financial, contact, and usage data

Who it’s best for:

- US users looking for regular credit score updates

- Individuals monitoring credit report activity and identity data

- People using simulations to plan credit-related decisions

- Users wanting guidance on credit score factors

- Those interested in free credit tracking without account registration requirements

Contact Information:

- Website: www.capitalone.com

- App store: apps.apple.com/us/app/capital-one-creditwise

- Google Play: play.google.com/store/apps/details

- Instagram: www.instagram.com/capitalone

- Twitter: x.com/capitalone

- Facebook: www.facebook.com/capitalone

- LinkedIn: www.linkedin.com/company/capital-one

Conclusion

Finding the right credit score app depends on what someone needs most, whether it’s checking their score for free, tracking changes, getting alerts, or exploring loan options. Some people want a quick snapshot of where their credit stands, while others prefer deeper insights with detailed reports, credit simulators, or identity monitoring features. With so many choices available, it helps to compare how each app handles score updates, what kind of data they use, and what extras they offer beyond just the numbers.

No single app fits everyone, but using the right one can make staying on top of credit easier and less stressful. Whether someone’s just starting to build their credit or trying to maintain a strong score, these tools can support smarter financial decisions over time.

Leave a Reply

You must be logged in to post a comment.