Saving money doesn’t have to feel like a chore. With the right apps, you can track your spending, stash away cash, and even score deals without breaking a sweat. Whether you’re trying to build an emergency fund, cut down on bills, or just make your paycheck stretch further, these money-saving apps can help. They’re designed for real people with busy lives, offering simple tools to manage your finances in a way that fits your routine. Let’s dive into the apps that can help you keep more money in your pocket.

Saving money often starts with small, everyday choices – like what you spend on groceries. That’s where our app ReciMe comes in handy. ReciMe is a recipe organizer that lets you save recipes from social media, plan meals, and create grocery lists sorted by supermarket aisles. By planning your meals with our app, you can avoid impulse buys and food waste, which adds up to real savings. Trusted by over 5 million users, ReciMe makes it easy to stick to a budget while enjoying home-cooked meals. It’s a practical way to tie your financial goals to your kitchen routine.

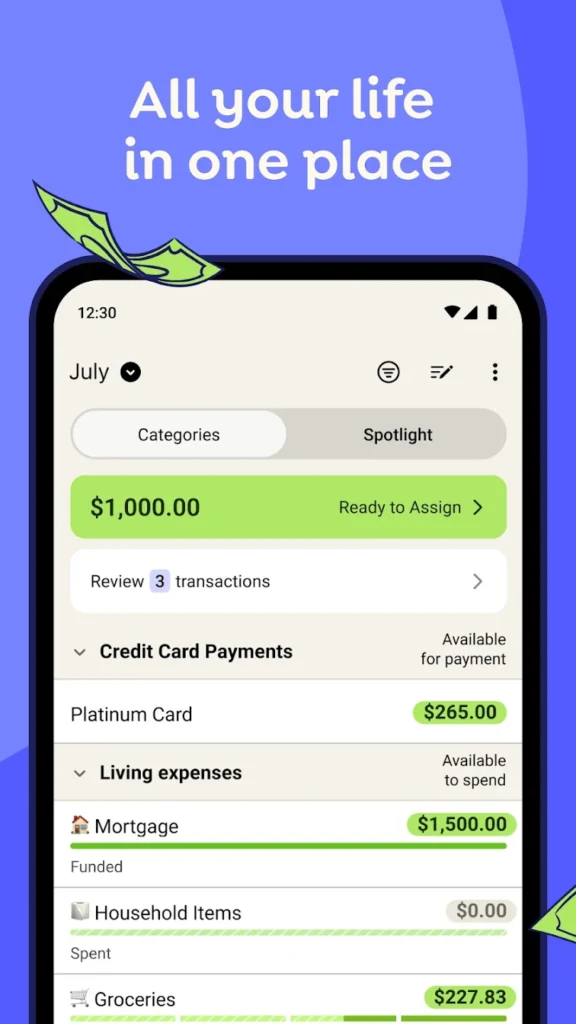

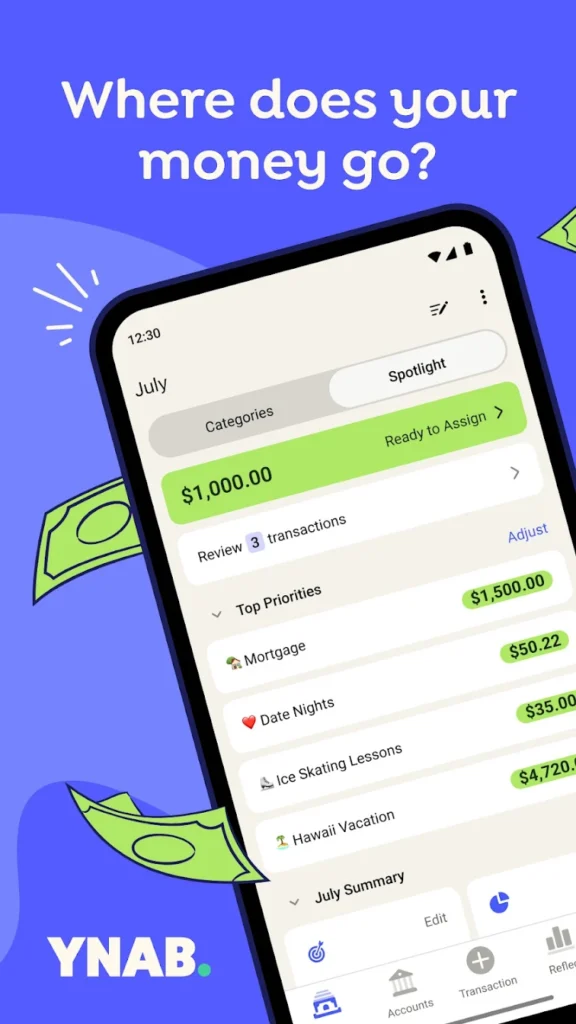

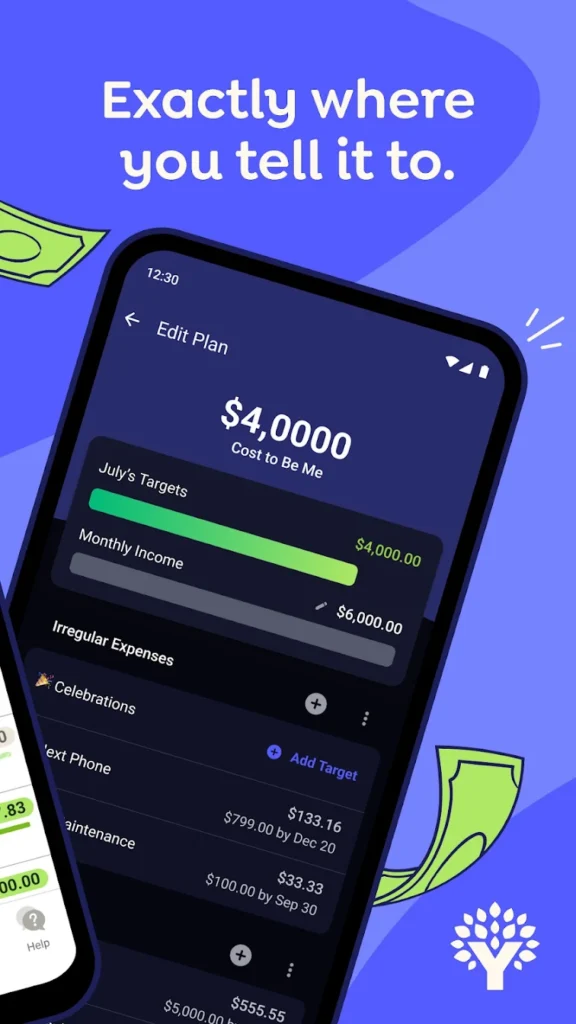

1. YNAB (You Need A Budget)

This app helps users manage their money through a budgeting system where every dollar is assigned a specific purpose. It connects to bank accounts to track transactions and allows users to set financial goals. The app also provides tools for monitoring spending patterns and planning for future expenses.

Users can create budgets, categorize expenses, and view reports to understand their financial habits. It supports multiple devices, enabling shared budgeting for households. The app includes educational resources like tutorials to help users improve their budgeting skills.

The interface focuses on manual control, encouraging users to actively engage with their finances. It offers features for tracking net worth and managing debt. The app requires a subscription for full access to its features.

Key highlights:

- Assigns every dollar a purpose for budgeting

- Connects to bank accounts for transaction tracking

- Supports goal setting and spending reports

- Allows shared budgeting across devices

- Includes educational resources for budgeting

Contact Information:

- App store: apps.apple.com/us/app/ynab

- Google Play: play.google.com/store/apps

- Website: app.ynab.com

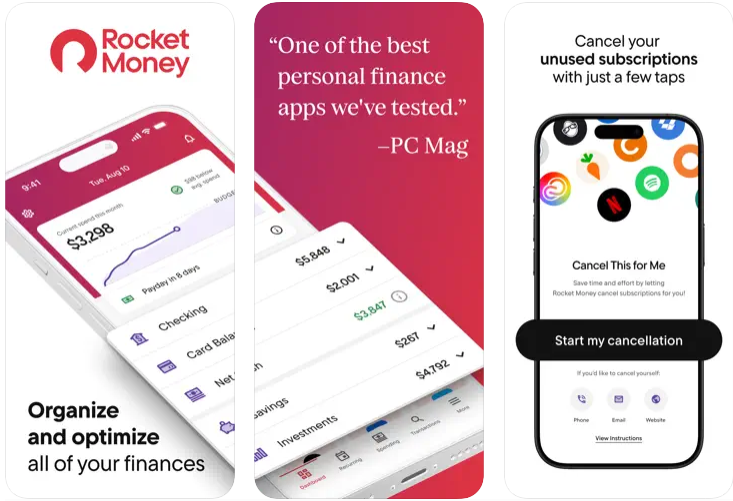

2. Rocket Money

Rocket Money is a personal finance app that focuses on tracking subscriptions and managing expenses. It connects to bank accounts to monitor spending and identify recurring payments. Users can set budgets and receive alerts about their financial activity.

The app provides tools for negotiating bills and canceling unwanted subscriptions. It offers insights into spending habits and tracks net worth across various accounts. Users can also monitor their credit score through the app’s premium features.

The interface is designed for ease of use, with options for both free and paid plans. The app emphasizes automation for tasks like subscription management. It supports multiple platforms for accessibility.

Key highlights:

- Tracks and manages subscriptions

- Connects to bank accounts for spending monitoring

- Offers bill negotiation and cancellation tools

- Provides net worth and credit score tracking

- Supports free and premium plans

Contact Information:

- App store: apps.apple.com/us/app/rocket-money-bills-budgets

- Google Play: play.google.com/store/apps/details

- Website: www.rocketmoney.com

- Instagram: www.instagram.com/rocketmoney

- LinkedIn: www.linkedin.com/company/rocketmoney

- Twitter: x.com/rocketmoneyapp

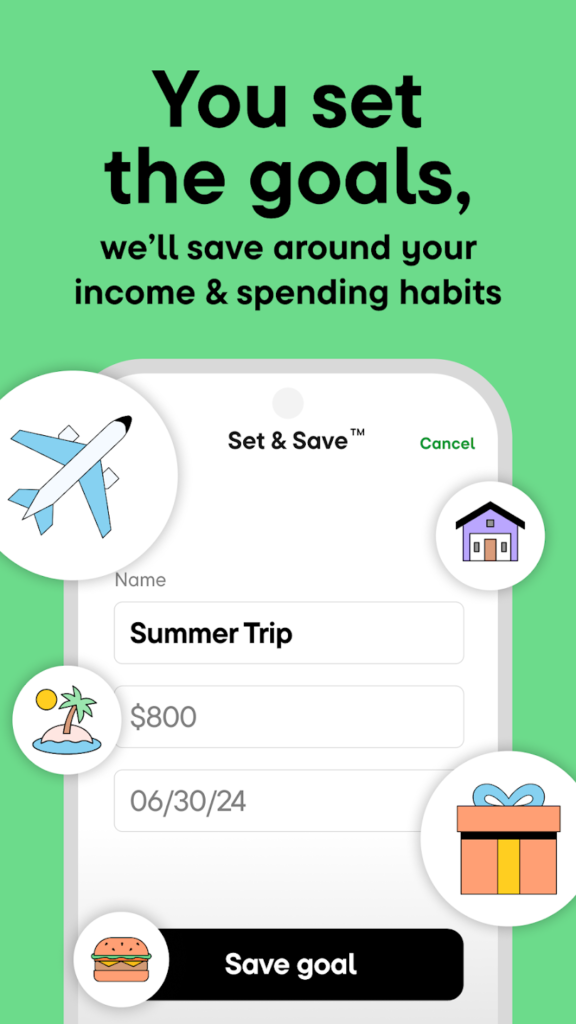

3. Qapital

Qapital is an app that automates savings through customizable rules. It connects to bank accounts to transfer small amounts to savings based on user-defined triggers, like rounding up purchases. The app also offers tools for tracking spending and setting financial goals.

Users can create visual savings goals and share them with others, such as a partner. The app includes a checking account with a debit card and options for investing saved money. It provides insights into spending patterns to help users manage their finances.

The app requires a subscription for full access and operates through partner banks for account services. It focuses on making saving engaging through visual and automated features. The interface is available on mobile devices.

Key highlights:

- Automates savings with customizable rules

- Connects to bank accounts for transfers

- Offers checking account and investment options

- Supports shared savings goals

- Provides spending insights

Contact Information:

- App store: apps.apple.com/us/app/qapital-set-forget-finances

- Google Play: play.google.com/store/apps/details

- Website: www.qapital.com

- Facebook: www.facebook.com/Qapital

- Instagram: www.instagram.com/qapital

- LinkedIn: www.linkedin.com/company/qapital

- Twitter: x.com/qapitalapp

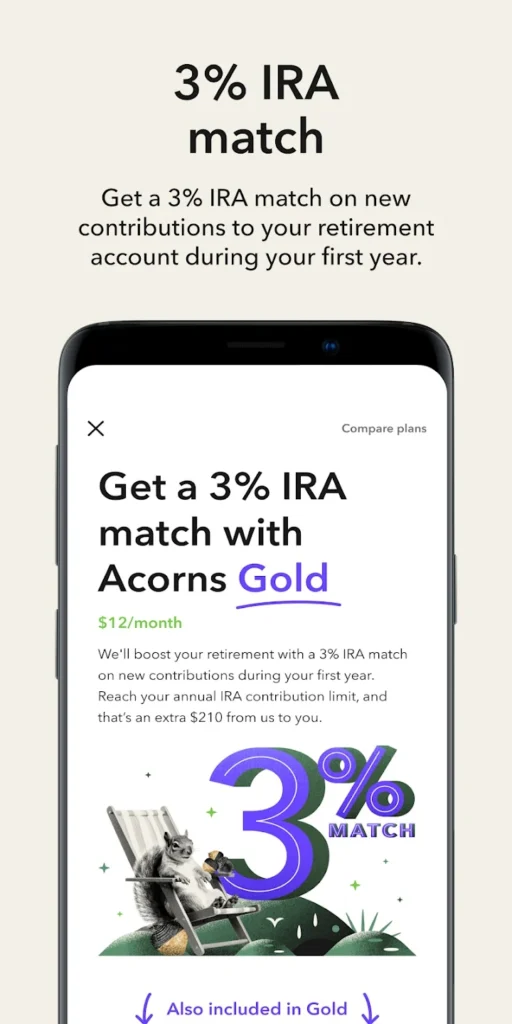

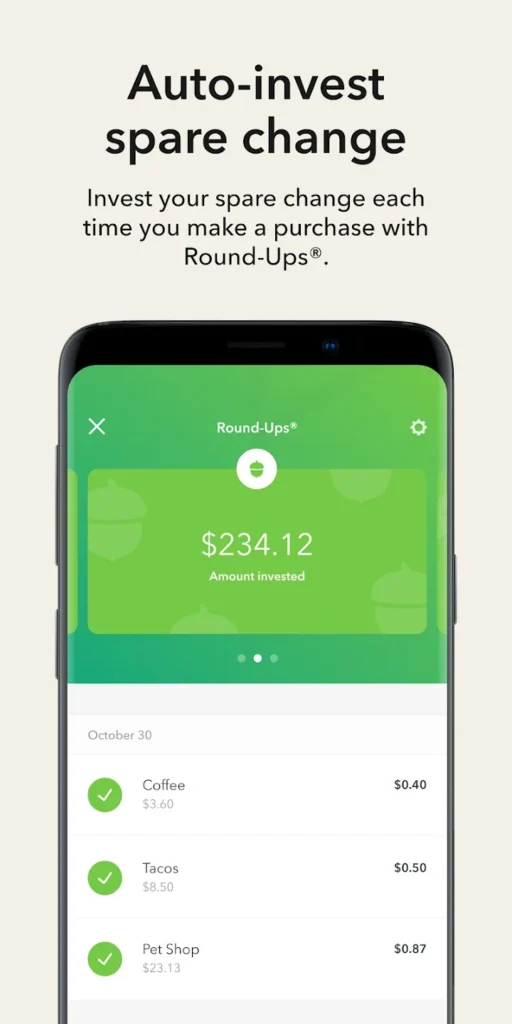

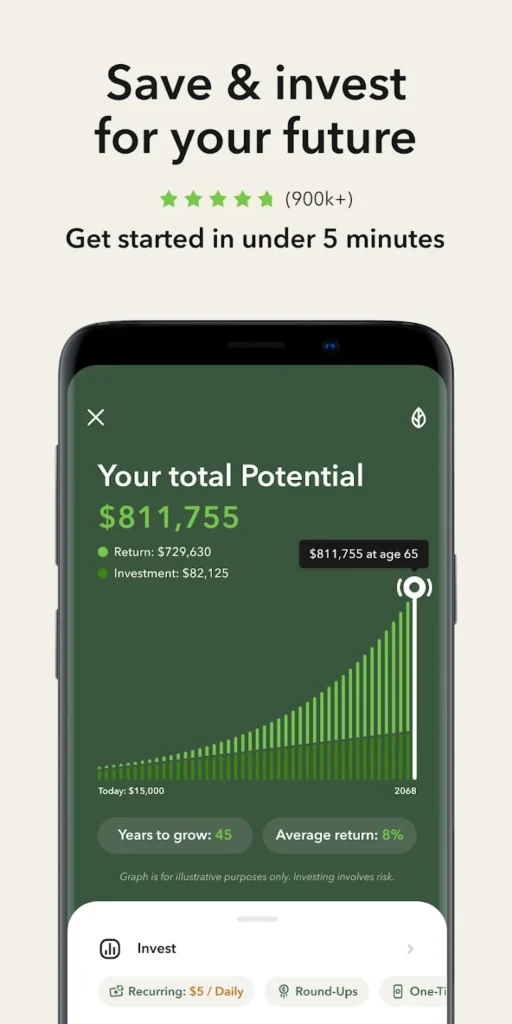

4. Acorns

Acorns is an app that focuses on investing small amounts of money. It rounds up purchases to the nearest dollar and invests the difference into a portfolio of ETFs. The app also offers a checking account with a debit card and savings features.

Users can track their investments and spending through the app’s interface. It provides options for customizing investment portfolios based on financial goals. The app includes cashback rewards when shopping with partner brands.

The app operates on a subscription model and uses partner banks for account services. It emphasizes simplicity for users new to investing. The interface is accessible on multiple platforms.

Key highlights:

- Invests spare change from rounded-up purchases

- Offers checking and savings accounts

- Provides customizable investment portfolios

- Includes cashback rewards with partners

- Supports multiple platforms

Contact Information:

- App store: apps.apple.com/us/app/acorns-invest-for-your-future

- Google Play: play.google.com/store/apps/details

- Website: www.acorns.com

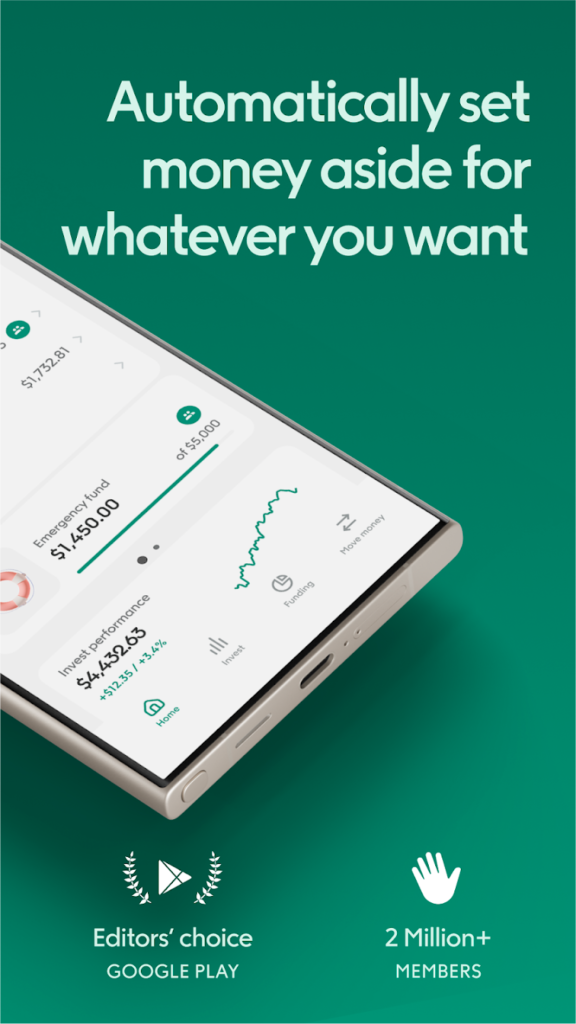

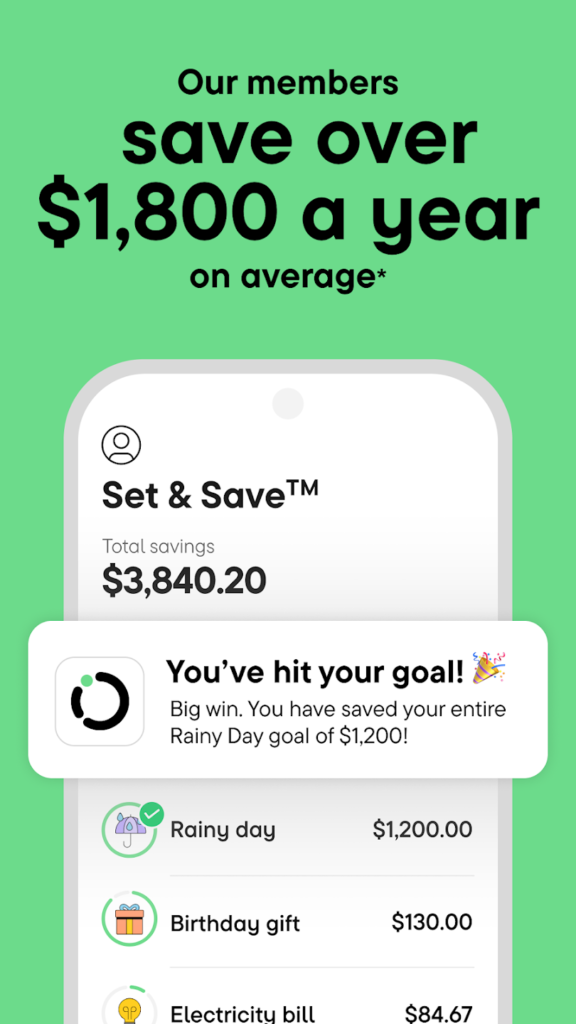

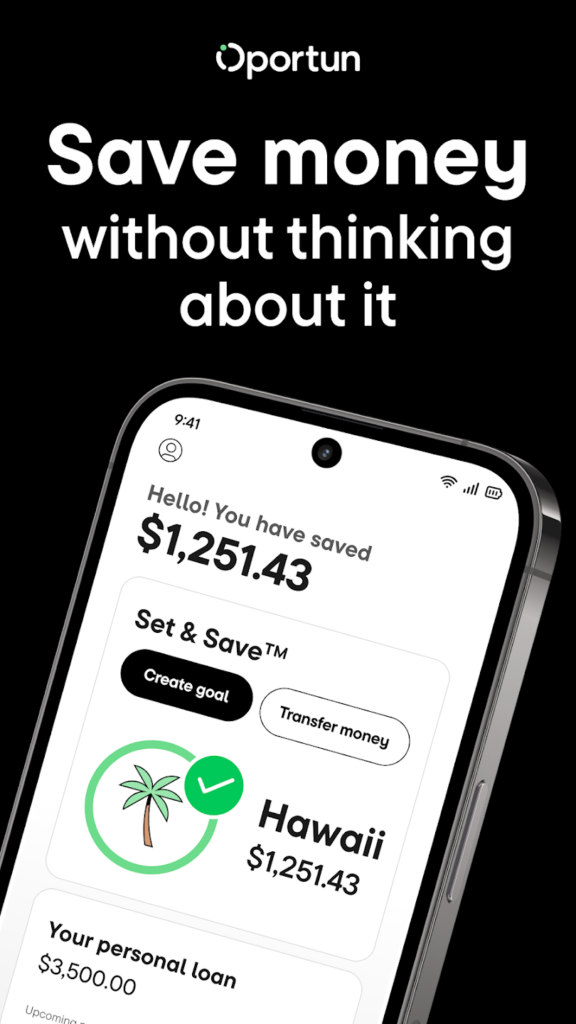

5. Oportun

Oportun is an app that automates savings and investing using AI. It analyzes spending patterns to determine affordable amounts to save and transfers them to savings or investment accounts. The app also tracks expenses and sets financial goals.

Users can manage bills by setting aside money for recurring payments. The app offers investment options tailored to user preferences. It provides insights into income and spending to help users plan their finances.

The app charges a monthly fee after a trial period and uses partner banks for account services. It focuses on hands-off saving through automation. The interface is designed for mobile use.

Key highlights:

- Automates savings and investing with AI

- Tracks expenses and sets financial goals

- Manages bills with dedicated savings

- Offers tailored investment options

- Designed for mobile access

Contact Information:

- App store: apps.apple.com/us/app/oportun-finances-made-simple

- Google Play: play.google.com/store/apps/details

- Website: digit.co

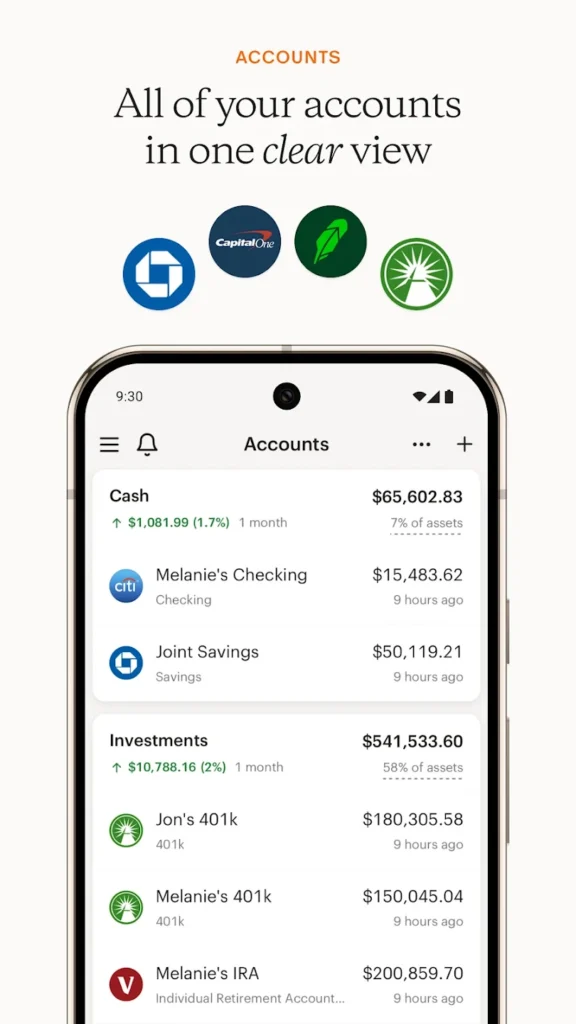

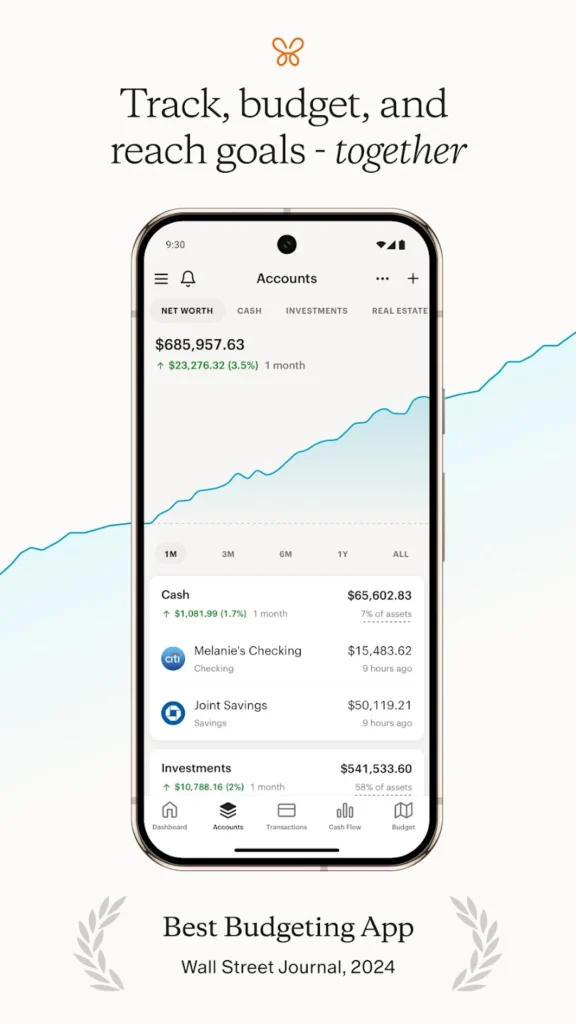

6. Monarch Money

Monarch Money is an app for tracking finances across multiple accounts. It connects to bank accounts, investments, and loans to provide a complete view of a user’s financial situation. The app allows users to create budgets and set savings goals.

The app tracks subscriptions and recurring bills for easier management. It offers tools for planning large financial goals, like retirement. Users can collaborate with others, such as family members, on shared budgets.

The app requires a subscription and is accessible on multiple devices. It emphasizes comprehensive financial tracking with customizable features. The interface focuses on clarity and ease of use.

Key highlights:

- Tracks finances across multiple accounts

- Connects to banks, investments, and loans

- Manages subscriptions and recurring bills

- Supports collaborative budgeting

- Offers tools for long-term financial planning

Contact Information:

- App store: apps.apple.com/us/app/monarch-budget-track-money

- Google Play: play.google.com/store/apps/details

- Website: www.monarchmoney.com

- Instagram: www.instagram.com/monarch_money

- LinkedIn: www.linkedin.com/company/monarch-money

- Twitter: x.com/monarch_money

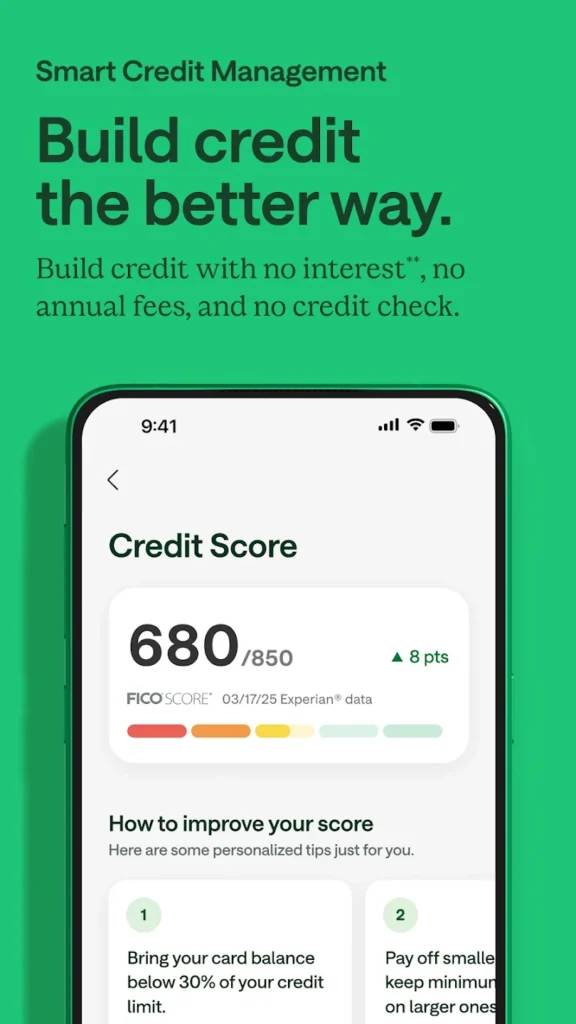

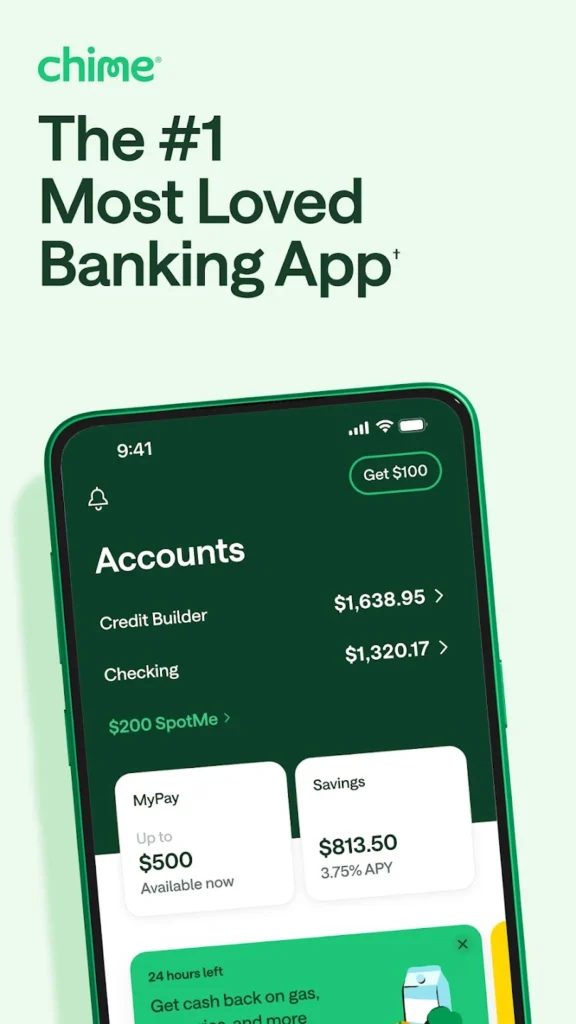

7. Chime

Chime is a digital banking app with features for saving money. It offers a checking account with a debit card and a savings account with automatic savings options, like rounding up transactions. The app does not charge monthly or overdraft fees, though other fees like out-of-network ATM charges may apply.

Users can receive direct deposits earlier than traditional banks. The app tracks spending and provides basic budgeting tools. It focuses on simplicity and accessibility for everyday banking needs.

The app is free to use and operates through partner banks for account services. It is designed for mobile access. The interface prioritizes ease of use for managing accounts.

Key highlights:

- Offers checking and savings accounts

- Automates savings with round-ups

- No monthly or overdraft fees

- Provides early direct deposit access

- Designed for mobile banking

Contact Information:

- App store: apps.apple.com/us/app/chime-mobile-banking

- Google Play: play.google.com/store/apps/details

- Website: www.chime.com

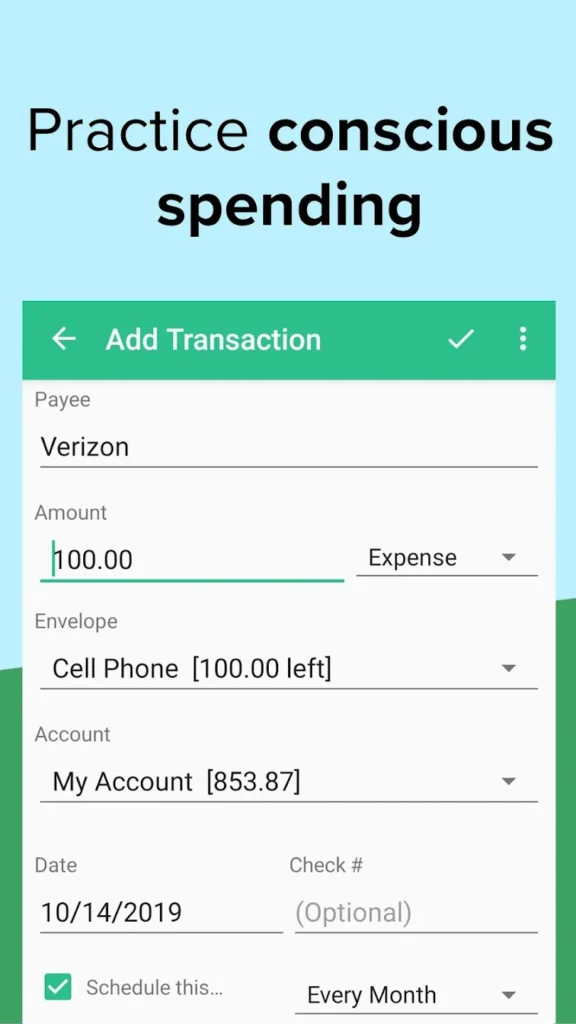

8. Goodbudget

Goodbudget is an app that uses the envelope budgeting system. Users allocate money to virtual envelopes for different expense categories, like groceries or rent. The app allows manual transaction entry or file imports for tracking.

The app supports shared budgeting for households and tracks debt repayment. It provides reports to show how much money remains in each envelope. Users can access the app on multiple devices for synchronized budgeting.

The app offers a free plan with limited features and a paid plan for unlimited envelopes. It focuses on manual budgeting for greater control. The interface is straightforward and accessible.

Key highlights:

- Uses envelope budgeting system

- Supports manual or file-based transaction entry

- Allows shared budgeting for households

- Tracks debt and provides envelope reports

- Offers free and paid plans

Contact Information:

- App store: apps.apple.com/us/app/goodbudget-budget-planner

- Google Play: play.google.com/store/apps

- Website: goodbudget.com

- Instagram: www.instagram.com/goodbudgetapp

- Twitter: x.com/goodbudget

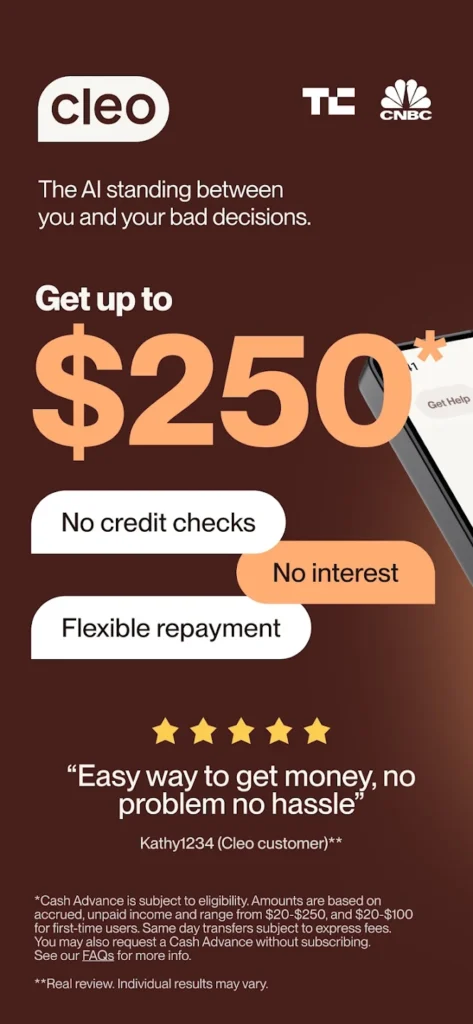

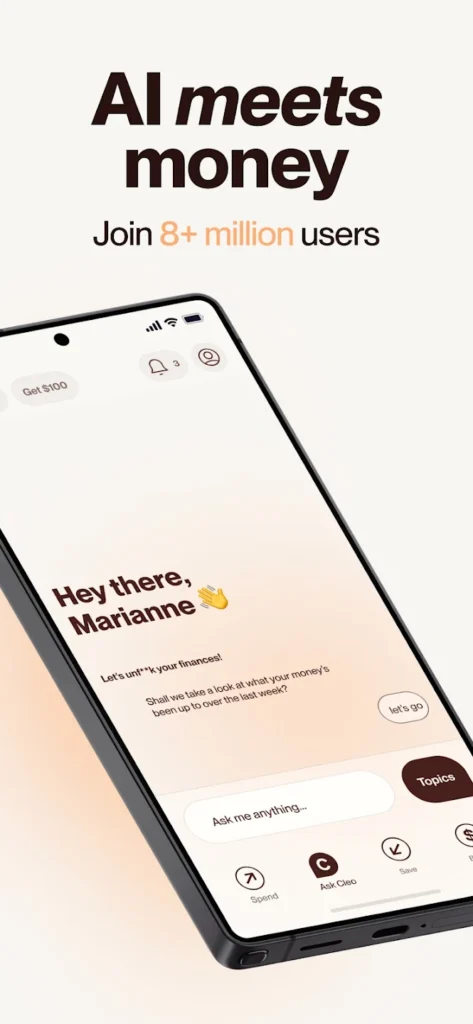

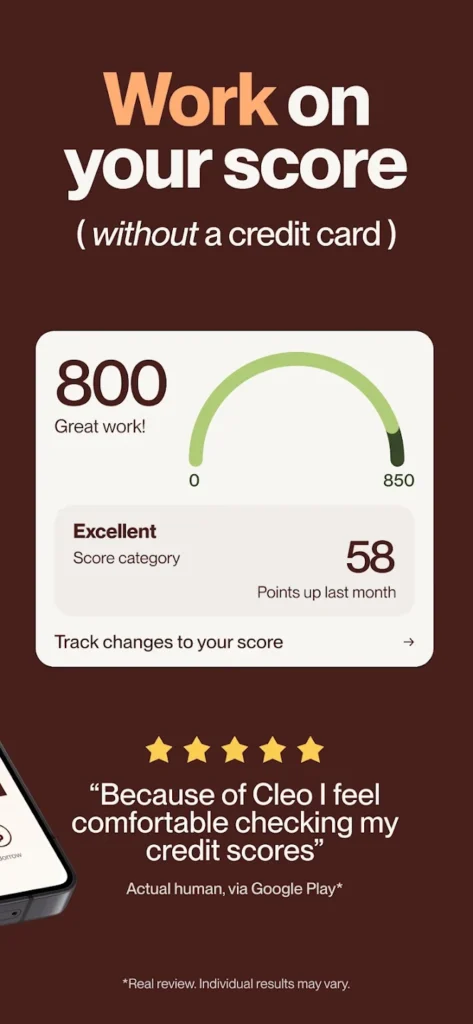

9. Cleo

Cleo is an app with an AI assistant for managing finances. It connects to bank accounts to track spending and create budgets. The app provides insights into spending habits and suggests ways to save money.

Users can set savings goals and automate small transfers to savings. The app includes features for monitoring credit and building better financial habits. It uses a conversational interface to engage users.

The app offers free and paid plans and is designed for mobile use. It focuses on simplicity and automation. The interface is interactive and user-friendly.

Key highlights:

- Uses AI to track spending and budget

- Connects to bank accounts for insights

- Automates savings with small transfers

- Monitors credit and financial habits

- Offers free and paid plans

Contact Information:

- App store: apps.apple.com/us/app/cleo-ai-smart-money-manager

- Google Play: play.google.com/store/apps/details

- Website: web.meetcleo.com

- Facebook: www.facebook.com/MeetCleo

- Instagram: www.instagram.com/meetcleo

- LinkedIn: www.linkedin.com/company/cleo-ai

- Twitter: x.com/meetcleo

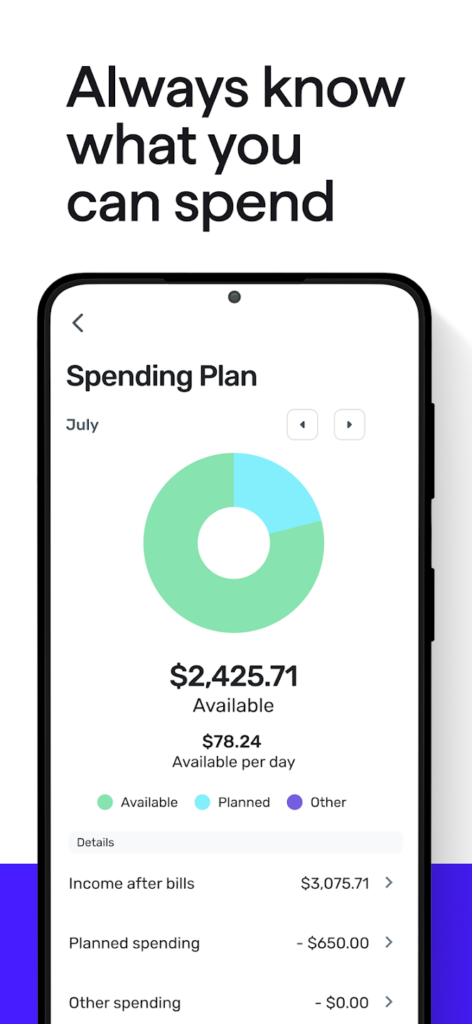

10. Simplifi by Quicken

Simplifi is an app for budgeting and tracking finances. It connects to bank accounts, credit cards, and loans to monitor transactions. The app creates spending plans based on income and expenses.

Users can set savings goals and track upcoming bills. The app provides reports on spending and savings trends. It also offers tools for monitoring credit scores and financial health.

The app requires a subscription and is accessible on multiple platforms. It focuses on automated tracking with a clear interface. The design emphasizes ease of use for beginners.

Key highlights:

- Connects to accounts for transaction monitoring

- Creates spending plans based on income

- Tracks savings goals and bills

- Provides spending and credit reports

- Accessible on multiple platforms

Contact Information:

- App store: apps.apple.com/us/app/quicken-simplifi-budget-smart

- Google Play: play.google.com/store/apps/details

- Website: www.quicken.com

- Facebook: www.facebook.com/Quicken

- LinkedIn: www.linkedin.com/company/quicken-inc.

- Twitter: x.com/quicken

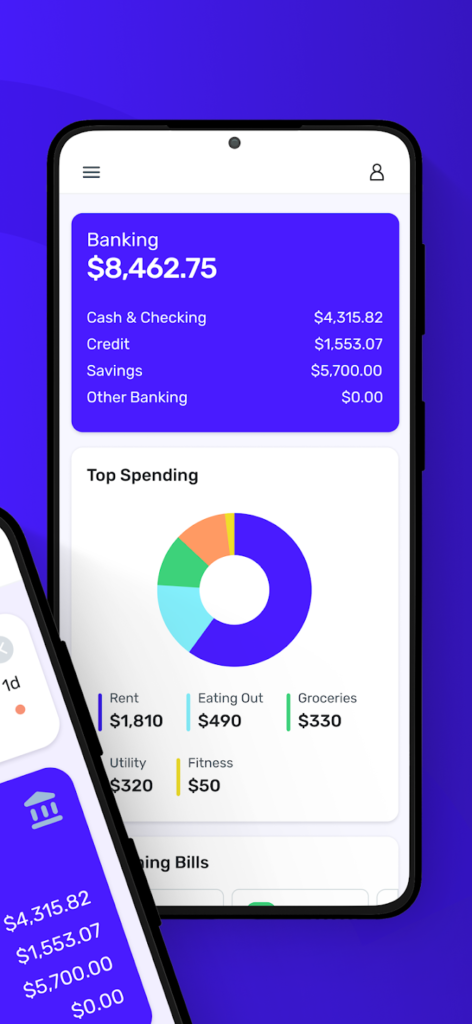

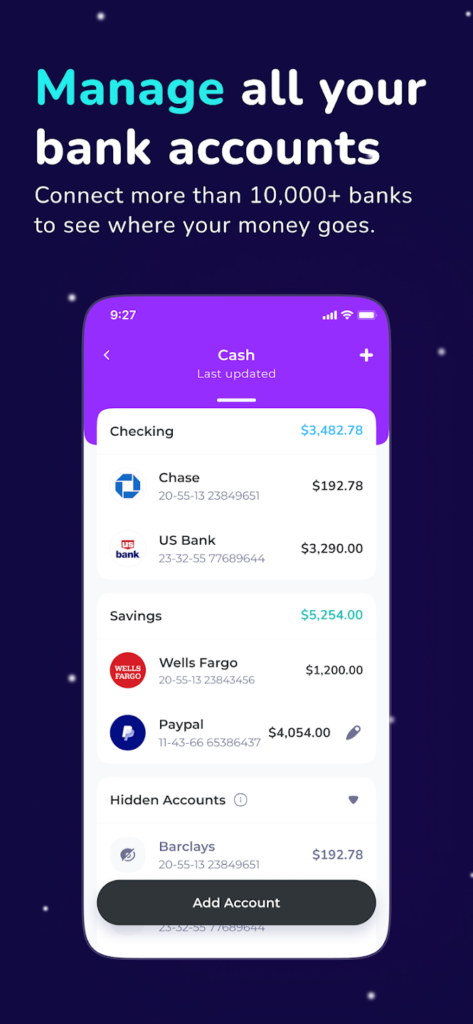

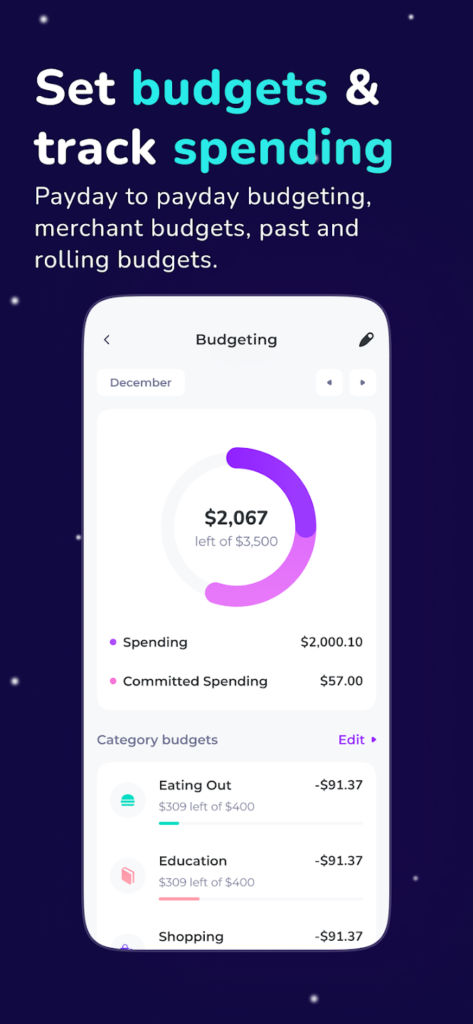

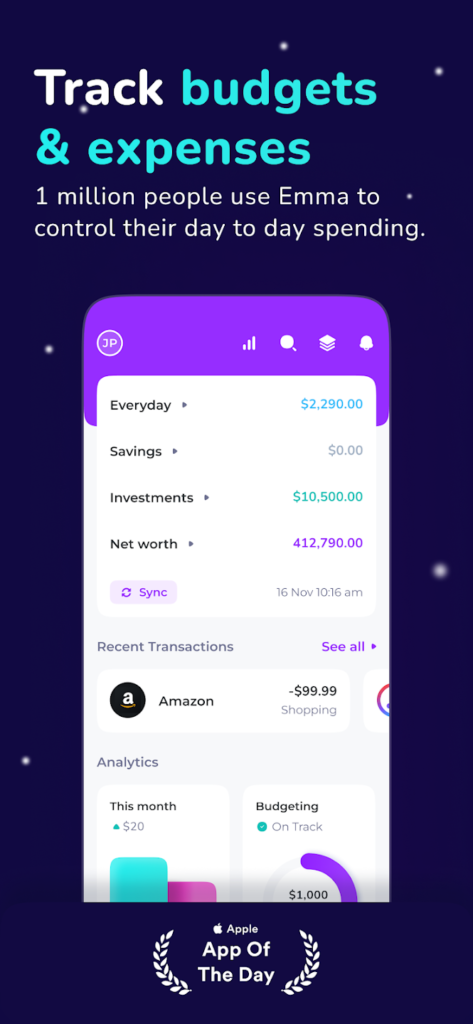

11. Emma

Emma is an app for tracking finances, primarily for UK users. It connects to bank accounts using open banking to monitor spending and subscriptions. The app sets budgets and alerts users to overspending.

Users can create savings goals and track their progress. The app categorizes expenses to provide insights into spending habits. It focuses on identifying and managing recurring payments.

The app offers a free plan with premium options and is designed for mobile use. It emphasizes secure connections through open banking. The interface is simple and focused on usability.

Key highlights:

- Uses open banking to track spending

- Monitors subscriptions and recurring payments

- Sets budgets and savings goals

- Categorizes expenses for insights

- Offers free and premium plans

Contact Information:

- Google Play: play.google.com/store/apps

- App Store: apps.apple.com/gb/app/emma-budget-planner-tracker

- Website: emma-app.com

- Facebook: www.facebook.com/emmafinance

- Twitter: x.com/emma_finance

- Instagram: www.instagram.com/emma_finance

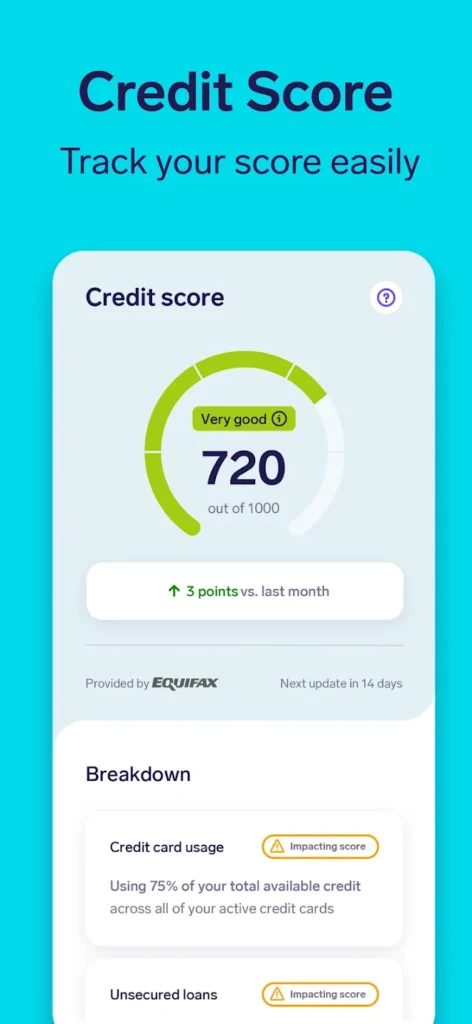

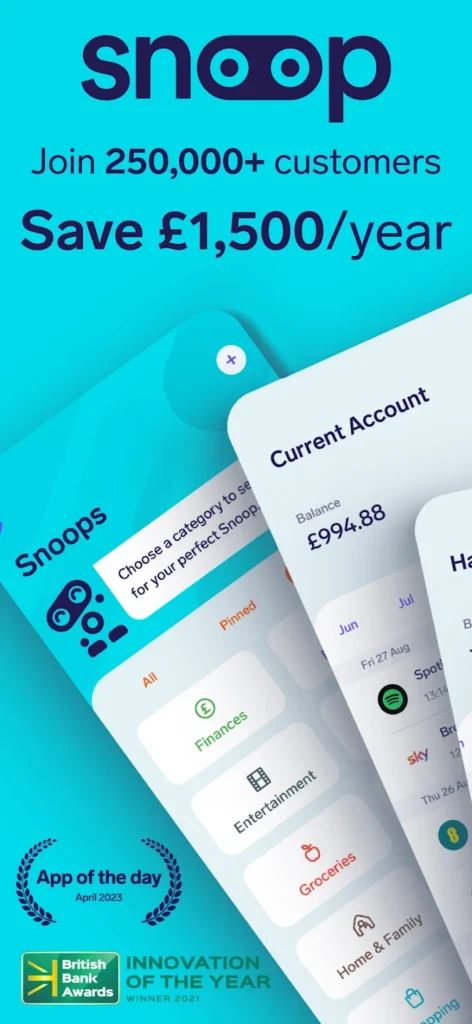

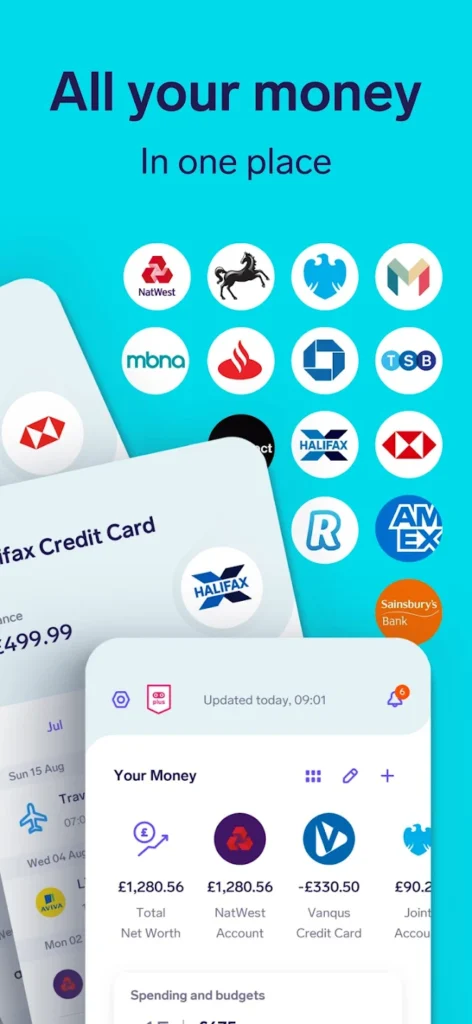

12. Snoop

Snoop is an app for UK users that tracks spending and suggests savings. It connects to bank accounts using open banking to analyze transactions. The app provides insights into spending patterns and recurring bills.

Users can set budgets and receive alerts about potential savings, like cheaper bill providers. The app identifies unused subscriptions for cancellation. It focuses on helping users find better deals.

The app offers a free plan with premium features and is mobile-focused. It uses AI to deliver personalized suggestions. The interface is designed for clarity and ease of use.

Key highlights:

- Tracks spending via open banking

- Suggests savings on bills and subscriptions

- Sets budgets and provides spending insights

- Identifies unused subscriptions

- Offers free and premium plans

Contact Information:

- Google Play: play.google.com/store/apps

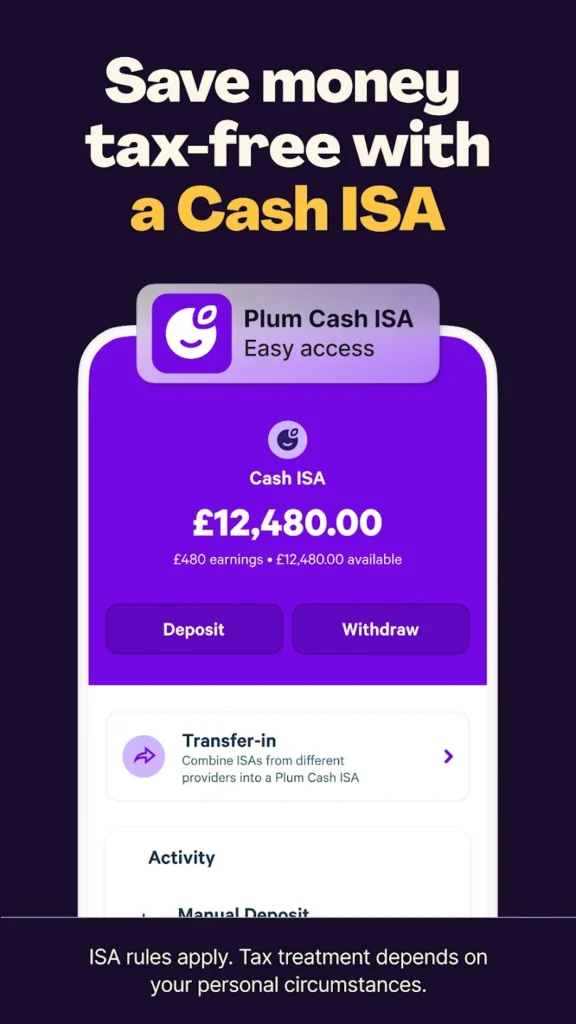

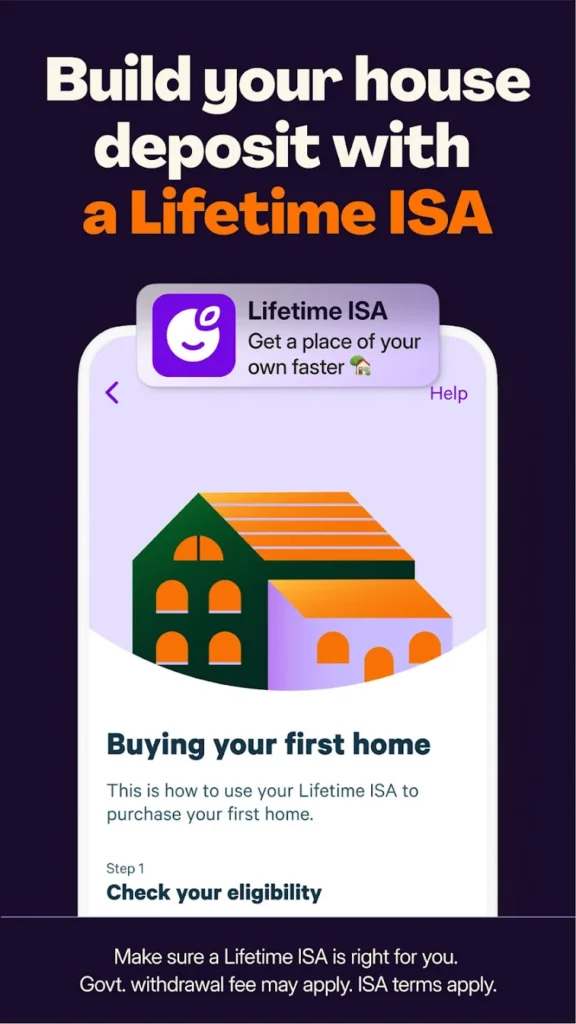

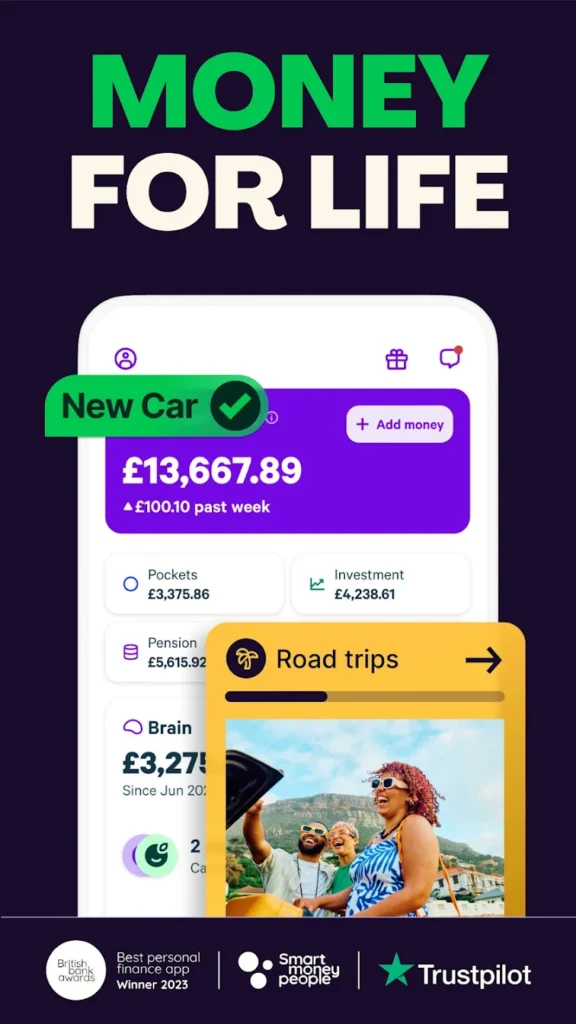

13. Plum

Plum is an app for UK users that automates savings. It connects to bank accounts to analyze spending and transfer affordable amounts to savings. The app also offers investment options and spending tracking.

Users can set savings goals and monitor their progress. The app suggests ways to save on bills and categorizes expenses for better financial planning. It provides interest-bearing savings accounts through partner banks.

The app offers a free plan with paid upgrades and is mobile-focused. It uses AI for automated savings. The interface is straightforward and user-friendly.

Key highlights:

- Automates savings based on spending

- Offers investment and savings accounts

- Tracks expenses and sets savings goals

- Suggests bill savings

- Offers free and paid plans

Contact Information:

- Google Play: play.google.com/store/apps

- App Store: apps.apple.com/gb/app/plum-smart-saving-investing

- Website: withplum.com

- Instagram: www.instagram.com/withplum

- Facebook: www.facebook.com/withplum

- Twitter: x.com/withplum

- LinkedIn: www.linkedin.com/company/plum-fintech

- E-mail: help@withplum.com

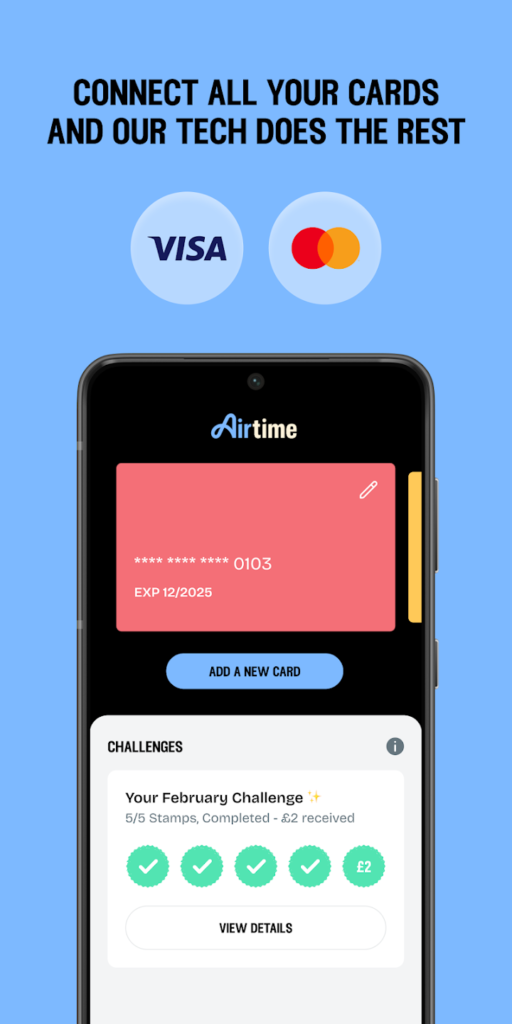

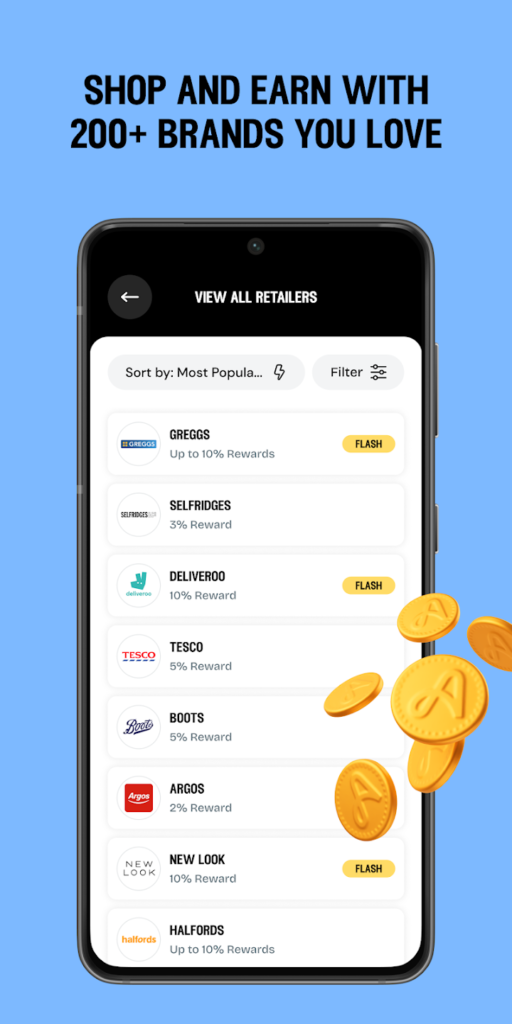

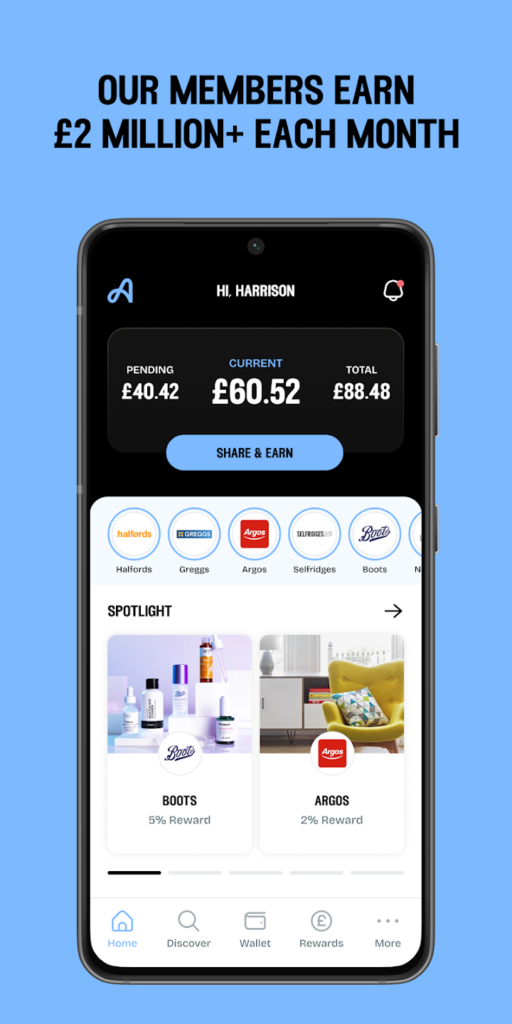

14. Airtime Rewards

Airtime Rewards is a UK app that provides cashback on purchases. Users link their debit or credit cards to earn rewards when shopping at partner retailers. The cashback is applied to reduce mobile phone bills.

The app supports multiple UK mobile networks and offers cashback on some purchases. Users can track their rewards and spending through the app. It does not require a subscription.

The app is designed for mobile use and focuses on simplicity. It connects securely to payment cards without storing bank details. The interface is easy to navigate.

Key highlights:

- Provides cashback to reduce mobile bills

- Links to debit or credit cards

- Supports multiple UK mobile networks

- Tracks rewards and spending

- Free to use with no subscription

Contact Information:

- Google Play: play.google.com/store/apps

- App Store: apps.apple.com/gb/app/airtime-mobile-rewards

- Website: airtime.co.uk

- Twitter: x.com/AirtimeRewards

- Instagram: www.instagram.com/airtimerewards

- LinkedIn: www.linkedin.com/company/airtime-rewards

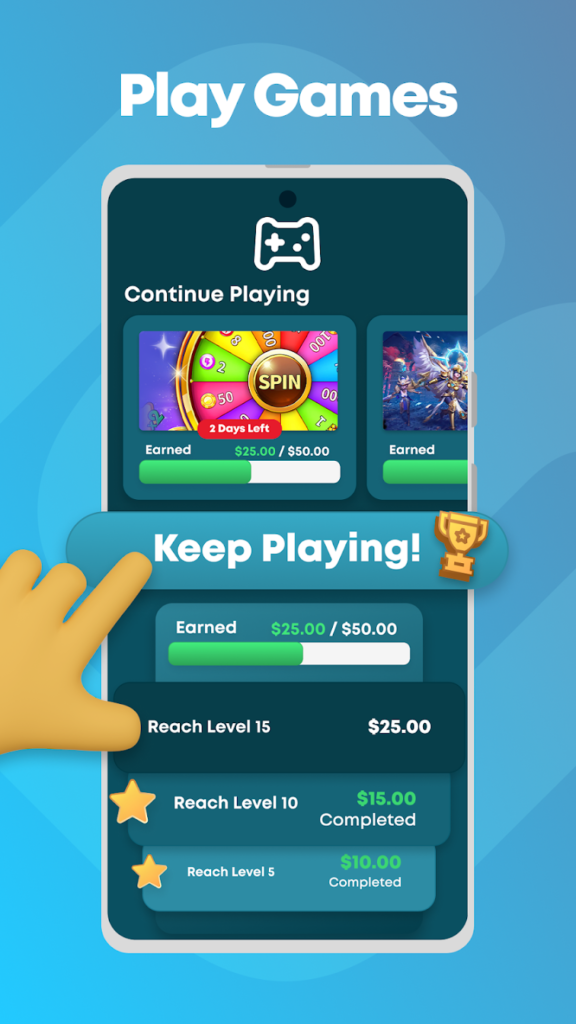

15. Swagbucks

Swagbucks is an app where users earn points for various activities. Points can be earned by taking surveys, watching videos, shopping, or searching the web. These points are redeemable for gift cards or cash.

Users can shop at partner retailers to earn additional points. The app offers daily tasks to increase earnings. It includes a referral program for extra rewards when inviting others.

The app is free to use and accessible on multiple platforms. It focuses on providing flexible earning options. The interface is designed for ease of use and engagement.

Key highlights:

- Earns points through surveys, videos, and shopping

- Redeems points for gift cards or cash

- Offers cashback at partner retailers

- Includes daily tasks and referral program

- Free to use on multiple platforms

Contact Information:

- App store: apps.apple.com/us/app/swagbucks-surveys-for-money

- Google Play: play.google.com/store/apps

- Website: www.swagbucks.com

- Facebook: www.facebook.com/swagbucks

- Instagram: www.instagram.com/swagbucksofficial

- Twitter: x.com/swagbucks

Conclusion

Saving money doesn’t have to be a grind, and these apps prove it. Whether you’re all about budgeting every penny with YNAB, or letting Acorns invest your spare change, there’s something here for everyone. Each app brings its own vibe – some automate the process, others keep you hands-on – so you can pick what fits your life. Try a couple that catch your eye, see what clicks, and start building those savings without overthinking it. Your wallet will thank you, and you might even have fun along the way.