Getting into trading can feel overwhelming, especially with so many apps claiming to be the best. For beginners, what really matters is an app that’s easy to use, doesn’t bombard you with complex features, and helps you understand the basics without the jargon. The right trading app can make all the difference between feeling lost and feeling in control. This guide breaks down the best trading apps that are perfect for beginners who want a smooth, stress-free start to their investing journey.

Hey, as we explore top trading apps for a smooth start in 2025, let’s add some balance to your busy life. Home-cooked meals are a great way to stay sharp, and ReciMe’s got your back. Import recipes from Instagram or Facebook, organize your week’s menu, and get auto-sorted grocery lists that make shopping effortless. Install ReciMe today, simplify your meal prep, and then check out those beginner-friendly trading tools!

1. Robinhood Crypto

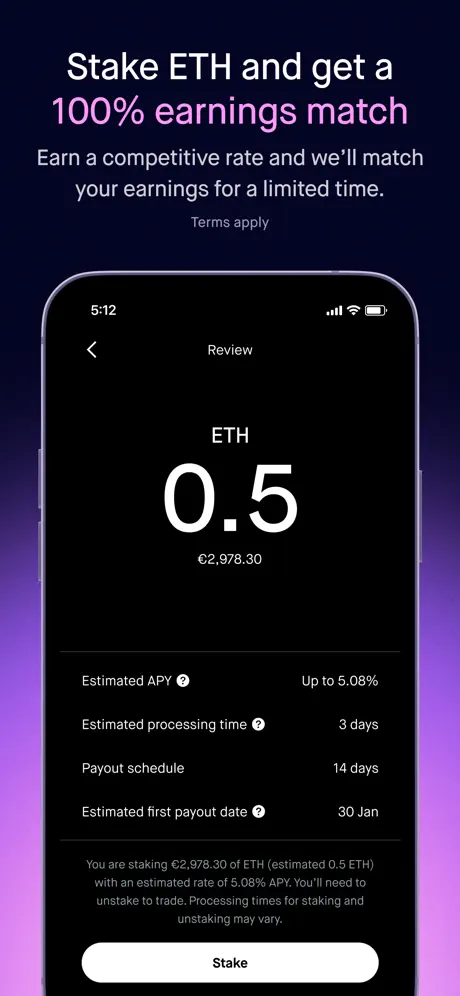

Robinhood Crypto offers access to over 40 cryptocurrencies through a mobile app available for both Android and iPhone users. The platform focuses on cost transparency by advertising zero trading fees, zero commissions, and no added spreads. Users can buy, sell, and store assets such as Bitcoin, Ethereum, and Solana. Features like staking for Ethereum and Solana are also available. Certain users may be eligible for rewards after signing up or completing learning modules.

The app supports SEPA Instant and SEPA Credit transfers for euro-based transactions. Robinhood Crypto is currently available in select European jurisdictions. The service does not provide fiat withdrawals without additional fees, which some users have mentioned in their reviews. Robinhood states that customer assets are not lent or used for leverage. Security features include account protection against theft and cybersecurity breaches. According to its disclosures, the platform is not covered by deposit insurance, and user data may be retained even if registration is not completed.

Key Highlights:

- Trade 40+ cryptocurrencies including BTC, ETH, SOL, and DOGE

- Zero trading fees and commissions, subject to terms

- Crypto staking available for SOL and ETH with capped rewards

- SEPA Instant and Credit bank transfers supported

- Reward incentives available for account setup and quiz completion

- Account security measures and limited crime insurance coverage

- No fiat withdrawal without fees

- Available only in specific European countries

Who it’s best for:

- Beginners interested in crypto exposure through a mobile app

- Users looking to trade crypto with SEPA-based euro transfers

- People who want to explore staking options for ETH and SOL

- Individuals comfortable providing full personal and financial data during signup

- Traders seeking fee transparency without in-depth trading tools

Contact Information

- Website: robinhood.com

- AppStore: apps.apple.com/us/app/robinhood-crypto-stocks/id6467049008

- PlayMarket: play.google.com/store/apps/details?id=com.robinhood.global

- Twitter: x.com/robinhoodapp_eu

- Instagram: www.instagram.com/robinhoodcryptoeu

- Facebook: www.facebook.com/RobinhoodAppEU

- Linkedin: www.linkedin.com/company/robinhood

2. SoFi – Invest. Simple.

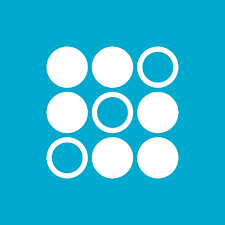

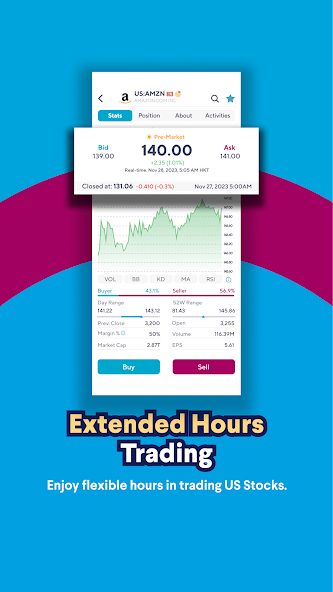

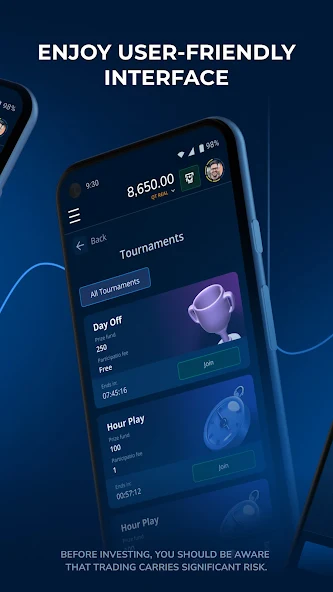

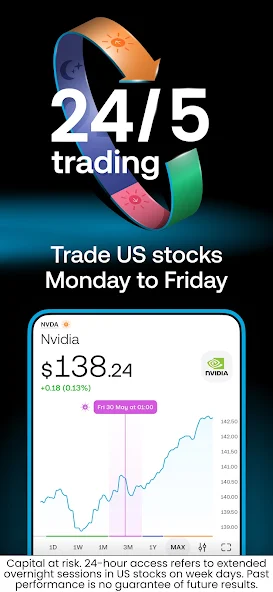

SoFi’s Hong Kong app combines stock trading, automated investing, and community features within a mobile platform. Users can access U.S. and Hong Kong markets and invest in over 15,000 stocks and ETFs. The app supports extended trading hours for U.S. markets and offers tools such as fractional shares and margin trading. Robo-advisor functionality is also available, where users are matched with a portfolio based on their responses to a risk profile questionnaire.

Other features include a watchlist, a social feed to follow other investors, and a points-based loyalty program. SoFi supports multi-currency deposits and in-app currency conversion. For deposits, eDDA is available for instant funding. Users can also participate in eIPO offers for Hong Kong-listed companies. The app collects certain user data types and uses encryption during transmission.

Key Highlights:

- Access to U.S. and Hong Kong stocks and ETFs

- Extended hours trading for U.S. markets

- Robo advisor portfolio management based on user-defined risk

- Fractional shares from US$10

- In-app currency conversion and multi-currency deposit support

- Margin trading and electronic direct debit deposits

- Community-driven features like social trading and watchlists

- eIPO application feature within the app

- SoFi Points loyalty program with in-app rewards

Who it’s best for:

- Users interested in trading U.S. and Hong Kong markets

- People who want fractional investing with small amounts

- Investors seeking both manual and automated portfolio tools

- Those who use mobile-first platforms for trading

- Users looking for peer insights through community trading features

Contact Information

- Website: www.sofi.com

- AppStore: apps.apple.com/us/app/sofi-invest-simple/id1212242967

- PlayMarket: play.google.com/store/apps/details?id=com.eigthsecurities.tradeflix

3. Forex Trading for Beginners (Go Forex)

Forex Trading for Beginners by Go Forex is an app that offers a simulation-based learning environment focused on the basics of forex and stock trading. It includes structured lessons, quizzes, and practical trading features using virtual currency. Users can trade popular forex pairs, stocks, indices, and commodities within a simulator. The app also features interactive tools like technical analysis presets and market signal alerts, aimed at teaching users how markets move and how trading decisions are made.

The platform incorporates a trading game that uses real-time price data to simulate market behavior. Users compete on leaderboards and receive daily trading signals covering a range of assets. Educational sections include concepts such as trading strategies, emotional control, and risk profiling. It also includes lessons on capital market fundamentals and a range of preset trading styles. Some data types may be shared with third parties and the app supports encrypted data transfers.

Key Highlights:

- Virtual trading simulator for forex and stock assets

- Daily trading signals for over 120 instruments

- Trading game with leaderboard rankings

- Technical analysis tools and strategy guides

- Interactive forex market hours calculator

- Trader style presets for scalping, swing, and day trading

- Courses and quizzes covering fundamentals and advanced strategies

- Simulation based on limited leverage and realistic virtual funds

Who it’s best for:

- Beginners interested in learning forex and stock trading basics

- Users who prefer simulation before using real funds

- Traders exploring strategy development in a low-risk environment

- Individuals looking for structured lessons with interactive features

- People wanting exposure to real-time market data through a training app

Contact Information

- Website: www.goforex.net

- Email: hello@goforex.app

- AppStore: apps.apple.com/us/app/forex-trading-for-beginners/id915926888

- PlayMarket: play.google.com/store/apps/details?id=com.tiim.goforexx24

- Instagram: www.instagram.com/goforex

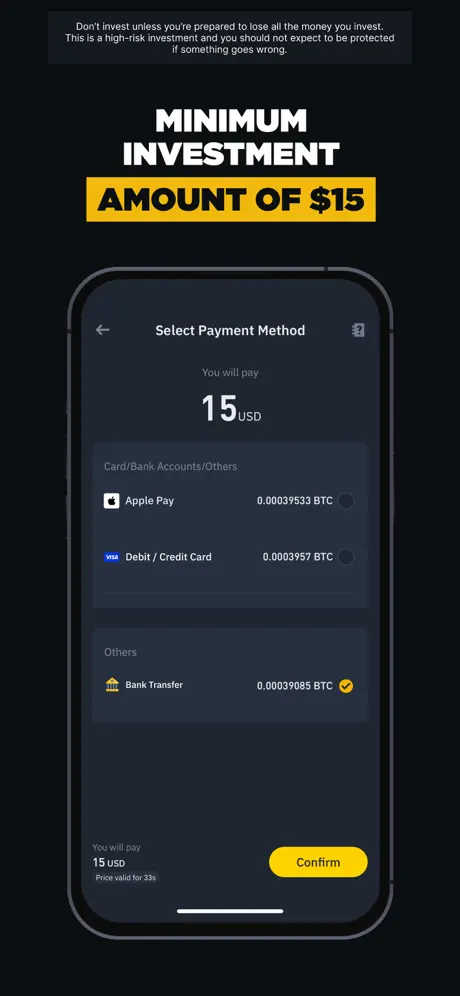

4. Pocket Broker

Pocket Broker is a trading app designed to provide access to over 100 financial instruments and a simulated learning experience. It includes chart analysis tools, educational materials, and virtual practice accounts. The app interface supports task-based learning and achievement tracking. Users can explore different asset classes and trade on price movements without owning the assets themselves. It also offers localized language support and claims availability in multiple regions.

The app features a demo account that can be replenished, technical chart tools, and customer support. Users can choose from a variety of payment options to fund accounts when switching to real trading mode. There are no deposit or withdrawal fees stated, and the platform displays market movements through live charts. Security practices include encrypted data transfers, with the option for users to request data deletion. Some user reviews report delays in fund processing and concerns about account handling, while others mention ease of initial use and accessibility.

Key Highlights:

- More than 100 financial instruments available for trading

- Charting tools for market analysis

- Educational content and trading simulator

- Gamified task system with achievement rewards

- Demo account with virtual funds and one-click top-up

- No stated deposit or withdrawal fees

- Supports over 50 payment methods

- Full platform localization in 24 languages

- 24/7 customer support

Who it’s best for:

- Users exploring simulated trading without initial risk

- Beginners looking for in-app educational tools

- Individuals who prefer localized app interfaces

- Traders interested in trying various asset types

- People who want to test platform features before funding an account

Contact Information

- Website: pocket-broker.com

- PlayMarket: play.google.com/store/apps/details?id=com.potradeweb

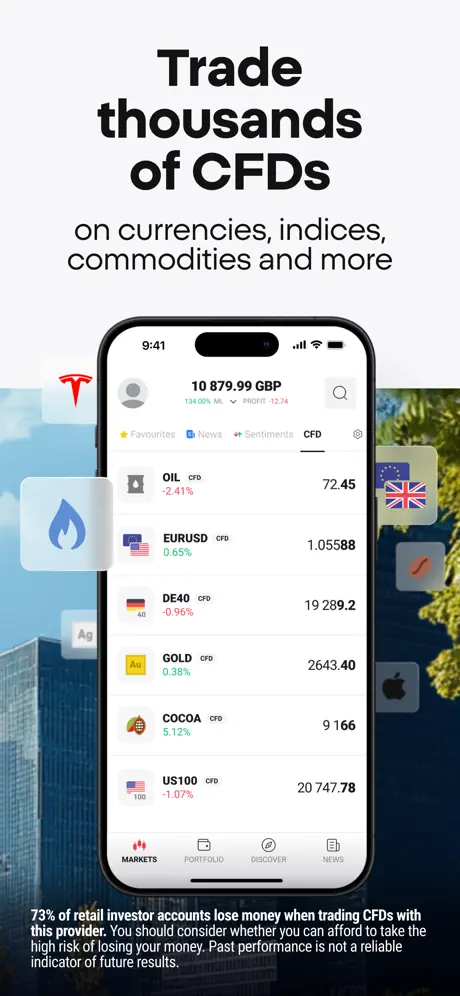

5. Trading 212

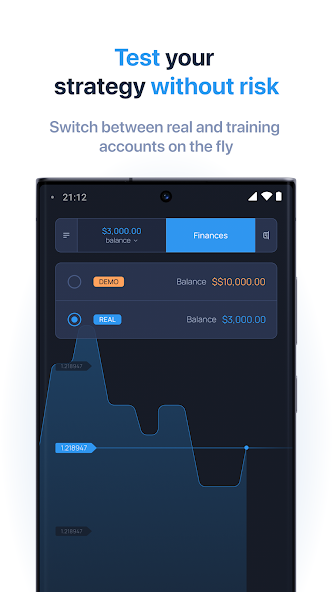

Trading 212 is an investing and trading app that provides access to stocks, ETFs, forex, indices, commodities, and other financial instruments. It operates under multiple regulatory bodies and offers both Invest and CFD accounts. Users can trade over 13,000 real stocks and ETFs across various markets, or access CFD trading for leveraged positions. A free practice account is available for those who want to try out features before switching to real funds.

The app includes features like fractional shares, auto-investment, extended trading hours for fractional shares, and a multi-currency account. Users earn daily interest on uninvested cash balances in different currencies. Trading is commission-free, although a currency exchange fee applies when dealing in non-account currencies. Data encryption and data deletion options are listed among its privacy measures, and some user data may be shared with third parties.

Key Highlights:

- Access to 13,000+ stocks and ETFs from multiple global markets

- CFD trading on stocks, forex, indices, and commodities

- Free demo account with virtual funds

- Fractional shares and automatic investing tools

- Daily interest on uninvested funds in 13 supported currencies

- No commission on stock trading

- Currency exchange fee of 0.15% for trades in other currencies

- Extended trading hours for fractional shares

- Portfolio transfer support to and from other brokers

- Community section to observe other users’ activity

- Regulated in the UK, Cyprus, Australia, and Bulgaria

Who it’s best for:

- Users seeking access to both stock investing and CFD trading

- Individuals wanting to explore fractional investing

- Traders interested in building automated portfolios

- Investors using multiple currencies for deposits and investments

- People who prefer a practice account before using real funds

- Users looking for a commission-free trading structure with basic fee transparency

Contact Information

- Website: www.trading212.com

- AppStore: apps.apple.com/us/app/trading-212/id566325832

- PlayMarket: play.google.com/store/apps/details?id=com.avuscapital.trading212

- Instagram: www.instagram.com/trading212

- Facebook: www.facebook.com/Trading212

- Twitter: x.com/Trading212

- YouTube: www.youtube.com/user/Trading212

6. eToro: Trade. Invest. Connect.

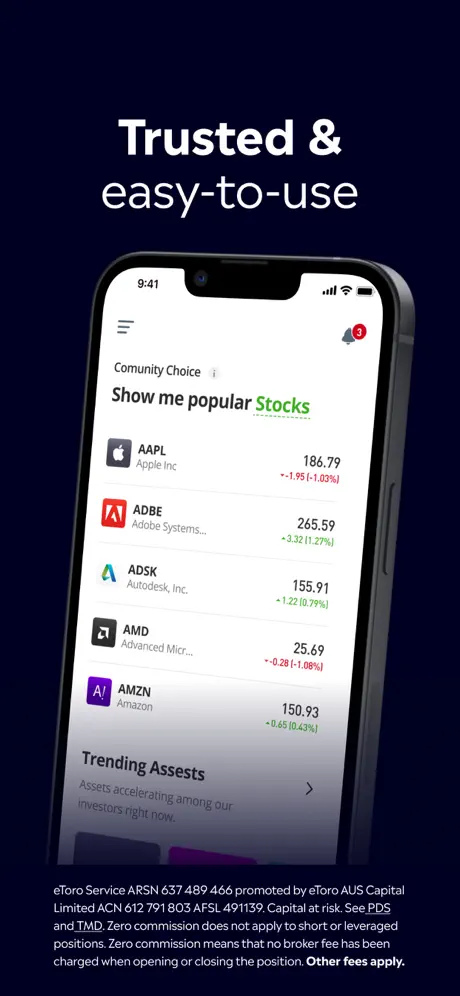

eToro is a multi-asset trading app that combines investing, social interaction, and portfolio management. Users can access stocks, cryptocurrencies, and other financial products while engaging with a community of traders through features like CopyTrader, which lets users replicate the activity of other accounts in real time. The app provides both real and virtual portfolios, with the latter funded with $100,000 in demo money for practice.

Investment options include global stocks and various cryptocurrencies. Additional features include smart portfolios, customizable watchlists, and tools for technical analysis. The platform is regulated in several jurisdictions and outlines risks associated with both regulated and non-regulated instruments. Some user reviews mention concerns with withdrawal processes and newly introduced fees per transaction.

Key Highlights:

- Access to global stocks and cryptocurrencies

- CopyTrader feature for replicating other user portfolios

- $100,000 virtual demo account for risk-free practice

- No deposit fee on crypto purchases

- Social feed and trading community interaction

- Smart portfolios with asset allocation based on predefined strategies

- Technical charting and ProCharts tools

- Alerts for volatility and watchlist customization

- Regulated by multiple financial authorities

- In-app commissions may apply to specific actions

Who it’s best for:

- Users interested in social and copy trading features

- People looking to combine stock and crypto assets in one app

- Beginners seeking to practice with virtual funds before using real money

- Traders wanting to view market sentiment through a social community

- Investors looking for a variety of regulated and unregulated instruments in one place

Contact Information

- Website: www.etoro.com

- AppStore: apps.apple.com/us/app/etoro-trade-invest/id674984916

- PlayMarket: play.google.com/store/apps/details?id=com.etoro.openbook

- Instagram: www.instagram.com/etoro_official

- Facebook: www.facebook.com/eToro

- Twitter: twitter.com/eToro

- Linkedin: www.linkedin.com/company/etoro

- YouTube: www.youtube.com/etoro

7. Olymptrade – Online Trading

Olymptrade is a trading app offering access to over 250 financial instruments, including indices, metals, commodities, and ETFs. The app features a user-friendly interface and provides a demo account funded with 10,000 units of virtual currency. Users can open real trades from as little as $1 or the equivalent in their local currency after depositing a minimum of $10. Educational resources, such as webinars and trading strategies, are also part of the platform’s offering.

The app includes over 30 technical indicators and supports mobile-based trading with built-in market analytics. Traders can access content in multiple languages and use security features like two-factor authentication and biometric login. Support is available 24/7 in the user’s language. User funds are reportedly insured up to €20,000 in cases where service disputes arise. The app is operated by a registered financial dealer based in Vanuatu.

Key Highlights:

- Access to 250+ financial instruments across multiple asset types

- Demo account with 10,000 units of virtual currency

- Minimum trade size of $1 and deposit from $10

- Educational content, including webinars and strategy guides

- 30+ technical indicators available

- In-app analytics and personal trade tracking

- Support available 24/7 in multiple languages

- Two-factor authentication and biometric login

- Insurance coverage for disputes up to €20,000

- Licensed operator based in Vanuatu

Who it’s best for:

- Users looking to start with small trade sizes

- Beginners interested in risk-free practice accounts

- Traders who rely on mobile access and multi-language support

- Individuals who value on-demand educational materials

- People seeking round-the-clock customer support within a trading app

Contact Information

- Website: olymptrade.com

- AppStore: apps.apple.com/ke/app/olymptrade-flex-trades/id6476768808

- PlayMarket: play.google.com/store/apps/details?id=com.ticno.olymptrade

- Instagram: www.instagram.com/olympglobal

- Facebook: www.facebook.com/olymptradecom

- YouTube: www.youtube.com/c/OLYMPTRADEGlobal

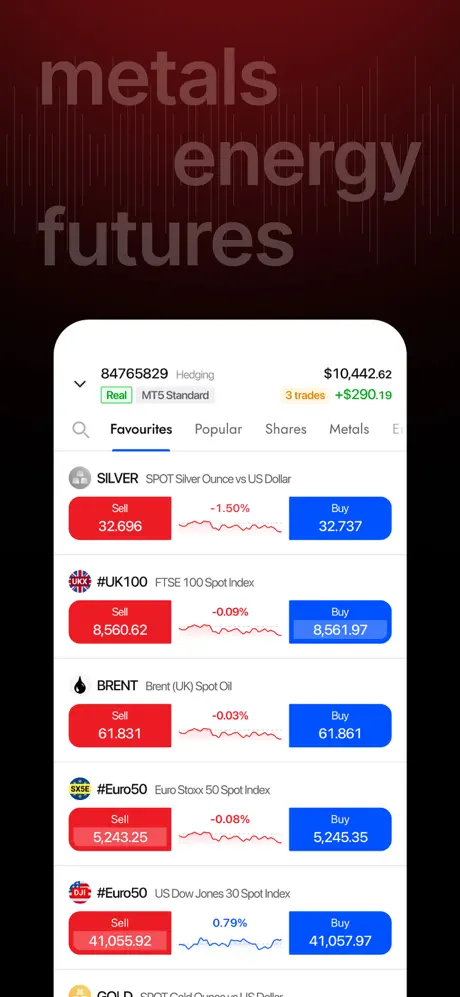

8. Vantage: All-In-One Trading App

Vantage is a trading platform that offers access to more than 1,000 CFD instruments, including forex, stocks, indices, metals, and commodities. The app features a mobile-friendly interface with integrated tools for technical analysis, personalized watchlists, and a $100,000 demo account for users who want to test features without using real funds. Traders can switch between demo and real accounts, manage trades, or explore strategies used by other investors.

Users can trade with low spreads and zero commission on U.S. assets, and the app supports multiple currencies and payment methods for account funding. Vantage also includes in-app offers, access to market signals, and portfolio tracking. It is operated by a licensed provider in Vanuatu and discloses the risks associated with CFD trading, including the potential for losses beyond initial capital.

Key Highlights:

- Over 1,000 CFD instruments across major asset classes

- Demo account preloaded with $100,000 in virtual funds

- Forex, stocks, commodities, indices, and metals trading

- Copy-trading functionality and access to strategies

- Low spreads and zero commission on selected assets

- In-app promotions and monthly offers

- Charting tools and market alert features

- Multi-currency account options and payment support

- Regulated by the Vanuatu Financial Services Commission

Who it’s best for:

- Traders interested in CFDs across a wide range of assets

- Users looking to start with a risk-free demo account

- Investors exploring copy-trading features

- People trading with smaller spreads and no commission on U.S. assets

- Individuals needing multi-account and multi-currency support on mobile

Contact Information

- Website: www.vantagemarkets.com

- Registered address: 12/15 Castlereagh Street, Sydney, NSW, Australia, 2000.

- AppStore: apps.apple.com/au/app/vantage-all-in-one-trading-app/id1457929724

- PlayMarket: play.google.com/store/apps/details?id=cn.com.vau

- Instagram: www.instagram.com/vantagemarkets

- Twitter: twitter.com/vantagemkts

- Linkedin: www.linkedin.com/company/vantagemarkets

- Facebook: www.facebook.com/vantagemarkets.glb

- Tiktok: www.tiktok.com/@vantagemarkets_global

- YouTube: www.youtube.com/vantagemarkets

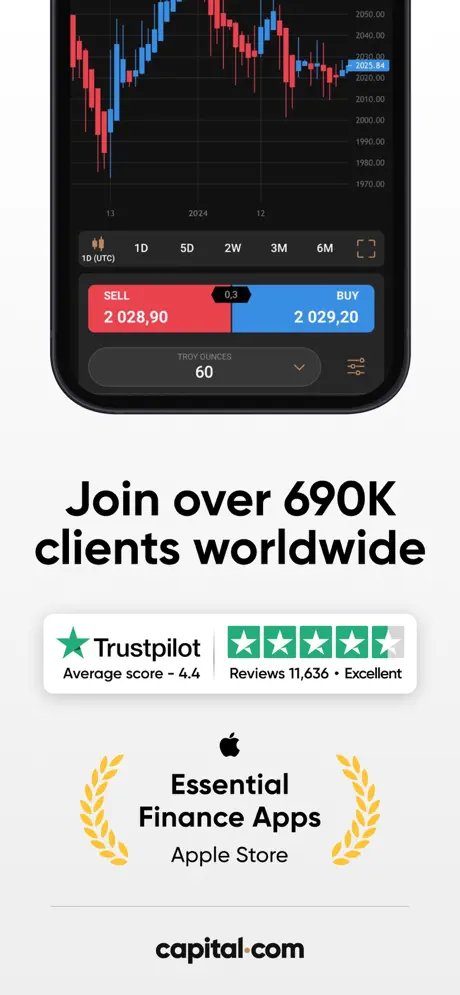

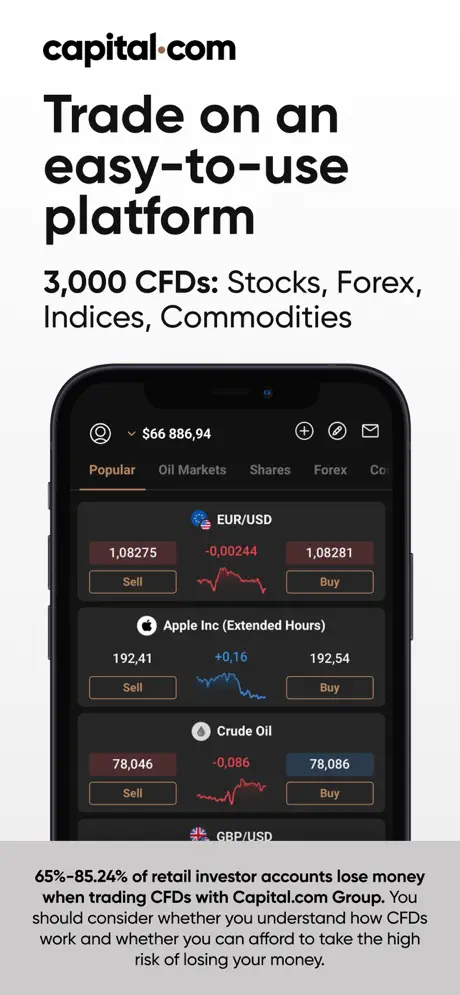

9. Capital

Capital is a trading app offering access to over 3,000 markets, including forex, indices, stocks, commodities, and crypto CFDs. The platform provides real-time pricing, multiple chart types, and technical analysis tools. Users can practice on a demo account with up to $100,000 in virtual funds before using a real account. Deposits and withdrawals are processed with no fees, and customer support is available 24/7 in multiple languages.

The app features risk management tools such as stop-loss and take-profit, along with integration options for MetaTrader 4 and TradingView. Capital operates under several financial regulatory authorities across multiple jurisdictions. Users can access educational content through built-in guides and courses. The platform supports popular payment methods, and client funds are held in segregated accounts.

Key Highlights:

- 3,000+ markets including forex, stocks, indices, commodities, and crypto CFDs

- Real-time pricing and 70+ technical indicators

- Demo account with up to $100,000 in virtual funds

- Multiple chart formats including candlesticks, bars, and Heikin-Ashi

- Integrated with MT4 and TradingView

- 24/7 multilingual customer support

- Commission-free deposits and withdrawals

- Educational content and market news feed

- Regulated in the UK, Cyprus, Australia, and the Bahamas

- Client funds held in segregated accounts

Who it’s best for:

- Beginners looking for a practice environment before trading real funds

- Traders who use MT4 or TradingView alongside mobile apps

- Users seeking CFD exposure to multiple asset classes

- Individuals who want built-in learning tools and trading guides

- People looking for commission-free funding options and multilingual support

Contact Information

- Website: www.vantagemarkets.com

- Phone: +44 203 769 7865

- Email: support@capital.com

- AppStore: apps.apple.com/ie/app/capital-com-trading-finance/id1230088754

- PlayMarket: play.google.com/store/apps/details?id=com.capital.trading

- Twitter: x.com/capitalcom

- Linkedin: www.linkedin.com/company/capital.com

- Facebook: www.facebook.com/capitalcom

- Tiktok: www.tiktok.com/@capitalcom_international

10. FBS – Trading Broker

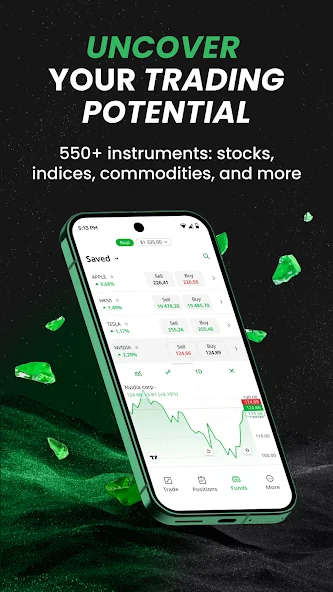

FBS is a trading app offering access to over 550 instruments, including forex pairs, commodities, metals, indices, and stocks. The platform supports real-time trading, portfolio tracking, and order customization through a mobile interface. Users can manage risk settings, monitor open trades, and set alerts for market changes. A demo account is available for those who want to test strategies without using real funds.

The app provides over 90 chart indicators and multiple tools for technical analysis. Deposits and withdrawals are supported through more than 200 payment methods. Trading conditions are displayed before orders are placed, and users receive notifications on price changes. FBS is operated by a regulated entity and offers customer support in multiple languages on a 24/7 basis.

Key Highlights:

- Access to 550+ trading instruments including gold, oil, and major stock indexes

- Real-time portfolio tracking and market chart monitoring

- Over 90 technical indicators for strategy planning

- Risk management tools with adjustable order settings

- Demo account available for testing strategies

- Notifications for price movements and trading updates

- 200+ supported payment methods for deposits and withdrawals

- No stated hidden fees on trading execution

- Regulated by FSC in Belize

- 24/7 multilingual customer support

Who it’s best for:

- Traders looking to explore a wide range of asset classes

- Users interested in testing trades without financial risk

- Individuals who rely on technical analysis and charting tools

- People who need flexible deposit and withdrawal options

- Beginners and experienced traders seeking in-app market alerts and portfolio tools

Contact Information

- Website: fbs.com

- PlayMarket: play.google.com/store/apps/details?id=com.fbs.pa

- Instagram: www.instagram.com/fbs_forex

- Facebook: www.facebook.com/financefreedomsuccess

- YouTube: www.youtube.com/@FBSAnalytics

11. AvaTrade: Trading App

AvaTrade is a mobile trading platform that provides access to a range of CFD products including forex, stocks, indices, commodities, ETFs, and options. Users can monitor markets in real time, apply technical indicators, and use a demo account to test their trading strategies without using real funds. The app supports multiple languages and offers commission-free deposits and withdrawals, depending on the method used.

Features include access to trend data, live signals, customizable charts, and integrated risk management tools. Users can also access AvaProtect, a feature that limits losses on selected trades for a set fee. The app operates under regulation and includes standard data protection practices such as encryption and account-level security settings. Users report varying experiences with execution speed, withdrawal times, and interface responsiveness.

Key Highlights:

- Access to forex, stocks, indices, commodities, ETFs, and options

- Up to 30:1 leverage on major forex pairs

- $100,000 demo account for practice

- Technical analysis tools and trend tracking in real time

- AvaProtect trade protection feature (fee-based)

- No deposit or withdrawal fees listed for supported payment method

- Multilingual customer support via phone, chat, and email

- Regulated trading provider with global operations

Who it’s best for:

- Users interested in trading a broad range of CFD instruments

- Beginners testing strategies through a demo account

- Traders looking for built-in trade protection tools

- Individuals managing trades via mobile with live alerts

- People using both short-term and longer-term trading strategies on one platform

Contact Information

- Website: fbs.com

- AppStore: apps.apple.com/GB/app/id1247935193

- PlayMarket: play.google.com/store/apps/details?id=com.avatrade.mobile

- Facebook: www.facebook.com/AvaTradeOfficial

- Linkedin: www.linkedin.com/company/avatrade

- Twitter: x.com/AvaTrade

- YouTube: www.youtube.com/user/AvaTradeTV

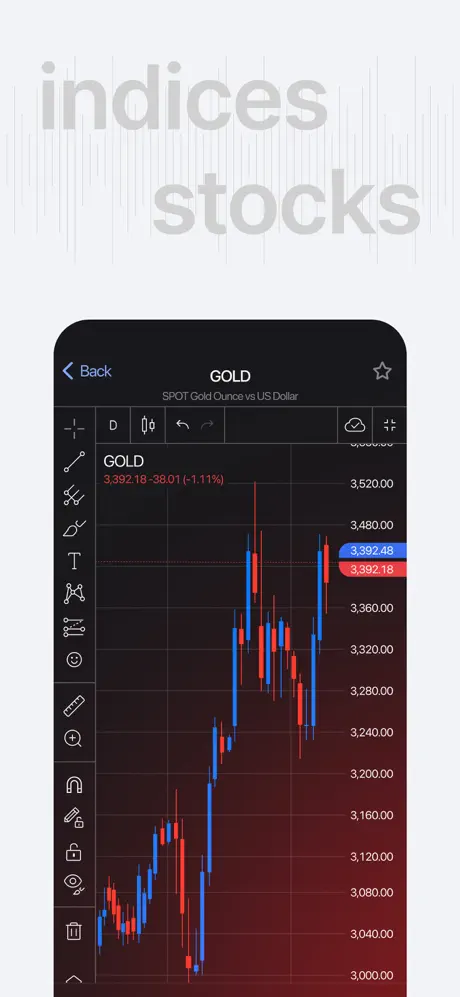

12. FxPro: Online Trading Broker

FxPro is a trading app that brings together account management and live trading for users interested in CFDs across multiple asset classes. The platform supports over 2,100 instruments, including metals, indices, stocks, futures, and energy products. Users can access full-screen TradingView charts, set up one-tap orders, and use built-in technical tools to follow market movements.

The app offers a demo account, economic calendar, market alerts, and support for multiple trading platforms including MT4 and MT5. Traders can manage risk using the integrated wallet system and fund their accounts without commissions. Some users report delays in account processes or limitations on non-trading fund withdrawals, and responses to such issues vary based on individual cases.

Key Highlights:

- Access to 2,100+ CFD instruments including stocks, metals, and futures

- Supports MT4 and MT5 accounts within one app

- Full-screen TradingView charts with technical indicators

- Demo trading environment for practice

- FxPro Wallet for fund management and risk separation

- Push notifications for significant price movements

- Economic calendar with alerts

- Commission-free deposits and multiple funding options

- 24/5 customer support via in-app chat

Who it’s best for:

- Users who want to trade across a wide range of global markets

- Individuals who rely on technical charts and market indicators

- Traders familiar with MT4 or MT5 environments

- People seeking integrated account and risk management tools

- Users looking for flexible funding options and live market updates

Contact Information

- Website: www.fxpro.com

- Address: FxPro UK Ltd: 13/14 Basinghall Street, City of London, EC2V 5BQ, UK

- Phone: +44 (0) 203 151 5550

- AppStore: apps.apple.com/us/app/fxpro-online-trading/id1388838533

- PlayMarket: play.google.com/store/apps/details?id=com.fxpro.direct.app

- Facebook: www.facebook.com/FxProGlobal

- Linkedin: www.linkedin.com/company/fxpro

- Twitter: x.com/FxProGlobal

- YouTube: www.youtube.com/user/FxProMarketing

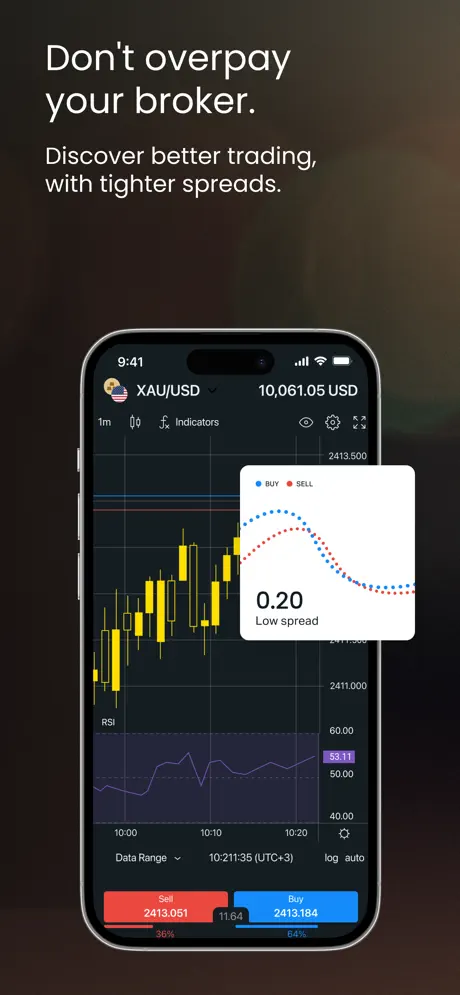

13. Exness Trade: Online Trading

Exness Trade is a mobile trading platform designed for managing accounts and accessing global financial markets from a smartphone. Users can trade a range of instruments such as stocks, gold, oil, and indices, open new accounts directly in the app, and monitor trading activity in real time. The platform provides tools like watchlists, charting features, and price alerts, and supports both live and demo accounts.

The app includes market analysis and news, risk control tools, and account notifications. Customer support is available 24/7 through the app. Exness Global Limited operates this platform and offers features like account switching, payment processing, and trading condition controls. The service is structured around CFD trading, and users are cautioned about the associated financial risks.

Key Highlights:

- Trading access to stocks, commodities, indices, and metals

- Option to create unlimited real and demo accounts

- Price alerts and trading notifications in-app

- Integrated chart analysis tools

- Watchlist functionality for asset tracking

- Real-time trade history and account activity

- In-app market analysis and news

- 24/7 customer support

- Risk management features built into the platform

Who it’s best for:

- Users interested in trading multiple asset classes from a mobile device

- Traders who need quick account setup and switching

- Individuals using demo accounts to test strategies

- People who prefer receiving trading alerts and market updates

- Those looking for in-app customer support and trading news sources

Contact Information

- Website: www.exness.com

- AppStore: apps.apple.com/kz/app/exness-trade-online-trading/id1359763701

- PlayMarket: play.google.com/store/apps/details?id=com.exness.android.pa

14. ExpertOption – Online Trading

ExpertOption offers access to short-term trading on over 100 financial instruments, including stocks, indices, gold, and oil. The app includes both real and demo accounts, giving users the choice to practice with virtual funds before making live trades. The platform supports multiple chart types, technical indicators, and a range of timeframes for market analysis. Account types include different tiers such as Basic, Silver, Gold, and Platinum, each with distinct conditions.

Traders can open and execute trades quickly within the app, with execution happening in real time. Withdrawals are processed through bank cards and several digital wallets. Support is available 24/7 through chat, email, and other channels. The app operates in a high-risk environment where losses can exceed initial deposits, and users are encouraged to understand the risk involved before participating.

Key Highlights:

- Access to 100+ instruments including stocks, indices, oil, and gold

- Demo account with virtual funds

- Real-time trade execution and pricing

- Multiple chart types and technical indicators

- Account tier system with different conditions

- 24/7 customer support via chat, email, and phone

- No data collected or shared with third parties according to current disclosures

Who it’s best for:

- Users interested in short-term speculative trading

- People who want to practice on a demo account before live trading

- Traders looking for chart-based tools and basic technical analysis

- Individuals who use digital wallets for deposits and withdrawals

- Users who prefer platforms with round-the-clock support availability

Contact Information

- Website: expertoption.com

- PlayMarket: play.google.com/store/apps/details?id=com.expertoption.twa

- Facebook: www.facebook.com/expertoption

- YouTube: www.youtube.com/expertoption

15. Binance: BTC and More

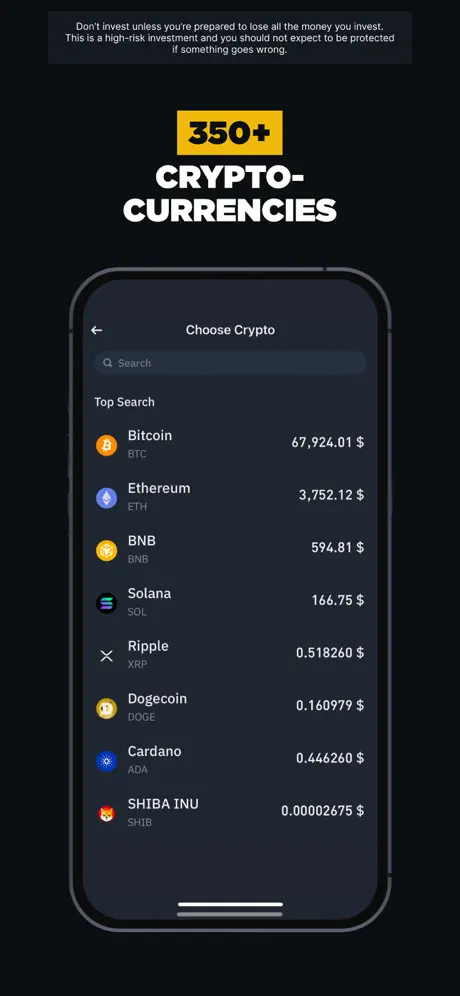

Binance is a digital asset platform where users can buy, trade, and manage cryptocurrencies through one app. The service provides access to up to 350 crypto assets including Bitcoin, Ethereum, and Cardano, with various funding options such as bank cards, transfers, and peer-to-peer (P2P) methods. Traders can set automated buy orders on a schedule, receive price alerts, and track market performance through charting tools. The app also offers Web3 wallet access, market education content, and integration with decentralized applications.

Users can open accounts, explore trading features, and move funds directly within the app. Binance supports transfers between users, shopping with crypto, and a range of services related to blockchain and DeFi. The app includes options to follow other traders, track activity in real time, and engage with a support team available in multiple languages. It includes Know Your Customer (KYC) verification and real-time monitoring systems, and stores user funds in a 1:1 reserve model backed by a user protection fund.

Key Highlights:

- Access to up to 350 cryptocurrencies for trading

- Funding options include bank cards, bank transfers, and P2P

- Support for scheduled purchases (DCA), price alerts, and live charts

- Built-in Web3 wallet with access to 10,000+ tokens

- Educational resources, quizzes, and blockchain content

- Copy-trading features and user communities

- 24/7 customer support in 18 languages

- KYC verification and encrypted data handling

- Supports crypto transfers and spending through select retailers

Who it’s best for:

- People actively trading a wide range of crypto tokens

- Users looking for multi-chain wallet access and DeFi tools

- Those interested in auto-investing features and recurring purchases

- Beginners wanting tutorials and interactive crypto education

- Traders who follow market influencers or copy strategies

- Individuals needing flexible funding and withdrawal options across regions

Contact Information

- Website: www.binance.com

- AppStore: apps.apple.com/sg/app/binance-buy-bitcoin-crypto/id1436799971

- PlayMarket: play.google.com/store/apps/details?id=com.binance.dev

- Tiktok: www.tiktok.com/@binance

- Facebook: www.facebook.com/binance

- YouTube: www.youtube.com/binanceyoutube

- Twitter: x.com/binance

16. XTB Online Investing

XTB Online Investing gives users access to over 3,600 stocks and ETFs from 16 global exchanges, including NASDAQ and the London Stock Exchange. The app includes technical tools, market data, and the option to practice using a demo account funded with virtual currency. Users can track global sentiment, view their trade exposure, and use built-in calculators to assess risk. It also provides integrated charts, alerts, and news coverage for ongoing market events.

The app supports various payment services such as cards, PayPal, and e-wallets for deposits and withdrawals. Investors can customize the interface, check economic calendars, and use educational courses available within the platform. The app is part of the broader XTB Group, which operates internationally and offers client support through in-app chat during market hours.

Key Highlights:

- Access to 3,600+ global stocks and ETFs

- Technical indicators, advanced charts, and drawing tools

- Integrated trading calculator for margin and risk assessment

- Real-time alerts for custom price levels

- Economic calendar and daily market analysis

- Multiple funding methods including Visa, Mastercard, PayPal, Skrill

- Free demo account with $100,000 in virtual funds

- Video courses and structured learning paths in the Investment Academy

- Switchable dark and light modes, customizable interface

Who it’s best for:

- Traders interested in equities and ETFs across international markets

- Beginners who want a demo account and structured educational content

- Users looking for tools like calculators, alerts, and technical analysis

- Those who need built-in charting, sentiment tracking, and real-time data

- Investors who prefer flexible funding and withdrawal options through the app

Contact Information

- Website: www.xtb.com

- AppStore: apps.apple.com/cz/app/xtb-online-investing/id949905889

- PlayMarket: play.google.com/store/apps/details?id=com.xtb.xmobile2

17. XM – Trading & Investment

XM – Trading & Investment is a trading platform offering access to over 1,300 financial instruments, including global stocks, indices, and themed portfolios. Users can open a demo account to test strategies or join copy trading by selecting from thousands of shared strategies. The app also includes daily analysis, live webinars, and market updates to help users stay informed. Features like stop-loss, take-profit, and detailed charting tools are available across real and demo accounts.

The app supports multilingual customer service, free deposits and withdrawals (with exceptions on low-value wire transfers), and competition-based events with prize pools. Users can access trading education content and take part in real-time contests using either live or demo funds. Additional services like VPS hosting and alerts for technical setups are integrated into the platform.

Key Highlights:

- Trade 1,300+ instruments including stocks, indices, and sector-based portfolios

- Copy trading with access to over 4,000 public strategies

- Free lifetime demo account for risk-free practice

- Daily signals, market analysis, and economic news

- No commissions on most account types

- Real-time execution without requotes

- Trading competitions with prize payouts

- Support in over 30 languages via chat, phone, and email

Who it’s best for:

- Users interested in global stock and index trading

- Beginners wanting to explore copy trading or demo practice

- Traders looking for education through webinars and live sessions

- Users who want to compete in trading contests

- Those who need multi-language support and clear pricing conditions

Contact Information

- Website:www.xm.com

- AppStore: apps.apple.com/uy/app/xm-trading-point/id1072084799

- PlayMarket: play.google.com/store/apps/details?id=com.xm.webapp

- Tiktok: www.tiktok.com/@xm_com

- Linkedin: www.linkedin.com/company/xm-global

- Facebook: www.facebook.com/xmglobal

- YouTube: www.youtube.com/user/xmglobal

- Twitter: x.com/XM_COM

Conclusion

Choosing the best trading app for beginners often comes down to ease of use, educational resources, and access to basic trading tools without overwhelming features. Each app in this list offers a slightly different experience, whether it’s a clean interface, a demo account to practice on, or step-by-step guidance for building confidence in the market. For someone just starting out, these small differences can help shape their learning curve and trading habits.

Ultimately, beginners should look for an app that matches their comfort level and provides room to grow. Whether the priority is low fees, risk management tools, or simply a space to learn without pressure, there are solid options available. Getting started with trading doesn’t have to be complicated, what matters most is having the right tools and support at hand.

Leave a Reply

You must be logged in to post a comment.